CHEVRON NET INCOME $5,2 BLN

Chevron Corporation (NYSE: CVX) reported earnings of $2.0 billion ($1.09 per share – diluted) for third quarter 2015, compared with earnings of $5.6 billion ($2.95 per share – diluted) in the 2014 third quarter. Foreign currency effects increased earnings in the 2015 quarter by $394 million, compared with an increase of $366 million a year earlier.

"Third quarter earnings were down substantially from a year ago," saidChairman and CEO John Watson. "While downstream earnings remained strong, lower overall earnings reflected weaker market prices for both crude oil and natural gas, which depressed upstream profitability. We are focused on improving results by changing outcomes within our control. Operating and administrative expenses are 7 percent lower than last year, and we expect further reductions in the quarters ahead."

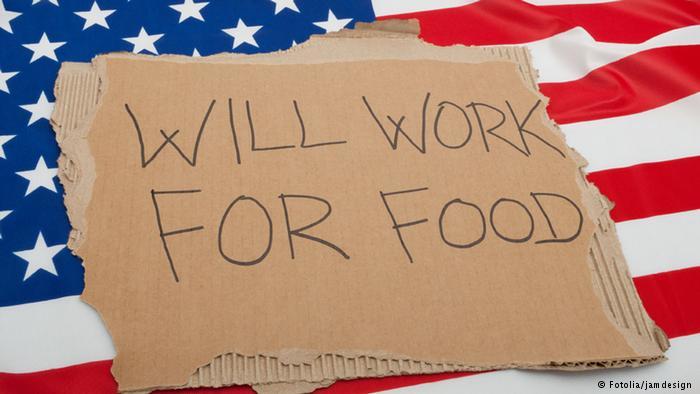

"We expect capital and exploratory expenditures for 2016 to be $25-28 billion, roughly 25 percent lower than this year's budget," Watson continued. "We expect further reductions in spending for 2017 and 2018, to the $20 to $24 billion range, depending on business conditions at the time. With the lower investment, we anticipate reducing our employee workforce by 6–7,000."

"We continue to make good progress on our asset sales program," Watson continued. "In the last two years we've generated $11 billion in proceeds. We expect $5-10 billion in additional proceeds by the end of 2017."

-----

More:

PRODUCERS NEED $ 500,000,000,000