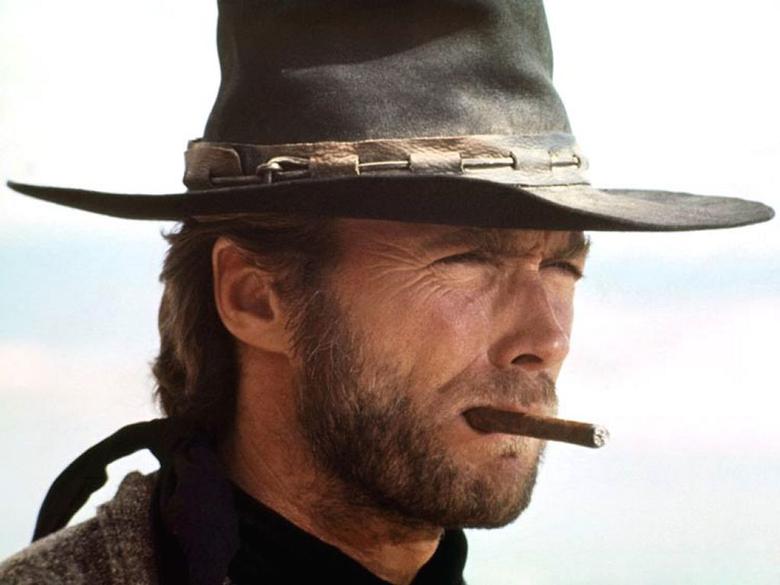

BP: THE GOOD, THE BAD AND THE UGLY

BLOOMBERG. Anadarko Petroleum Corp. (APC) officials urged BP Plc (BP/) to drill deeper into the Gulf of Mexico well that caused the worst offshore oil spill in U.S. history even after BP warned that doing so would be unsafe.

A BP executive and a geologist working on the Macondo well rejected Anadarko's urging to deepen the well, according to e-mails sent the week before the April 2010 deep-sea blowout. BP officials said in the e-mails, unsealed earlier this month in lawsuits over the spill, that the well's condition "provided for little to no margin to continue drilling" safely.

Justice Department lawyers lost their bid yesterday for U.S. District Judge Carl Barbier in New Orleans to consider Anadarko's e-mails as proof the Texas-based oil explorer was involved in day-to-day monitoring and decisions at the well when he calculates a potentially multibillion-dollar pollution fine against the drilling partners.

Anadarko, which owned a 25 percent stake in the Macondo well, off the Louisiana coast, contends it was a passive investor and can't be held liable for pollution fines from the spill, which sent more than 4 million barrels of oil spewing into the Gulf of Mexico, closing fisheries and tainting shorelines from Texas to Florida.

Potential Fines

Barbier discussed the Anadarko e-mails yesterday during a hearing about the scope of a January 2015 trial over the size of potential pollution fines against BP and The Woodlands, Texas-based Anadarko.

The judge, who has already ruled Anadarko wasn't negligent in connection with the Macondo well's operations, rejected the government's claims it could use the e-mails to force the oil explorer to face hefty environmental penalties over the spill.

"I don't think this argument is going to get you anywhere," Barbier told the Justice Department lawyers. "It's pretty clear to me, once I ruled that Anadarko had no legal duty to intervene in the well and could not be negligent," that the U.S. couldn't legitimately claim the company faced heightened culpability for the disaster.

The spill sparked thousands of lawsuits against London-based BP and Anadarko, as well as Transocean Ltd. (RIG), the owner of the Deepwater Horizon drilling rig that burned and sank, killing 11, and Halliburton Co. (HAL), which provided cement services for the well.

'Consistent' Ruling

"Today's ruling is consistent with previous court determinations that we were not at fault for the Deepwater Horizon event," Al Walker, Anadarko's chairman and chief executive officer, said yesterday in an e-mailed statement. "We look forward to seeing the Clean Water Act portion of the trial resolved soon."

Anadarko fell 16 cents to $83.59 yesterday in New York. The shares dropped about 1.7 percent from an intraday high to a low of $82.65 during trading yesterday before rising again.

Anadarko officials said in a Feb. 28 filing with the U.S. Securities and Exchange Commission that the company didn't believe it faced significant exposure to pollution fines over the spill.

Given its "lack of direct operational involvement" and Barbier's ruling that it wasn't negligent during the drilling operation, the company said it believed Clean Water Act penalties assessed against it would materially impact its financial health.

Barbier is weighing whether BP, Transocean and Halliburton were grossly negligent in their work on the well. For BP, such a finding could mean more than $17 billion in environmental fines.

Pollution Penalties

Those penalties would be on top of the $9.2 billion settlement of most private-party lawsuits that BP reached in 2012. Anadarko paid BP $4 billion to resolve its share of liability for those suits.

BP pleaded guilty to 11 counts of felony seaman's manslaughter, two pollution violations and one count of lying to Congress in connection with the spill. It agreed to pay $4.5 billion in related criminal and civil penalties.

While Barbier has concluded Anadarko wasn't negligent in connection with the Macondo drilling operations, the company remains potentially liable for spill damages and penalties under the Oil Pollution Act and the Clean Water Act. The government pointed to the unsealed e-mails as proof Anadarko played an active role in assessing the well's safety and performance.

