Statements

2020, October, 29, 16:30:00

SHELL INCOME $489 MLN

Income attributable to Royal Dutch Shell plc shareholders was $0.5 billion for the third quarter 2020

2020, October, 29, 16:25:00

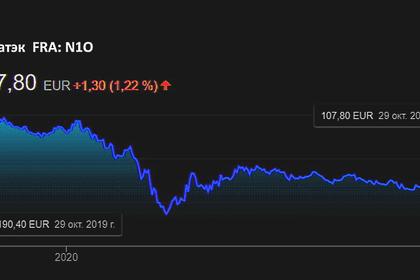

NOVATEK PROFIT RUB13.2 BLN

Profit attributable to shareholders of PAO NOVATEK amounted to RR 13.2 billion

2020, October, 27, 14:05:00

NOV VARCO NET LOSS $55 MLN

National Oilwell Varco, Inc. (NYSE: NOV) today reported third quarter 2020 revenues of $1.38 billion, a decrease of seven percent compared to the second quarter of 2020 and a decrease of 35 percent compared to the third quarter of 2019.

2020, October, 23, 15:35:00

RUSHYDRO GENERATION +13.7%

112,748 GWh - total electricity generation by RusHydro Group including Boguchanskaya hydropower plant (+13.7%)

2020, October, 21, 16:35:00

BAKER HUGHES NET LOSS $170 MLN

Baker Hughes Company (NYSE: BKR) ("Baker Hughes" or the "Company") announced results today for the third quarter of 2020.

2020, October, 16, 12:35:00

NORWAY'S FUND RETURNED $45.8 BLN

In the third quarter of 2020, the Government Pension Fund Global returned 4.3 percent, equivalent to 412 billion kroner.

2020, September, 1, 14:15:00

GAZPROM'S PROFIT RUB33 BLN

Profit attributable to the owners of PJSC Gazprom amounted to RUB 32,919 million for the six months ended June 30, 2020.

2020, August, 28, 14:45:00

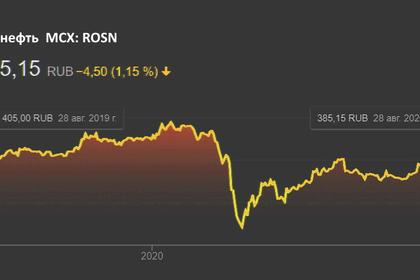

ROSNEFT NET INCOME RUB43 BLN

ROSNEFT Net income in 2Q 2020 amounted to RUB 43 bln

2020, August, 28, 14:40:00

ROSNEFT PRODUCTION 4.34 MBD

ROSNEFT 1H 2020 LIQUIDS PRODUCTION AMOUNTED TO 4.34 MMBPD UNDER NEW OPEC+ AGREEMENT

2020, August, 28, 14:35:00

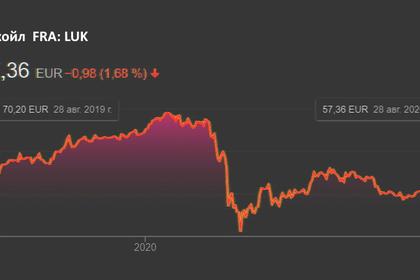

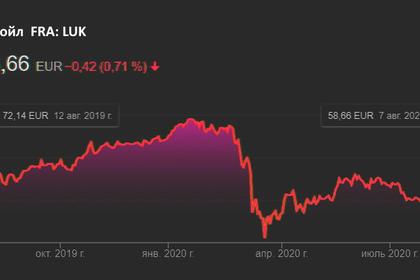

LUKOIL LOSS RUB18.7 BLN

Since the start of COVID-19 pandemic, LUKOIL has been undertaking necessary measures to rule out the direct impact of the pandemic on the Group's operating activity,

2020, August, 21, 11:10:00

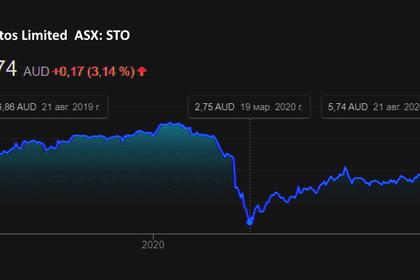

AUSTRALIA'S SANTOS NET LOSS $289 BLN

Santos reported first half free cash flow of US$431 million and underlying profit of US$212 million

2020, August, 19, 12:00:00

NORWAY'S FUND DOWN

The return on the fund's equity investment was -6.8 percent. Investments in unlisted real estate returned -1.6 percent, whereas the fixed income investments returned 5.1 percent. The fund's overall return was 11 basis points lower than the return on the benchmark index.

2020, August, 10, 11:15:00

SAUDI ARAMCO NET INCOME $23.2 BLN

The Saudi Arabian Oil Company (“Aramco” or “the Company”) announced its results for the second quarter and first half of 2020,

2020, August, 10, 11:05:00

LUKOIL PRODUCTION DOWN

Oil production excluding the West Qurna-2 project was 40.2 million tonnes for the six months of 2020, which is 5.6% lower year-on-year