Statements

2021, May, 31, 13:25:00

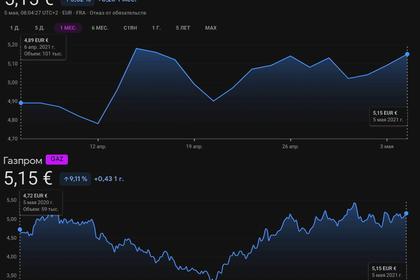

GAZPROM PROFIT RUB 447 BLN

Gain attributable to the owners of PJSC Gazprom amounted to RUB 447,263 million for the three months ended March 31, 2021.

2021, May, 6, 12:50:00

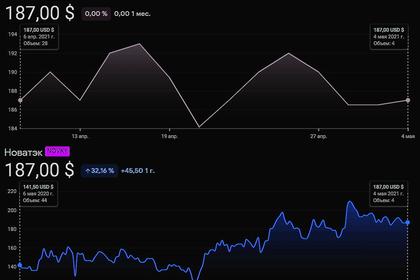

NOVATEK PROFIT RUB 75.8 BLN

PAO NOVATEK released its consolidated interim condensed financial statements for the three months ended 31 March 2021 prepared in accordance with International Financial Reporting Standards (“IFRS”).

2021, May, 5, 16:10:00

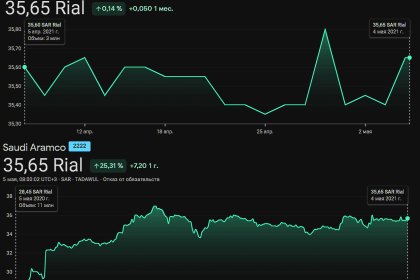

SAUDI ARAMCO NET INCOME $21.7 BLN

Net income for the first quarter of 2021 increased to SAR 81,440 ($21,717), from SAR 62,478 ($16,661) for the same period in 2020, primarily driven by higher crude oil prices, improved downstream margins and the consolidation of SABIC’s results, partly offset by lower crude oil volumes sold.

2021, May, 5, 16:05:00

GAZPROM PROFIT RUB 135 BLN

For the year ended December 31, 2020 profit attributable to the owners of PJSC Gazprom amounted to RUB 135,341 million.

2021, April, 22, 11:15:00

BAKER HUGHES NET LOSS $452 MLN

Baker Hughes Company Announces First Quarter 2021 Results

2021, April, 22, 11:10:00

AUSTRALIA'S SANTOS REVENUE $964 MLN

First quarter revenue of US$964 million was stronger despite the contractual 3-month lag in oil-linked LNG prices and lower overall sales volumes

2021, March, 22, 09:15:00

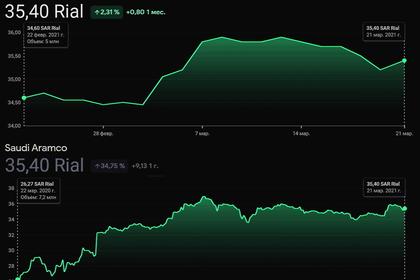

SAUDI ARAMCO NET INCOME $49 BLN

Aramco achieved a net income of $49 billion in 2020, one of the highest earnings of any public company globally.

2021, March, 19, 12:30:00

ENEL NET INCOME 2.6 BLN EUROS

In 2020, Group net ordinary income amounted to 5,197 million euros, compared with 4,767 million euros in 2019, an increase of 430 million euros (+9.0%).

2021, March, 12, 11:10:00

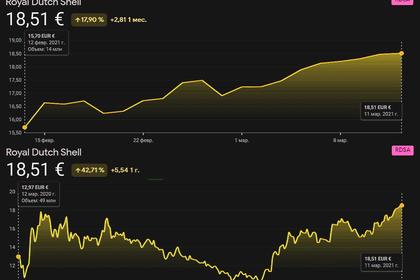

SHELL LOSS $21.7 BLN

Royal Dutch Shell plc published its Annual Report and Accounts for the year ended December 31, 2020.

2021, March, 11, 13:20:00

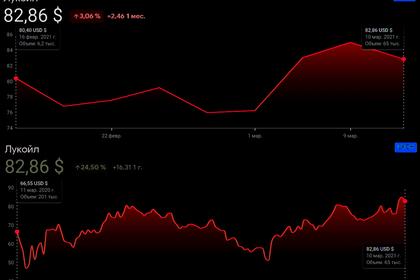

LUKOIL PROFIT RUB15.2 BLN

PJSC LUKOIL today released its audited consolidated financial statements for 2020 prepared in accordance with the International Financial Reporting Standards (IFRS).

2021, March, 3, 12:05:00

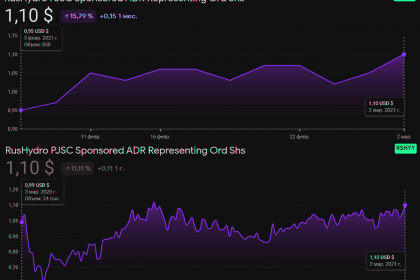

RUSHYDRO NET PROFIT RUB 46.6 BLN

RusHydro Group (hereinafter referred to as the “Group”, ticker symbol: MOEX, LSE: HYDR; OTCQX: RSHYY) announces its audited consolidated financial statements for the year ended December 31, 2020, prepared in accordance with International Financial Reporting Standards (IFRS).

2021, February, 18, 12:15:00

NOVATEK PROFIT RUB 67.8 BLN

PAO NOVATEK released its audited consolidated financial statements for the year ended 31 December 2020 prepared in accordance with International Financial Reporting Standards (“IFRS”).

2021, February, 18, 12:10:00

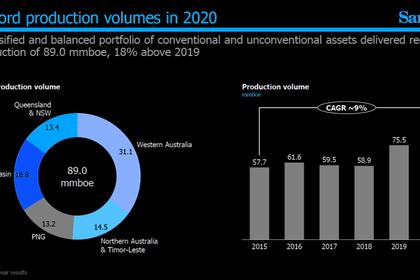

AUSTRALIA'S SANTOS LOSS $357 MLN

The reported net loss after tax of US$357 million includes the previously announced impairments, primarily due to lower oil price assumptions.

2021, February, 11, 14:00:00

TOTAL NET LOSS $7.2 BLN

Total preserves its financial strength with a gearing of 21.7% at the end of 2020.

2021, February, 5, 12:10:00

NOV VARCO NET LOSS $2.5 BLN

NOV Inc. (NYSE: NOV) today reported fourth quarter 2020 revenues of $1.33 billion, a decrease of four percent compared to the third quarter of 2020 and a decrease of 42 percent compared to the fourth quarter of 2019.