Statements

2018, October, 31, 12:40:00

BHGE NET INCOME $13 MLN

BHGE - Orders of $5.7 billion for the quarter, down 5% sequentially and flat year-over-year. Revenue of $5.7 billion for the quarter, up 2% sequentially and up 7% year-over-year. GAAP operating income of $282 million for the quarter, increased $204 million sequentially and increased $475 million year-over-year.

2018, October, 29, 12:05:00

PEMEX NET INCOME 27 BLN PESOS

PEMEX - Upon comparing the results of this quarter with the same quarter for the previous year, the following items stand out: (i) total sales increased by 33%; (ii) operation yield recorded a significant improvement of 83% and currently at 54 billion pesos; and (iii) the company recorded a net income of 27 billion pesos, compared to losses of 102 billion pesos recorded the previous year.

2018, October, 26, 12:15:00

EQUINOR NET INCOME $1,666 MLN

EQUINOR - Equinor reports adjusted earnings of USD 4.8 billion and USD 2.0 billion after tax in the third quarter of 2018. IFRS net operating income was USD 4.6 billion and the IFRS net income was USD 1.7 billion.

2018, October, 26, 12:10:00

NOVATEK'S PROFIT RUB 45.9 BLN

NOVATEK - In the third quarter and the nine months of 2018, profit attributable to shareholders of PAO NOVATEK increased to RR 45.9 billion (RR 15.23 per share), or by 21.6%, and to RR 121.1 billion (RR 40.17 per share), or by 8.1%, respectively, as compared to the corresponding periods in 2017.

2018, August, 31, 11:35:00

GAZPROM'S PROFIT UP BY 65%

GAZPROM - Profit attributable to the owners of PJSC Gazprom for the six months ended June 30, 2018 totalled RUB 630,804 million which is by RUB 249,458 million, or 65 %, more than for the same period of the prior year.

2018, August, 31, 11:05:00

PETROCHINA'S NET PROFIT UP OF 113%

PETROCHINA - Profit from operations was RMB65.891 billion, representing an increase of 80.6% compared to the same period in 2017. Net profit attributable to owners of the Company was RMB27.088 billion, representing an increase of 113.7% compared to the same period in 2017. Basic earnings per share was RMB0.148, representing an increase of RMB0.079 compared to the same period in 2017.

2018, August, 24, 11:00:00

CNOOC NET PROFIT UP 56.8%

CNOOC - In the first half of 2018, the Company maintained a healthy profitability and a sound financial position. Oil and gas sales reached RMB 90.31 billion, representing a year-on-year increase of 20.5%. Net profit reached RMB 25.48 billion, representing a significant increase of 56.8% year-on-year (“YoY”). The Company’s average realized oil price was US$ 67.36 per barrel, representing an increase of 33.6% YoY. The average realized natural gas price increased by 13.0% YoY to US$ 6.42 per thousand cubic feet. Despite the international oil prices rebound and industry costs inflation, the Company maintained a competitive all-in cost of US$ 31.83/BOE during the first half of the year.

2018, August, 22, 13:05:00

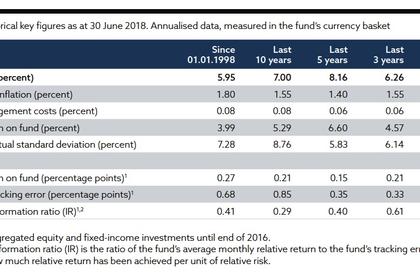

NORWAY'S FUND: $1 TLN + $20 BLN

NORWAY'S FUND - The Government Pension Fund Global returned 1.8 percent, or 167 billion kroner, in the second quarter of 2018.

