OIL: RUSSIAN SANCTIONS

Gains in crude prices driven by new sanctions on Russia will be limited because there's sufficient spare export capacity and no shortage of global supply, according to Nomura Holdings Inc. and Sapient Global Markets.

Brent crude for September delivery was little changed at about $107 a barrel in London trading today after the U.S. Treasury Department said OAO Rosneft, Russia's biggest oil company, and natural gas producer OAO Novatek are among those hit by the penalties. Futures rose 2 percent to $111.20 on March 3 after Ukraine mobilized its army reserves as its neighbor seized control of the Black Sea region of Crimea.

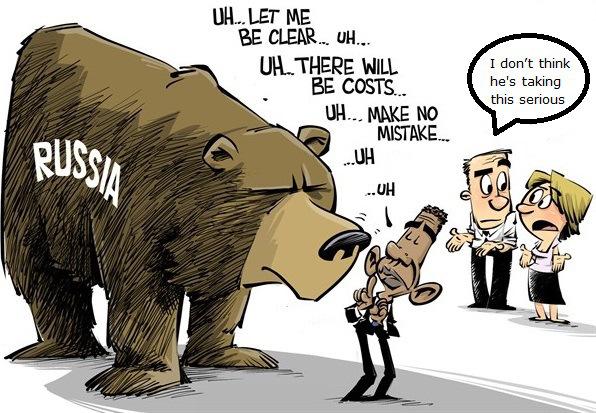

The measures are the latest response to what U.S. and European leaders say is President Vladimir Putin's refusal to end support for rebels who have been battling Ukrainian government forces in the east. The Organization of Petroleum Exporting Countries, which last month pledged to replace any barrels lost during the conflict in Iraq, may cover any potential cut in supply from Russia, Nomura predicts.

"OPEC will step up and export more to replace the lost Russian crude and calm these oil-price spikes," Gordon Kwan, the regional head of oil and gas research at Nomura Holdings Inc. in Hong Kong, said today. "The U.S. and EU are smart enough not to risk derailing the global economic recovery by choking off Russia's oil exports."

Spare Capacity

OPEC's spare capacity is estimated at 3.25 million barrels a day, the International Energy Agency said in its monthly report on July 11. Saudi Arabia, the group's biggest producer, pumped 9.9 million barrels a day of oil in June, according to data compiled by Bloomberg. The kingdom is capable of producing as much as 12.5 million.

Russia exported about 6.14 million barrels a day of crude in May, said the Paris-based agency, an adviser to developed nations. Commercial oil inventories held by members of the Organization for Economic Cooperation and Development rose by 44.2 million barrels in May to 2.639 billion, its report shows.

The EU said it would halt lending for new public-sector projects in Russia by the European Investment Bank, the bloc's in-house lender, and will use its influence to stop new lending by the European Bank for Reconstruction and Development. The U.S. and EU are seeking to squeeze the nation's $2 trillion economy by limiting access to financing.

At a news conference in Brasilia, Putin called the U.S. sanctions "aggressive policy" and will only end up hurting American companies. The sanctions will lead U.S.-Russia relations to a dead end, he said.

"People will be waiting to see what Putin does," Chip Register, the New York-based managing director of Sapient Global Markets, a financial and commodity market consultant, said by phone from London yesterday. "The oil markets, there's spare capacity in the world, so it'll be a little harder to move them around."

bloomberg.com