Statements

2020, August, 4, 14:10:00

EXXON LOSS $1 BLN

Exxon Mobil Corporation announced an estimated second quarter 2020 loss of $1.1 billion,

2020, August, 4, 14:05:00

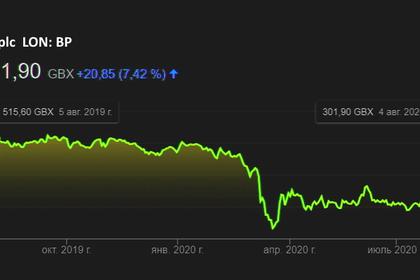

BP LOSS $16.8 BLN

BP Reported loss for the quarter was $16.8 billion, compared with a profit of $1.8 billion for the same period a year earlier,

2020, August, 3, 12:25:00

CHEVRON NET LOSS $ 8.3 BLN

Chevron Second quarter loss of $8.3 billion; adjusted loss of $3.0 billion

2020, August, 3, 11:55:00

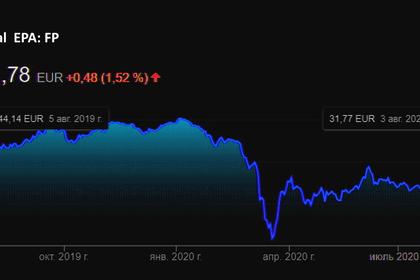

TOTAL NET INCOME $0.13 BLN

In this historically difficult context, Total demonstrates its resilience, reporting $3.6 billion of cash flow,

2020, July, 31, 09:55:00

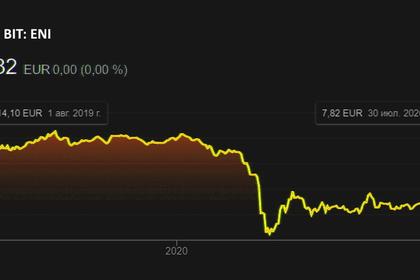

ENI NET LOSS €4.41 BLN

Eni reported a net loss of €4.41 billion and €7.34 billion in the second quarter and the first half 2020,

2020, July, 31, 09:50:00

TC ENERGY NET INCOME $1.3 BLN

TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company) today announced net income attributable to common shares for second quarter 2020 of $1.3 billion

2020, July, 30, 11:35:00

SHELL LOSS $18 BLN

Income attributable to Royal Dutch Shell plc shareholders was a loss of $18.1 billion for the second quarter 2020

2020, July, 30, 11:20:00

NOVATEK PROFIT ₽41.6 BLN

PAO NOVATEK today released its consolidated interim condensed financial statements as of and for the three and six months ended 30 June 2020

2020, July, 28, 10:55:00

NOV VARCO NET LOSS $93 MLN

National Oilwell Varco, Inc. (NYSE: NOV) reported second quarter 2020 revenues of $1.50 billion,

2020, July, 27, 15:40:00

AUSTRALIA'S SANTOS REVENUE DOWN 11%

Quarterly sales revenue of US$785 million was 11% lower than the prior quarter primarily due to lower liquids prices partially offset by higher domestic gas and LNG sales revenues

2020, July, 27, 15:30:00

SCHLUMBERGER NET LOSS $3.4 BLN

Schlumberger Limited (NYSE: SLB) reported results for the second quarter of 2020.

2020, July, 27, 15:25:00

BAKER HUGHES NET LOSS $201 MLN

Baker Hughes Company Announces Second Quarter 2020 Results

2020, June, 8, 12:50:00

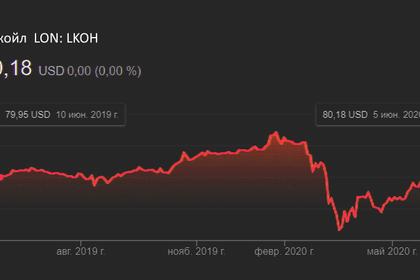

LUKOIL NET LOSS RUB 46 BLN

In the first quarter of 2020, LUKOIL booked a loss attributable to shareholders in the amount of RUB 46.0 bln.

2020, June, 5, 12:00:00

RUSHYDRO NET PROFIT +57%

PJSC RusHydro (MOEX, LSE: HYDR; OTCQX: RSHYY) announces non-consolidated financial results under Russian accounting standards (RAS) for the first quarter ended March 31, 2020.

2020, May, 28, 11:30:00

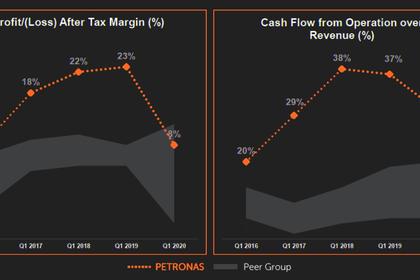

MALAYSIA'S PETRONAS PROFIT 68% LOWER

Petronas Profit After Tax (PAT) for the quarter stood at RM4.5 billion, 68 per cent lower than the RM14.2 billion posted in the corresponding quarter in the previous year,