ИРАК ХОЧЕТ РУССКИХ ДЕНЕГ

На фоне роста спроса на нефтепродукты в Ираке, правительство в Багдаде прилагает усилия для увеличения перерабатывающих мощностей на территории страны, предлагая зарубежным инвесторам участие в проектах на льготных условиях.

Разработанное правительством технико-экономическое обоснование выявило 30%-й рост спроса на нефтепродукты в период с 2015 по 2020 год, при этом уровень мощностей по нефтепереработке должен составить 940 тыс. баррелей в сутки. Об этом в рамках международной конференции по переработке, транспортировке и продаже углеводородов (ADID 2014), проходившей недавно в Абу-Даби, рассказал участникам форума Тамир Гадбан, председатель консультативной комиссии при премьер-министре Ирака. Согласно ТЭО, в этой ближневосточной стране ожидается среднегодовой рост спроса на бензин в размере 4,8% в период с 2015 по 2030 год, тогда как спрос на газойль будет в среднем увеличиваться на 6% в год.

В настоящее время мощности старых нефтеперерабатывающих заводов Ирака, разрушенных во время военных конфликтов и простаивавших в период действия экономических санкций в отношении Ирака, ограничены объемом 660 тыс. баррелей в сутки.

На форуме Гадбан представил ряд проектов по строительству новых НПЗ на территории Ирака, рассказал о главных вызовах, связанных с их реализацией, и обратил внимание аудитории на стимулы, которые местное правительство готово предоставить зарубежным инвесторам, такие как интеграционные модели «строительство-владение-эксплуатация», освобождение от уплаты налогов и законодательно закрепленные льготы при создании свободных зон.

По словам чиновника, Ирак пригласил инвесторов к участию в четырех проектах по строительству новых НПЗ в Кербеле, Насирии, Амаре и Киркуке.

В Кербеле инвестиционный контракт стоимостью $6 млрд на строительство НПЗ, который будет перерабатывать 140 тыс. баррелей в сутки, в феврале получила корейская компания Hyundai Engineering and Construction.

Иностранных инвесторов также пригласили вложиться в строительство НПЗ на севере Ирака, в подконтрольной курдам провинции Киркук, и в Амаре – городе, расположенном на юго-востоке страны, в регионе Майсан. Перерабатывающая мощность каждого завода составит 150 тыс. баррелей в сутки. В Киркуке North Oil Company выступает против проведения тендеров из-за непрекращающихся территориальных споров между Курдистаном и Ираком.

Насирийский проект предусматривает разработку нефтяного месторождения Насирия с запасами 4 млрд баррелей нефти, и строительство НПЗ мощностью 300 тыс. баррелей в сутки. Ориентировочная стоимость проекта составляет $13 млрд. Компания Foster Wheeler недавно завершила выполнение предпроектных изысканий для НПЗ.

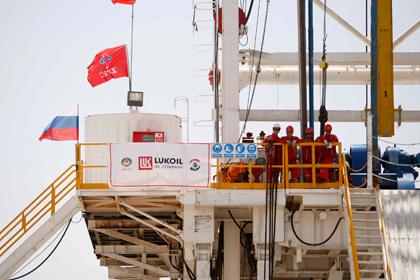

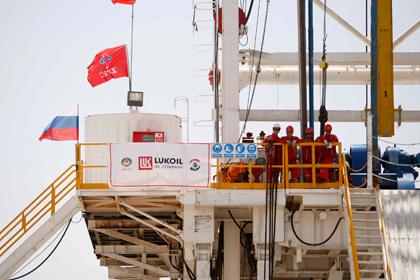

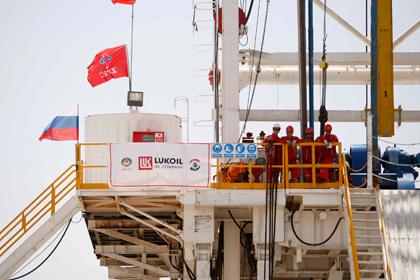

В марте прошлого года Управление по нефтяным контрактам и лицензированию Ирака объявило о том, что для разработки нефтяного месторождения Насирия и строительства НПЗ было предварительно выбрано семь международных нефтяных компаний, включая представителей России – «Зарубежнефть» и «ЛУКОЙЛ». Позднее, в августе 2013-го к этому списку было добавлено еще несколько компаний, включая «Роснефть». Сегодня в Ираке ждут проведения аукциона по проекту строительства НПЗ в Насирии, который недавно был перенесен уже во второй раз и теперь должен состояться 19 июня, сообщает информагентство Reuters.

