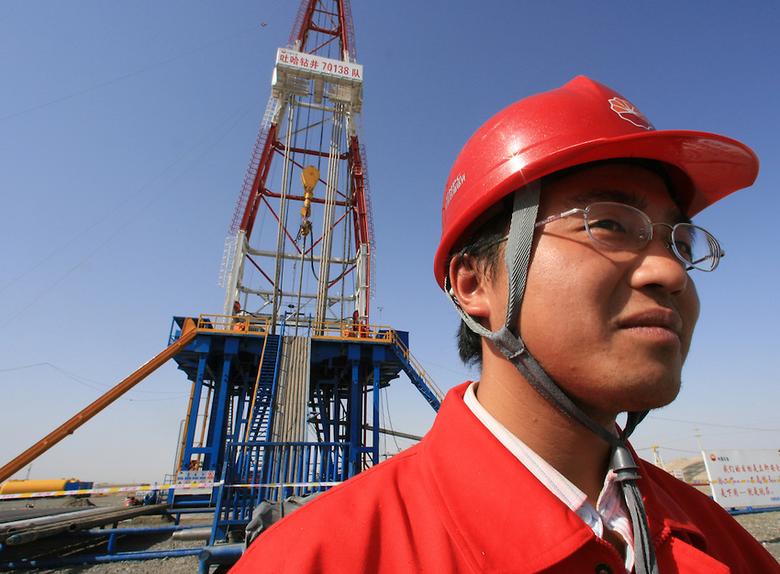

PETROCHINA FALLS 4.9%

State-controlled PetroChina Co. on Thursday said its first-quarter net profit fell 4.9% from a year earlier, due mainly to rising costs and a decline in international crude prices.

China's largest oil company by production capacity said first-quarter net profit fell to 34.2 billion yuan ($5.5 billion) from 36 billion yuan a year earlier.

Revenue fell 2% to 528.9 billion yuan from a year earlier because of a lower contribution from the company's upstream exploration-and-production operations. The company's crude oil output rose 2.3% in the first quarter, although the average selling price for its crude oil fell 2.9% during the period.

Beijing-based PetroChina and parent China National Petroleum Corp. have for years been building their international portfolio of upstream assets—in 2013 alone, they spent $20 billion on oil and gas projects in Australia, Mozambique, Peru and Brazil, according to data provider Dealogic.

Among recent purchases aimed at boosting its reserves was its November acquisition of a 25% stake in Iraq's giant West Qurna-1 field.

In March, PetroChina Chairman Zhou Jiping said the company is still looking for acquisitions to fuel growth, even as it plans to trim 2014 capital spending by 7% to 296.5 billion yuan (US$47.9 billion). On April 17 the company said it would pay 1.32 billion Canadian dollars (US$1.2 billion) for the 40% stake it doesn't already own in an oil-sands operation in northern Alberta.

First-quarter operating losses from its refining and chemical businesses narrowed to 2.2 billion yuan from 4.7 billion yuan, helped by the Chinese government's authorization in September for an increase in refined product prices.

Also, a 15% increase in wholesale natural gas prices introduced last July helped PetroChina's gas and pipeline business to report a 27% increase in operating profit from a year earlier. It has lost billions of dollars from selling imported natural gas at government-mandated deep discounts in the past few years.

Earlier this week, Cnooc Ltd., China's largest offshore oil and gas producer by capacity, reported a 6.9% rise in first-quarter revenue on higher oil and gas output. Cnooc provides only net profit figures for its first-half and full-year periods.

The third of China's big three oil and gas companies, China Petroleum & Chemical Corp., will post its first-quarter results on Monday.

wsj.com