Statements

2020, February, 3, 11:30:00

SHELL INCOME $15.8 BLN

"The strength of Shell’s strategy and portfolio has enabled delivery of competitive cash flow performance in 2019 despite challenging macroeconomic conditions in refining and chemicals, as well as lower oil and gas prices. We generated $47 billion in cash flow from operating activities

excluding working capital movements and distributed over $25 billion in dividends and share buybacks to our shareholders.

2020, February, 3, 11:25:00

EXXON NET INCOME $5.69 BLN

ExxonMobil Earns $14.3 Billion in 2019; $5.7 Billion in Fourth Quarter

2020, February, 3, 11:20:00

CHEVRON NET LOSS $6.6 BLN

Chevron Corporation (NYSE: CVX) reported a loss of $6.6 billion ($(3.51) per share - diluted) for fourth quarter 2019,

2020, January, 24, 12:50:00

BAKER HUGHES NET INCOME $128 MLN

Orders of $6.9 billion for the quarter, down 11% sequentially and up 1% year-over-year

Revenue of $6.3 billion for the quarter, up 8% sequentially and up 1% year-over-year

GAAP operating income of $331 million for the quarter, up 11% sequentially and down 13% year-over-year

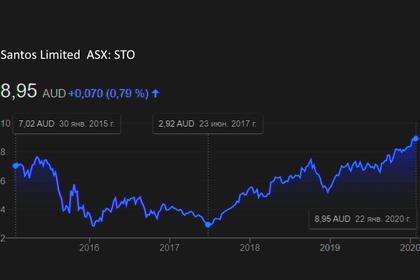

2020, January, 22, 12:25:00

AUSTRALIA'S SANTOS SALES REVENUE UP 10%

Australia's Santos record annual sales revenue of over $4 billion, up 10%, generated from sales volumes of 94.5 mmboe

2020, January, 22, 12:05:00

SCHLUMBERGER NET LOSS $10 BLN

Schlumberger CEO Olivier Le Peuch commented, “Full-year revenue for 2019 was $32.9 billion, a level essentially flat with 2018. Overall performance was positive—particularly in the international markets—and we generated $2.7 billion in free cash flow, which was a remarkable achievement under these market conditions. Full-year pretax segment operating margin of 12%, however, was slightly down year-on-year.

2019, November, 29, 15:30:00

GAZPROM PROFIT +3%

Profit attributable to the owners of PJSC Gazprom amounted to RUB 1,048,286 million for the nine months ended September 30, 2019, which is by RUB 31,036 million, or 3%, more than for the same period of the prior year.

2019, November, 18, 13:00:00

GAZPROM NEFT NET PROFIT +7%

Gazprom Neft’s revenue in the nine months of 2019 grew by 2.4 percent year-on-year to RUB1.871 trillion

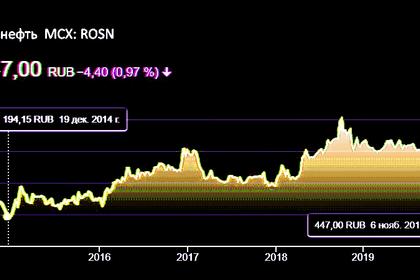

2019, November, 6, 12:25:00

ROSNEFT'S NET INCOME +25%

9M 2019 Net income jumped by 25% YoY to RUB 550 bln, including a QoQ growth to RUB 225 bln in 3Q 2019

2019, November, 5, 14:15:00

EXXONMOBIL EARNINGS $3.2 BLN

Exxon Mobil Corporation announced estimated third quarter 2019 earnings of $3.2 billion, or $0.75 per share assuming dilution. Earnings included a favorable tax-related identified item of about $300 million, or $0.07 per share assuming dilution. Capital and exploration expenditures were $7.7 billion, including key investments in the Permian Basin.

2019, November, 5, 14:10:00

CHEVRON NET INCOME $2.6 BLN

Chevron Corporation (NYSE: CVX) reported earnings of $2.6 billion ($1.36 per share - diluted) for third quarter 2019, compared with $4.0 billion ($2.11 per share - diluted) in the third quarter 2018. Included in the current quarter was a tax charge of $430 million related to a cash repatriation. Foreign currency effects increased earnings in the third quarter 2019 by $74 million.

2019, November, 5, 14:05:00

TC ENERGY NET INCOME $928 MLN

TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company) today announced net income attributable to common shares for third quarter 2019 of $739 million or $0.79 per share compared to net income of $928 million or $1.02 per share for the same period in 2018. Comparable earnings for third quarter 2019 were $970 million or $1.04 per common share compared to $902 million or $1.00 per common share in 2018.

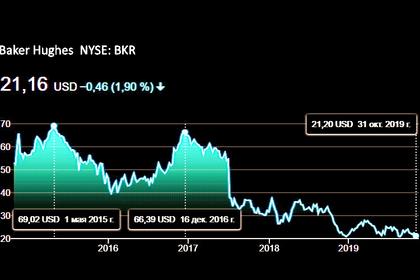

2019, November, 1, 13:55:00

NOVATEK INCOME UP EIGHT-FOLD

Profit attributable to shareholders of PAO NOVATEK increased to RR 370.0 billion (RR 122.86 per share), or eight-fold, in the third quarter of 2019

2019, November, 1, 13:25:00

SHELL Q3 CCS EARNINGS $4.8 BLN

Compared with the third quarter 2018, CCS earnings attributable to shareholders excluding identified items were $4.8 billion, reflecting lower realised oil, LNG and gas prices, as well as weaker realised refining and chemicals margins. This was partly offset by significantly stronger contributions from LNG and oil products trading and optimisation as well as higher realised margins in retail and global commercial.

2019, November, 1, 13:15:00

BAKER HUGHES NET INCOME $57 MLN

Baker Hughes Company (NYSE: BKR) ("Baker Hughes" or the "Company") announced results for the third quarter of 2019.