«ЛУКОЙЛ» ведет переговоры с иракскими властями по проекту в Насирии уже более года. 12 февраля президент российской компании Вагит Алекперов сказал, что следующий раунд переговоров по этому проекту с правительством Ирака ожидается этим летом. В своем заявлении Алекперов также отметил, что первоначальный проект контракта на добычу и строительство НПЗ, предложенный иракской стороной, содержал слишком большие финансовые риски.

Как отметил Гадбан в своей презентации на ADID 2014, насирийский проект все еще находится в стадии переговоров, и контракт получит инвестор, чье предложение гарантирует наибольшую финансовую отдачу от вложенных средств.

«Компания "ЛУКОЙЛ" определенно является одним из наиболее активных участников конкурса по этому проекту», – добавил он.

Чиновник также пояснил, что будущий контракт будет основываться на принципе «строительство-владение-эксплуатация», обязывающем инвестора построить завод, владеть им и эксплуатировать его, одновременно предоставляя инвестору право реализовать нефтепродукты, как на внутреннем, так и на внешнем рынке.

«Инвестор будет делиться с правительством 25% доходов от продажи нефтепродуктов. Помимо этого, ему предоставят 5%-ю скидку на нефть, от $4 до $8 за баррель, и он также получит право на определенные льготы в соответствии с измененным Законом об инвестициях №13», указал Гадбан.

Чиновник пояснил, что Закон об инвестициях № 13 освобождает инвестора от уплаты налогов и сборов в течение 10 лет после начала коммерческой деятельности, а также позволяет ему не платить таможенные пошлины на активы, ввозимые в Ирак для реализации проекта в течение трех лет после получения инвестиционной лицензии.

Гадбан подтвердил, что измененный Закон об инвестициях №13 был введен в действие для привлечения инвесторов в свободную нефтегазовую зону компании BIOGH (Basra International Oil and Gas Hub) в Хор Аль-Зубайре – городе на юге страны, в области Басра.

Как сообщает агентство Iraq Business News, решение об основании BIOGH, зоны площадью 118 млн квадратных футов, было принято в сентябре 2012 года Главной комиссией Ирака по свободным зонам и компанией Basra International Oil and Gas Hub Ltd, которую основали в 2009 году Джон Мур и Том О'Доннелл.

Компания BIOGH – это основной разработчик проекта, ответственный за руководство проектом, финансирование и маркетинг. Предполагается, что Свободная нефтегазовая зона BIOGH должна обеспечить площадки и объекты для производства, хранения и отгрузки продукции нефтяного сектора Ирака.

Объекты Свободной зоны находятся в непосредственной близости от таких гигантских месторождений, как разрабатываемое компанией BP месторождение Румайла, месторождения Западная Курна I и II, разрабатываемые Exxon Mobil/Shell и «ЛУКОЙЛ», месторождение Зубайр (осваивается Eni) и месторождение Майнун (разработку ведет Shell), – все они располагаются на расстоянии от 30 до 130 км.

В настоящее время проект Свободной зоны находится на этапе завершения проектирования.

oilandgaseurasia.com

IRAQ WANTS RUSSIAN MONEY

As Iraq's demand in oil products rises, the government in Baghdad is taking efforts to enhance the country's refining capacities by promoting incentives offered to foreign investors.

A government-conducted feasibility study has revealed a 30-percent increase in demand for petroleum products in 2015-2020, reaching the estimated refining capacity level of 940,000 barrels per day, Thamir Ghadhban, chairman of Advisory Commission to the Prime Minister's Office, told participants of the Abu-Dhabi International Downstream Conference 2014 (ADID 2014). The study forecast a 4.8-percent average annual growth in gasoline demand in 2015-2030, whereas gas oil demand is expected to grow at 6 percent per year on average.