Drilling Halt

After urging BP to deepen the well the week before the blowout, Anadarko agreed to a drilling halt, according to the e-mails. "In the event BP concludes it is safe and prudent to continue drilling," Anadarko said it "would not oppose BP doing so."

Anadarko managers continued to brainstorm about how to persuade BP to deepen the well in the future, according to the e-mails.

Robert Quitzau, an Anadarko employee, told colleagues in an April 9, 2010, e-mail that they should wait for a more opportune time to push their partners at BP to deepen the Macondo well. That e-mail was sent 11 days before the fatal explosion.

"My sense is that BP doesn't like to make changes to a plan at the last minute," Quitzau said in the e-mail. "So it might be better to propose any further drilling deeper after new plans and budget can be put in place."

The internal communications "demonstrate how intimately Anadarko monitored the drilling of the Macondo well; how it failed to take any precautions despite BP's notorious prior safety and environmental problems; and how it failed to make inquiries at critical junctures," the government said in a court filing.

Anadarko Portrayal

The internal files will make it difficult for Anadarko to continue portraying itself as a silent investor in the Macondo site, David Uhlmann, a University of Michigan law professor and former head of the Justice Department's environmental crimes division, said in a phone interview.

"Anadarko was more than just a passive investor and therefore is going to be required to pay substantially more to settle its liability for the spill," Uhlmann said, based on the e-mails. "The fact that Anadarko may pay more, however, does not mean that BP will pay less. Each company will be penalized based on its culpability."

Transocean, which handled drilling operations at the well, agreed to pay the government $1 billion to resolve its spill liability under the Clean Water Act. Anadarko could have faced a similar fine based on the unsealed e-mails, Uhlmann said.

Third Partner

Mitsui & Co. (8031)'s MOEX Offshore 2007 LLC unit, the Macondo well's third partner, paid BP more than $1 billion to resolve spill-damage claims stemming from its 10 percent stake. It paid the government $90 million to resolve all state and federal pollution claims from the spill.

Uhlmann said the size of MOEX's environmental fine was linked to its status as a silent partner in the well.

In other e-mails, Anadarko employees discussed technical aspects of the well while drilling proceeded and expressed worries about BP's safety record.

Two weeks before the blowout, Anadarko's lead geologist on the project e-mailed a fellow employee that Macondo was still having "well-control issues" and leaking "6.3 barrels of mud every 2 minutes" into the underground formation. Drilling mud is used to lubricate and control pressure within the well.

"Yikes, that sounds like a lot," the colleague replied.

The day after the explosion aboard the Deepwater Horizon, an Anadarko manager messaged co-workers who were discussing the company's stake in BP's well.

'Not Sure'

"I tell you, BP is up s__t creek; between the Texas City refinery fire, the Alaska pipeline leak, Thunderhorse almost sinking –- not sure I would partner with them anymore," the supervisor said in the e-mail.

BP admitted responsibility for the March 2005 explosion at its Texas City plant, its largest refinery, which killed 15 and injured hundreds. The company, which has denied it intentionally endangered workers at the facility, paid more than $2 billion to settle lawsuits stemming from the incident plus a $50 million pollution fine.

In 2006, BP's Alaskan pipeline spilled about 200,000 gallons of oil at Prudhoe Bay. The company pleaded guilty to a misdemeanor pollution violation and paid a $20 million fine to settle state and federal criminal claims.

Production at BP's Thunderhorse floating oil and gas platform, one of the Gulf of Mexico's largest, was delayed for about two years after Hurricane Dennis left the structure listing in the water in 2005.

Calculating Fines

The U.S. was urging Barbier to calculate Anadarko's fine for the 2010 spill at the maximum rate of $4,300 a barrel, and to only consider a lower rate if he determined there were extenuating factors. Clean Water Act penalties aren't pro-rated based on fractional ownership of an oil well under the law.

"Anadarko on several occasions encouraged BP to drill deeper despite the risks" and that should expose the company to additional liability for environmental fines, the government's lawyers said in a filing.

Anadarko asked Barbier to rule that the company should pay "zero" environmental fines and to reject the government's arguments that the e-mails show it had input into drilling operations.

While Anadarko concedes in court papers that it approved Macondo's well design and drilling expenditures and had "limited access to certain forms of operational data," that didn't mean it had "operational control" of the site "or contributed to the discharge."

Geoff Morrell, a BP spokesman, didn't respond to an e-mail seeking comment on the Anadarko e-mails.

Financial Interest

Anadarko shouldn't be able to escape liability for pollution fines for a well in which it had a financial interest, Raleigh Hoke, a spokesman for the New Orleans-based Gulf Restoration Network, said in a phone interview.

"All the parties responsible for the blowout of the Macondo well and the resulting environmental damage should have to pay their fair share of the costs of addressing the problems caused by this disaster," Hoke added.

Barbier set a 2015 trial for the next phase of the spill litigation to hear evidence concerning penalty factors he should consider in calculating the pollution fine for BP and Anadarko.

The judge said at yesterday's hearing that the government's claim Anadarko should have shied away from a BP partnership because of the U.K. company's poor safety record was flawed.

"That's kind of a hard argument to make since the government just let BP back into the Gulf of Mexico," Barbier said.

This month the government lifted a ban on BP competing for U.S. contracts and bidding on new gulf oil leases that was put in place over its mishandling of the Macondo well. U.S. Interior Department officials announced March 19 that BP was the highest bidder for 24 new leases in the gulf region.