Statements

2018, April, 30, 10:00:00

EXXONMOBIL EARNINGS $4.7 BLN

EXXONMOBIL - Exxon Mobil Corporation announced estimated first quarter 2018 earnings of $4.7 billion, or $1.09 per share assuming dilution, compared with $4 billion a year earlier. Cash flow from operations and asset sales was $10 billion, including proceeds associated with asset sales of $1.4 billion. During the quarter, the corporation distributed $3.3 billion in dividends to shareholders. Capital and exploration expenditures were $4.9 billion, up 17 percent from the prior year.

2018, April, 30, 09:55:00

CHEVRON NET INCOME $3.638 BLN

CHEVRON - Chevron Corporation (NYSE: CVX) reported earnings of $3.6 billion ($1.90 per share – diluted) for first quarter 2018, compared with $2.7 billion ($1.41 per share – diluted) in the first quarter of 2017. Foreign currency effects increased earnings in the 2018 first quarter by $129 million, compared with a decrease of $241 million a year earlier.

Sales and other operating revenues in first quarter 2018 were $36 billion, compared to $32 billion in the year-ago period.

2018, April, 30, 09:50:00

TOTAL NET INCOME $2.6 BLN

TOTAL - Oil prices continued to rebound in the first quarter 2018. Brent rose to an average of $67 per barrel, supported by strong demand, OPEC-non-OPEC compliance and geopolitical tensions. Conversely, as a result of this increase, refining margins were weaker (-34%). In this context, the Group's adjusted net income and DACF continued to increase, achieving growth of 13% and 16%, respectively, compared to a year ago, in line with announced sensitivities. Cash flow after organic investments increased to $2.8 billion, up by more than 50% from a year ago, thanks to good operational performance and continued spending discipline. Return on equity was 10%.

2018, April, 30, 09:45:00

STATOIL NET INCOME $1.3 BLN

STATOIL - Statoil reports adjusted earnings of USD 4.4 billion and USD 1.5 billion after tax in the first quarter of 2018. IFRS net operating income was USD 5.0 billion and the IFRS net income was USD 1.3 billion.

2018, April, 30, 09:40:00

ENI NET PROFIT €0.98 BLN

ENI - In the first quarter of 2018, Eni's consolidated adjusted operating profit of €2,380 million increased by 30% from the first quarter of 2017. The improvement was driven by a robust performance in the E&P segment (up by €0.67 billion or 47%) due to an ongoing recovery in crude oil prices, partly offset by a weaker dollar (the Brent benchmark in euro terms was up by 8%), as well as production growth. The G&P segment reported an adjusted operating profit of €0.3 billion, unchanged from the first quarter of 2017.

2018, March, 16, 10:55:00

STATOIL CHANGES TO EQUINOR

EQUINOR - The board of directors of Statoil proposes to change the name of the company to Equinor. The name change supports the company’s strategy and development as a broad energy company.

2018, February, 16, 23:10:00

TRANSCANADA NET INCOME $3.0 BLN

TRANSCANADA - TransCanada Corporation (TSX:TRP) (NYSE:TRP) (TransCanada or the Company) announced net income attributable to common shares for fourth quarter 2017 of $861 million or $0.98 per share compared to a net loss of $358 million or $0.43 per share for the same period in 2016. For the year ended December 31, 2017, net income attributable to common shares was $3.0 billion or $3.44 per share compared to net income of $124 million or $0.16 per share in 2016.

2018, February, 7, 07:30:00

BP PROFIT $3.4 BLN

BP - “2017 was one of the strongest years in BP’s recent history. We delivered operationally and financially, with very strong earnings in the Downstream, Upstream production up 12%, and our finances rebalanced. And we did all this while maintaining safe and reliable operations.

“We enter the second year of our five-year plan with real momentum, increasingly confident that we can continue to deliver growth across our business, improving cash flows and returns for shareholders out to 2021 and beyond.

“At the same time, we are embracing the energy transition, seeking new opportunities in a changing, lower-carbon world.”

2018, February, 7, 07:25:00

NOV VARCO NET LOSS $237 MLN

NOV - National Oilwell Varco, Inc. (NYSE: NOV) reported a fourth quarter 2017 net loss of $14 million, or $0.04 per share. Revenues for the fourth quarter were $1.97 billion, an increase of seven percent compared to the third quarter and an increase of 16 percent from the fourth quarter of 2016. Operating loss for the fourth quarter was $111 million, or 5.6 percent of sales. Adjusted EBITDA (operating profit excluding depreciation, amortization, and other items) for the fourth quarter was $197 million, or 10.0 percent of sales, an increase of $30 million from the third quarter. Other items were $133 million, pre-tax, and primarily consisted of charges for inventory write-downs, facility closures and severance. Cash flow from operations for the fourth quarter was $321 million.

2018, February, 2, 12:03:00

SHELL EARNINGS $15.8 BLN

SHELL - CCS earnings attributable to shareholders excluding identified items were $4.3 billion for the fourth quarter 2017 and $15.8 billion for the full year 2017, reflecting increased contributions from all businesses, compared with 2016. Full year earnings benefited mainly from higher realised oil, gas and LNG prices, improved refining performance and higher production from new fields, which offset the impact of field declines and divestments.

2018, February, 2, 12:01:00

CONOCO NET LOSS $855 MLN

CONOCOPHILLIPS - ConocoPhillips (NYSE: COP) today reported fourth-quarter 2017 earnings of $1.6 billion, or $1.32 per share, compared with a fourth-quarter 2016 net loss of $35 million, or ($0.03) per share. Excluding special items, fourth-quarter 2017 adjusted earnings were $0.5 billion, or $0.45 per share, compared with a fourth-quarter 2016 adjusted net loss of $0.3 billion, or ($0.26) per share. Special items for the current quarter were primarily driven by benefits from U.S. tax reform and the settlement of Ecuador arbitration.

2018, January, 22, 07:35:00

SCHLUMBERGER NET LOSS $1.5 BLN

SCHLUMBERGER - Full-year 2017 revenue of $30.4 billion increased 9% year-on-year. This included a full year’s activity from the acquired Cameron businesses as compared to three quarters of activity in 2016. Excluding the addition of Cameron, revenue growth was driven by land activity in North America, which increased by 82% in line with the increase in rig count. Full-year Production Group revenue increased 21%, Reservoir Characterization Group revenue improved 2%, and Drilling Group revenue declined 2%.

2017, December, 1, 12:45:00

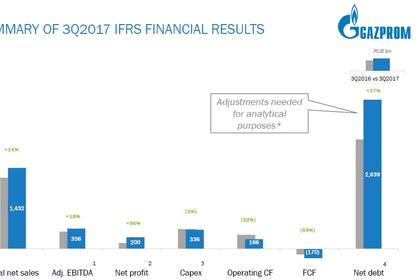

GAZPROM'S PROFIT: RUB 581,834 MLN

GAZPROM -Profit attributable to the owners of PJSC Gazprom for the nine months ended September 30, 2017 totalled RUB 581,834 million which is by RUB 127,487 million, or 18 %, less than for the same period of the prior year.

2017, November, 15, 12:32:00

PETROBRAS NET INCOME R$ 5,031 MLN

PETROBRAS - Net Income of R$ 5,031 million in 9M-2017, compared to a loss of R$ 17,334 million in 9M-2016.

2017, November, 2, 09:41:00

WEATHERFORD NET LOSS $256 MLN

Weatherford International plc (NYSE: WFT) reported a net loss of $256 million, or a loss of $0.26 per share, and a non-GAAP net loss of $221 million before charges and credits ($0.22 non-GAAP loss per share) on revenues of $1.46 billion for the third quarter of 2017.