ROSNEFT BUYS MORGAN STANLEY

Russia's state-controlled oil giant, OAO Rosneft, ROSN.MZ +0.98% has submitted a deal to buy a Morgan Stanley MS +0.40% oil-trading unit to a confidential U.S. committee that weighs national security risks, according to a person familiar with the matter.

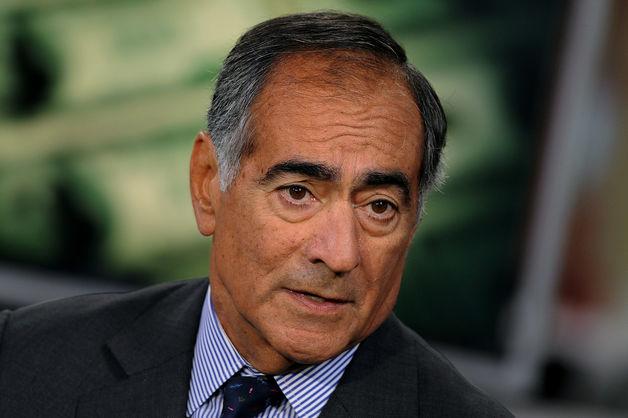

Approval of the deal faces special challenges because the U.S. Treasury, which leads the committee, in April added OAO Rosneft's Chief Executive Igor Sechin to a sanctions list. The list, which bans U.S. travel and triggers asset freezes, is part of U.S. efforts to alter Russia's interference in Ukraine.

Given the escalation of U.S. tensions with Russia this year, experts who follow the Committee on Foreign Investment in the U.S., or CFIUS, said the deal was likely to face added scrutiny even before Mr. Sechin was added to the sanctions list, which includes Russian officials and Ukrainian separatist leaders.

Since a foreign government controls Rosneft, U.S. law directs CFIUS to scrutinize the case at length, with higher-level officials weighing in unless an exception is granted. Top administration officials would likely take into account broader Russian economic and security factors that go beyond the specific risks of the business being sold, according to former CFIUS officials and Washington lawyers who work with the committee.

The companies' move to go ahead with a CFIUS review is significant because some people following the deal had expected that Rosneft and Morgan Stanley could re-evaluate their tie-up along the way, depending on geopolitical concerns.

A Rosneft spokeswoman declined to comment on the CFIUS filing, as did a Morgan Stanley spokesman. The Rosneft spokeswoman pointed to comments Mr. Sechin made in May, saying that the Morgan Stanley deal was proceeding according to schedule.

A decision by the committee on the Rosneft case is likely to come 75 days after the filing, which means if CFIUS blessed the deal, it could close in the third quarter. Executives from both companies have maintained that they would close the deal this year in spite of the rift between their governments.

Morgan Stanley had sought to head off Washington's concerns over the Rosneft deal by running a separate sale process for its TransMontaigne TLP -0.71% unit, which owns oil storage facilities and pipelines on U.S. soil, people familiar with the matter said. The Wall Street firm agreed last month to sell its interests in TransMontaigne, as well as related inventory, to NGL Energy Partners NGL +0.92% LP. That deal closed on Wednesday.

Morgan Stanley has joined other big banks in scaling back their commodities businesses as new rules force them to set aside more capital. Wall Street also has been bracing for stiffer U.S. regulations on the way those same banks trade and store oil, natural gas, aluminum and other commodities. Rosneft had agreed to buy the oil trading and storage arm for "several hundred million dollars," people familiar with the matter have said.

The Treasury Department is barred from commenting on cases before CFIUS except in certain rare circumstances. Officials in the Obama administration say the U.S. encourages foreign investment and blocks deals only occasionally when security concerns can't be mitigated.

Holly Shulman, a Treasury spokeswoman, declined to comment on whether a company headed by a person on the sanctions list represents a security risk.

wsj.com