2018, August, 17, 11:20:00

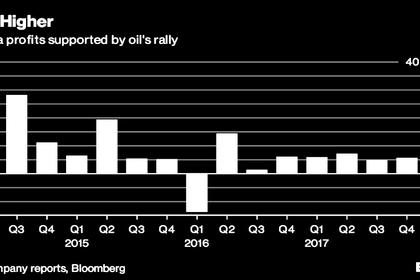

GAZPROM NEFT NET PROFIT UP TO 49.6%

GAZPROM NEFT - For the first six months of 2018 Gazprom Neft achieved revenue** growth of 24.4% year-on-year, at one trillion, 137.7 billion rubles (RUB1,137,700,000,000). The Company achieved a 49.8% year-on-year increase in adjusted EBITDA, to RUB368.2 billion. This performance reflected positive market conditions for oil and oil products, production growth at the Company’s new projects, and effective management initiatives. Net profit attributable to Gazprom Neft PJSC shareholders grew 49.6% year on year, to RUB166.4 billion. Growth in the Company’s operating cash flow, as well as the completion of key infrastructure investments at new upstream projects, delivered positive free cash flow of RUB47.5 billion for 1H 2018.

2018, August, 8, 11:45:00

ROSNEFT UP BY 2.8 TIMES

ROSNEFT - 2Q 2018 net income attributable to Rosneft shareholders jumped by 2.8 times QoQ and reached RUB 228 bln (USD 3.6 bln) on the back of operating income growth, FX impact and one-off gain from recognizing net income from the share acquisition in upstream JV with a foreign partner and recognition of fair value of previously held interest in JV.

2018, August, 8, 11:35:00

PETROBRAS NET INCOME R$ 17 BLN

PETROBRAS - Petrobras reported net income of R$ 17 billion in the first half of 2018. The positive result was mainly influenced by the increase in international oil prices, associated with the depreciation of the Brazilian Real against the US dollar. In the same period, net debt fell 13% compared to December 2017, to US$ 73.66 billion.

2018, August, 3, 09:10:00

TRANSCANADA NET INCOME $785 MLN

TRANSCANADA - TransCanada Corporation (TSX, NYSE: TRP) (TransCanada or the Company) today announced net income attributable to common shares for second quarter 2018 of $785 million or $0.88 per share compared to net income of $881 million or $1.01 per share for the same period in 2017.

2018, August, 3, 09:00:00

NOBLE NET LOSS $628 MLN

NOBLE - Noble Corporation plc (NYSE: NE, the Company) reported a net loss attributable to the Company for the three months ended June 30, 2018 of $628 million, or $2.55 per diluted share, on revenues of $258 million. The results included a non-cash charge totaling $793 million, or $2.06 per diluted share, ($507 million, net of tax and noncontrolling interests) relating to the impairment of three rigs and certain capital spares. Excluding the non-cash charge, the Company's net loss attributable to Noble Corporation for the three months ended June 30, 2018 would have been $121 million, or $0.49 per diluted share.

2018, August, 1, 09:05:00

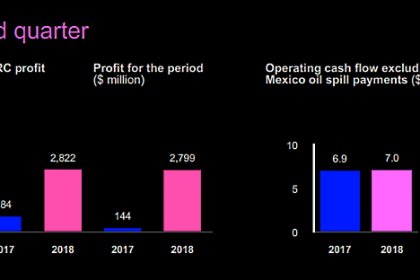

BP PROFIT $2.8 BLN

BP - BP’s profit for the second quarter and half year was $2,799 million and $5,268 million respectively, compared with $144 million and $1,593 million for the same periods in 2017.

2018, August, 1, 08:55:00

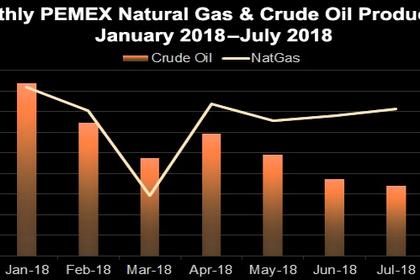

PEMEX NET LOSS MXN 163 BLN

PEMEX - Pemex achieved total sales for 254 billion pesos in the second quarter of 2018, a figure 36% higher than the result obtained during the same quarter of the previous year. Operating yields were 120 billion pesos, a growth almost 37% greater than the second quarter of 2017. Operation, management, distribution and sales costs remained stable and aligned with the current austerity and expenditure policies.