CHINA GROWTH 3,1%

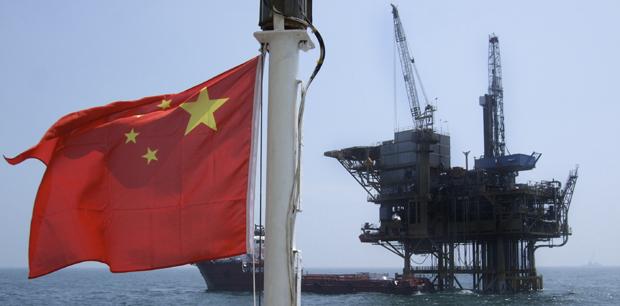

YOGN. China's apparent oil demand in February rose 3.1% year over year to an average 10.62 million barrels per day (b/d) or 40.56 million metric tons (mt), according to a Platts analysis of China's latest government data.

This followed a relatively large year-over-year contraction of 6.4% in January, when apparent oil demand averaged 9.48 million b/d.

The growth in apparent oil demand in February was evidenced by record high refinery runs. As reported by China's National Bureau of Statistics on March 19, crude oil processed by refineries in February rose 5.3% year over year to 10.52 million b/d, while net oil product imports slumped 66.9% from a year earlier to 390,000 mt.

In January, net oil products expanded by more than 1% year over year to 1.5 million mt, while refinery throughput fell by 6.7% to 9.13 million b/d, the lowest level since August 2012.

However, analysts told Platts that the disparity between apparent oil demand in January and February could be due to reporting and accounting issues with Chinese data.

China's average apparent oil demand during the first two months of 2014 fell 1.9% year over year to 10.03 million b/d. The figure was dragged down in part by refinery runs, which were down 1% on a year-over-year basis. Net oil product imports slid 28.5% to 1.91 million mt.

"China's oil demand is off to a slow start this year, on the back of slowing growth in industrial production and exports," said Song Yen Ling, Platts senior writer for China. Industrial production for the first two months of this year was up 8.6% from the same period a year ago.

Industrial production was up 9.7% and 10%, respectively in December and November of 2013.

Apparent demand for gasoil – which is the largest among oil products in China – averaged 3.42 million b/d during the January-February period. This is down 2.9% from a year ago and on the heels of the 2013 annual contraction of 0.6%.

The share of gasoil as a percentage of total apparent demand was 33.5% during the January-February period. This is down from 33.9% for the same period a year ago.

In contrast, gasoline apparent demand rose 4.9% to 2.39 million b/d in the first two months of this year, accounting for 20.6% of total apparent demand. This compares with a gasoline share of 19.2% in January-February last year. The fuel has benefited from booming car sales in China.

Meanwhile, China's apparent demand for fuel oil this year through February tumbled 8% to 699 million b/d, mainly due to weaker demand from China's small, independent refiners known as "teapot" refineries, which typically use imported fuel oil as feedstock.