Statements

2019, August, 1, 12:00:00

SHELL INCOME $3 BLN

“We have delivered good cash flow performance, despite earnings volatility, in a quarter that has seen challenging macroeconomic conditions in refining and chemicals as well as lower gas prices. This quarter we achieved some key milestones, such as the start-up of Appomattox and the first LNG cargo from Prelude. These add to our competitive portfolio, which is expected to generate additional cash in the coming quarters.

The resilience of our Upstream and customer-facing businesses and their ability to generate cash support the delivery of our 2020 outlook, which remains unchanged.”

2019, August, 1, 11:40:00

BAKER HUGHES A GE NET LOSS $9 MLN

BAKER HUGHES, A GE COMPANY ANNOUNCES SECOND QUARTER 2019 RESULTS

2019, July, 31, 13:20:00

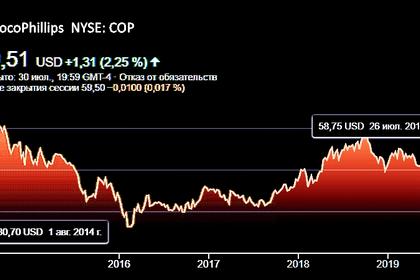

CONOCO EARNINGS $1.6 BLN

ConocoPhillips (NYSE: COP) reported second-quarter 2019 earnings of $1.6 billion, or $1.40 per share, compared with second-quarter 2018 earnings of $1.6 billion, or $1.39 per share.

2019, July, 30, 11:10:00

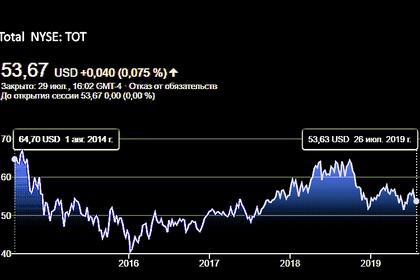

TOTAL NET INCOME $2.8 BLN

Total net income (Group share) of 2.8 B$ in 2Q19, a 26% decrease compared to 2Q18

Net-debt-to-capital ratio of 20.6% at June 30, 2019

Hydrocarbon production of 2,957 kboe/d in 2Q19, an increase of 9% compared to 2Q18

2019, July, 30, 11:05:00

BP PROFIT $2.8 BLN

Strong financial results

– Underlying replacement cost profit for the second quarter of 2019 was $2.8 billion, similar to a year earlier. The quarter’s result largely reflected continued good operating performance, offset by oil prices lower than in the second quarter of 2018.

– Non-operating items in the second quarter of $0.9 billion, post-tax, related mainly to impairment charges.

– Operating cash flow, excluding Gulf of Mexico oil spill payments, was $8.2 billion for the second quarter, including a $1.5-billion working capital release (after adjusting for net inventory holding gains), and $14.2 billion for the first half, including a $0.5-billion working capital release.

– Gulf of Mexico oil spill payments of $1.4 billion on a post-tax basis in the second quarter were primarily the scheduled annual payments.

– A dividend of 10.25 cents a share was announced for the quarter.

2019, July, 30, 11:00:00

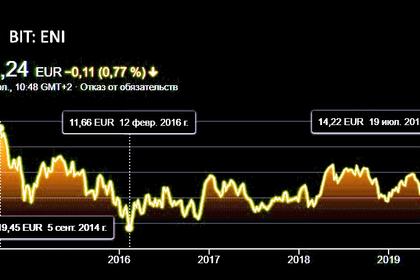

ENI NET PROFIT DOWN BY 27%

Eni adjusted net profit: €0.56 billion for the quarter, down by 27% q-o-q (down by 24% excluding IFRS 16 accounting effects). €1.55 billion in the first half, down by 11% (down by 8% excluding IFRS 16 accounting effects).

2019, July, 30, 10:55:00

EQUINOR NET INCOME UP 27%

Equinor reports adjusted earnings of USD 3.15 billion and USD 1.13 billion after tax in the second quarter of 2019. IFRS net operating income was USD 3.52 billion and the IFRS net income was USD 1.48 billion.

2019, July, 30, 10:45:00

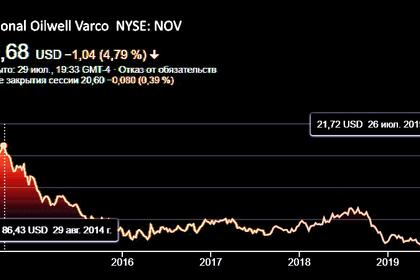

NOV VARCO NET LOSS $5.4 BLN

National Oilwell Varco, Inc. (NYSE: NOV) today reported second quarter 2019 revenues of $2.13 billion, an increase of 10 percent compared to the first quarter of 2019 and an increase of one percent from the second quarter of 2018.

2019, June, 13, 16:15:00

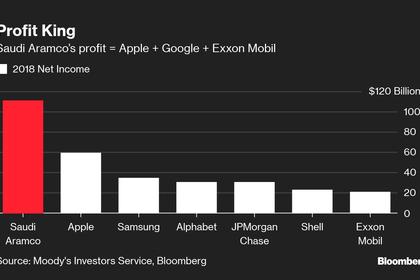

SAUDI ARAMCO NET INCOME $111 BLN

Saudi Aramco is the world’s largest integrated oil and gas company; its upstream operations are based in the Kingdom of Saudi Arabia and it also operates a global downstream business. Headquartered in the city of Dhahran, the company operates in eight locations within the Kingdom and 20 locations overseas, and employs around 76,000 people.

2019, May, 31, 12:25:00

GAZPROM'S PROFIT UP 44%

Profit attributable to owners of PJSC Gazprom amounted to RUB 535,908 million for the three months ended March 31, 2019 which is by RUB 164,285 million, or 44%, more than for the same period of the prior year.

2019, May, 31, 12:05:00

PETRONAS PROFIT UP 9%

First quarter Profit After Tax (PAT) stood at RM14.2 billion, up by 9 per cent on the back of higher revenue, but partially offset by increased net product and production costs, lower net write-back of assets impairment and higher contribution to the National Trust Fund.

2019, May, 30, 17:30:00

LUKOIL'S PROFIT +36,8%

Profit attributable to shareholders totaled RUB 149.2 bln, up 36.8% year-on-year. The growth was restrained with higher DD&A due to the launch of new production facilities.

2019, May, 15, 11:10:00

ROSNEFT'S NET INCOME +61.7%

ROSNEFT - Net income growth of 61.7% YoY to RUB 131 bln

2019, May, 6, 11:45:00

SHELL CCS EARNINGS $5.3 BLN

CCS earnings attributable to shareholders excluding identified items were $5.3 billion, reflecting lower realised chemicals and refining margins, decreased realised oil prices and lower tax credits, partly offset by stronger contributions from trading as well as increased realised LNG and gas prices compared with the first quarter 2018. In addition, there was a negative impact of $43 million related to the implementation of IFRS 16.

2019, May, 4, 11:20:00

TRANSCANADA'S NET INCOME $1 BLN

TransCanada Corporation (TSX, NYSE: TRP) (TransCanada or the Company) announced net income attributable to common shares for first quarter 2019 of $1.004 billion or $1.09 per share compared to net income of $734 million or $0.83 per share for the same period in 2018.