2Q: OIL&GAS M&A

The US oil and gas industry experienced a substantial rise in mergers and acquisitions during the second quarter, according to a quarterly report by PwC US Energy Practice.

During the 3-month period ending June 30, 54 oil and gas deals took place with values greater than $50 million, accounting for $42.2 billion, compared with 47 deals worth $30.3 billion during last year's second quarter.

The upward movement is largely attributed to an increase in megadeals, with 12 occurring worth a combined $30.8 billion—73% of total deal value—due to larger oil and gas companies divesting more valuable assets. There were just five megadeals during the first quarter.

"Over the past 3 months, we continued to see companies looking to realign their portfolios and divest noncore assets, which provided opportunities for acquirers with cash and access to capital," said Doug Meier, PwC's US energy sector deals leader.

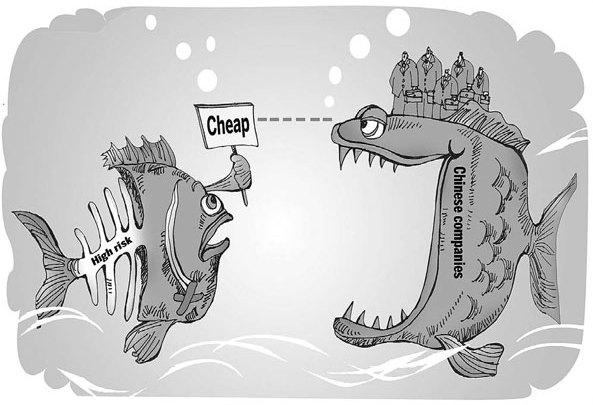

Foreign buyers, who showed an increased interest in divested assets, recorded 15 deals overall accounting for $8.5 billion, substantially more than the single deal that occurred during the same time last year. In the first quarter, 10 deals were made by foreign buyers.

Including the 47 deals that occurred during the first quarter worth $18.3 billion, the first half saw 101 total deals take place worth $60.5 billion.

"The first 3 months of 2014 set the stage for the strongest second quarter of oil and gas deal activity that we've seen in the last 5 years," Meier said.

Deal breakdown

Asset transactions again represented a vast majority of deals during the second quarter, tallying 44 worth $27.3 billion, respectively 81% of total deal volume and 65% of total deal value.

Upstream deals accounted for 61% of total deal activity, with 33 transactions representing $21.7 billion, 51% of total deal value. Ten midstream deals contributed $12.1 billion, and seven downstream deals added $7.5 billion, compared with 12 midstream deals worth $17.5 billion and five downstream deals worth $1.4 billion during the same period last year.

The number of oil field services deals during the quarter fell 30% while value dropped 80%. Master limited partnerships (MLPs), meanwhile, were involved in 19 transactions, 35% of total deal activity in the quarter, which PwC described as consistent with recent historical levels.

More interest in shale

Almost half of all deal value during the second quarter came from US shale plays. Jumping to $20 billion over 21 transactions, the total was substantially higher than the $4.4 billion first-quarter total and $7.7 billion second-quarter 2013 total.

Seventeen of those 21 deals came in the upstream sector, totaling $11 billion, 51% of total upstream deal value. Four midstream shale-related deals took place, representing $9 billion, doubling the volume of the two deals worth $210 million that occurred in the first quarter.

Texas was the primary hub of activity, with the Eagle Ford serving as the most active US play during the quarter, tallying six deals worth $6.9 billion. The neighboring Permian along with the Niobrara followed behind with three deals apiece, totaling $1.1 billion and $432 million, respectively. The Marcellus collected two deals worth $2.9 billion, while the Utica and Bakken each tallied one deal.

John Brady, partner with PwC's energy practice, described the shale activity as "a testament to how companies and investors view the success of the unconventional landscape, especially as new technologies and methods come to fruition that increase speed and efficiency from the upstream and drilling process to transportation and bringing oil and gas to market."

ogj.com