Currently, the capacities of Iraq's old refineries that had been ravaged in military conflicts and stagnating under economic sanctions, are limited to 660,000 barrels per day.

At the show, Ghadhban unveiled a number of projects to build new refineries, talked about the challenges they pose and stressed some of the incentives provided by the Iraqi government to foreign investors: build-own-operate models of integration, tax exemptions and free zone law incentives.

According to the official, Iraq has invited investors to participate in four new refining projects in Karbala, Nasiriyah, Amarah and Kirkuk.

In Karbala, the $6-billion refinery project that would handle 140,000 barrels per day was awarded to Hyundai Engineering and Construction in February.

A refinery in the Kurdistan-governed northern province of Kirkuk and a plant in Amarah, the city in the southeastern region of Maysan, are both awaiting foreign investors. Each project's capacity is 150,000 barrels per day. In Kirkuk, the North Oil Company has opposed bidding procedures due to the ongoing territorial dispute between Kurdistan and Iraq.

The Nasiriyah project involves a development of the 4-billion-barrel Nasiriyah oilfield, and a building of a 300,000-barrels-per-day refinery. The project's estimated value is $13 billion. Foster Wheeler recently completed the Front End Engineering and Design (FEED) for the refinery.

In March 2013, Iraq's Petroleum Contracts and Licensing Directorate (PCLD) announced that seven international oil companies had been selected to bid for development of its Nasiriya oilfield and refinery, including Russia's Zarubezhneft and LUKOIL. Later, in August 2013, a few more companies were added to the shortlist, including Rosneft. The refining project in Nasiriya is awaiting the auction that was postponed for a second time until June 19, Reuters reported.

LUKOIL has been in talks with Iraqi oil authorities concerning the Nasiriya project for over a year now. On Feb. 12, LUKOIL President Vagit Alekperov sai that the next round of talks on the project with the government in Baghdad is expected this summer. In his statement, Alekperov also pointed out that the first draft of the contract on Nasiriya Integrated oilfield and refinery project offered by the Iraqis posed too many financial risks.

As Ghadhban said during his presentation at ADID 2014, the Nasiriyah project was still at the negotiation stage and the project would be awarded to an investor who could make the best offer in terms of ROI for the Iraqi government.

"LUKOIL is definitely is one of the hot bidders for the project", he added.

The official also explained that the future contract would be based on a BOO concept, obliging the investor to build, own and operate the facility, simultaneously giving him the right to sell and market refined products domestically and abroad.

"The investor will share 25 percent of the revenue from petroleum products sales with the government. The investor will also get a 5-percent discount on the oil price, ranging from the $4-per-barrel minimum to an $8 maximum, and he will be entitled to selected benefits of the amended Investment Law #13," pointed out Ghadhban.

As he explained, Investment Law #13 exempts an investor from taxes and fees for a period of 10 years upon commencement of a commercial operation, and also makes an investor exempt from customs fees on assets imported for the project over the course of three years following receipt of the investment license.

Ghadhban confirmed that the amended Investment Law #13 has been put to use to attract investors into the BIOGH (Basrah International Oil and Gas Hub) Oil and Gas Free Zone in Khor Al-Zubair, Basra, in southern Iraq.

The decision to set up BIOGH, a 118-million-square-feet zone, reports Iraq Business News, was made in September 2012 by the Iraqi General Commission on Free Zones and Basrah International Oil and Gas Hub Ltd that was established in 2009 by John M. Moore and Tom O'Donnell.

BIOGH is the project's prime developer responsible for its management, financing and marketing. BIOGH Oil and Gas Free zone is deemed to provide facilities for manufacturing, storage and handling of Iraq's oil sector.

The Free Zone's facilities are in close proximity to such giant oilfields as BP operated Rumaila, West Qurna I and II operated by Exxon Mobil/Shell and LUKOIL, Eni's Zubair and Shell's Majnoon, – all at a 30-130 kilometers' distance.

Currently the Free Zone project is at the stage of completing design work.

oilandgaseurasia.com

Tags:

ИРАК,

ЛУКОЙЛ,

РОСНЕФТЬ,

IRAQ,

LUKOIL,

ROSNEFT,

EXXON,

SHELL