Finance

2019, May, 13, 11:45:00

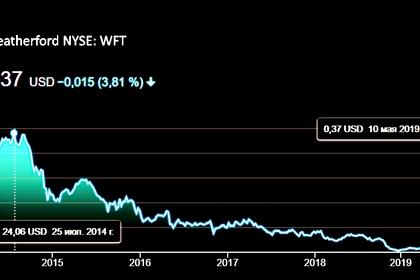

WEATHERFORD'S BANKRUPTCY

Oilfield services provider Weatherford International Plc, burdened by a heavy debt load and years of losses, said on Friday it would file for Chapter 11 bankruptcy protection.

2019, May, 8, 11:35:00

6 UNDERVALUED ENERGY STOCKS

Investors with a long-term horizons could give a look to Energy Industry. According a Value Line Report on Petroleum Industry, Oil Price above $50 a barrel provide some assurance that existing dividend will be maintained.

2019, May, 8, 11:30:00

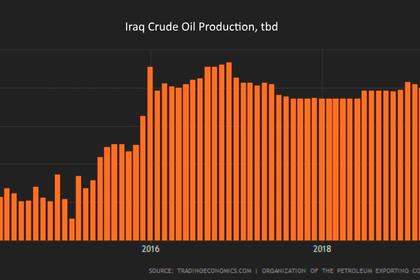

EXXON, PETROCHINA IN IRAQ: $53 BLN

Iraq is close to signing a $53 billion, 30-year energy agreement with Exxon Mobil and PetroChina,

2019, May, 8, 11:20:00

OCCIDENTAL SALES $8.8 BLN

Occidental Petroleum Corp agreed to sell Anadarko's Algeria, Ghana, Mozambique and South Africa assets to Total SA for $8.8 billion.

2019, May, 8, 11:10:00

NEW RUSSIA'S LNG INVESTMENT: $1,1 BLN

The Government of the Russian Federation has approved the plan to develop the investment project aimed at building a LNG terminal in Murmansk Region.

2019, May, 8, 11:05:00

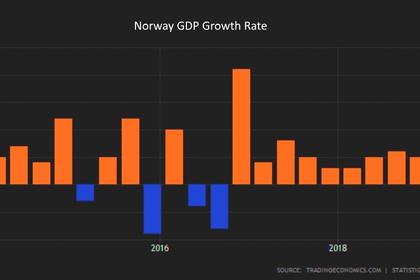

NORWAY'S GROWTH 2.5%

After growing by 2.2 percent in 2018, mainland economic activity is expected to accelerate further and rise by about 2.5 percent this year, before growth slows to 2.1 percent in 2020.

2019, May, 6, 12:00:00

MOZAMBIQUE'S LNG PROJECTS

With estimated gas reserves of over 5,000 Bcm, Mozambique has attracted three LNG projects with total capacity of more than 30 million mt/year and $50 billion capex development, with commissioning expected between 2022 and 2025.

2019, May, 6, 11:55:00

SHELL SELLS INDONESIA'S LNG

Shell, the world’s largest buyer and seller of LNG, is raising cash to help pay for its $54 billion purchase of BG Group in 2015 and hopes to raise around $1 billion from the sale of its 35 percent stake in the project, the sources said.

2019, May, 6, 11:45:00

SHELL CCS EARNINGS $5.3 BLN

CCS earnings attributable to shareholders excluding identified items were $5.3 billion, reflecting lower realised chemicals and refining margins, decreased realised oil prices and lower tax credits, partly offset by stronger contributions from trading as well as increased realised LNG and gas prices compared with the first quarter 2018. In addition, there was a negative impact of $43 million related to the implementation of IFRS 16.

2019, May, 6, 11:40:00

COAL FIRED POWER PLANT FOR EUROPE

General Electric will build and equip a new 500 megawatt (MW) coal-fired power plant in Kosovo

2019, May, 6, 11:35:00

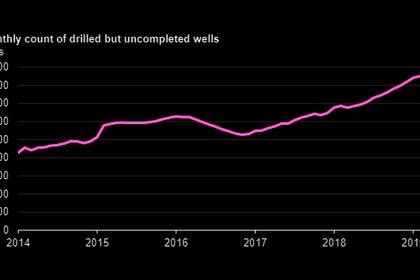

U.S. UNCOMPLETED WELLS UP

The number of drilled but uncompleted wells in seven key oil and natural gas production regions in the United States has increased over the last two years, reaching a high of 8,504 wells in February 2019,

2019, May, 6, 11:35:00

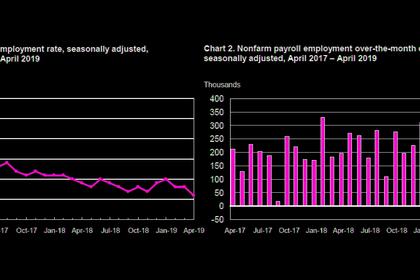

U.S. UNEMPLOYMENT DOWN TO 3.6%

Total nonfarm payroll employment increased by 263,000 in April, and the unemployment rate declined to 3.6 percent, the U.S. Bureau of Labor Statistics reported

2019, May, 6, 11:25:00

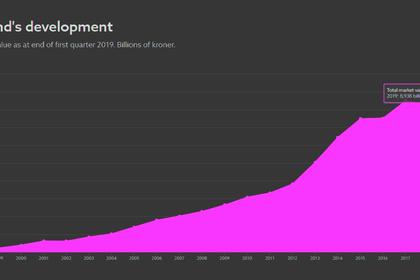

NORWAY'S FUND RETURNED 9.1%

The Government is allowing for the Government Pension Fund Global to be invested in unlisted renewable energy infrastructure under the dedicated environmental mandates. Such investments shall be subject to the same profitability and transparency requirements as the other investments of the Fund, says Siv Jensen, Minister of Finance.

2019, May, 4, 11:20:00

TRANSCANADA'S NET INCOME $1 BLN

TransCanada Corporation (TSX, NYSE: TRP) (TransCanada or the Company) announced net income attributable to common shares for first quarter 2019 of $1.004 billion or $1.09 per share compared to net income of $734 million or $0.83 per share for the same period in 2018.

2019, May, 2, 16:25:00

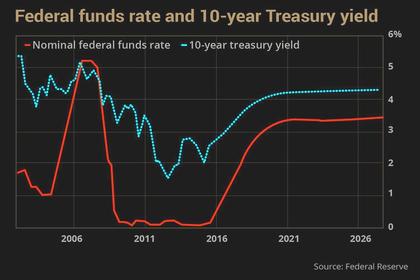

U.S. FEDERAL FUNDS RATE 2.25 - 2.5%

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent.