January 2015

2015, January, 17, 22:05:00

U.S. OIL CRACH

Any lingering doubt about the depth of the crisis facing the U.S. energy industry is quickly evaporating as even the biggest firms slash spending amid the steepest oil price crash since the recession, sending ripples across the vast sector.

2015, January, 17, 21:55:00

OIL PRICES AGAINST GROWTH

Global equity markets rebounded, with U.S. stocks capping five straight sessions of losses. European shares rose on growing expectations of economic stimulus from the European Central Bank.

2015, January, 17, 21:50:00

OPEC: OIL DEMAND IS GROWING

In 2015, world oil demand is anticipated to rise by 1.15 mb/d, following an upward revision of 30 tb/d due to expectations of higher oil requirements in OECD America and Other Asia.

2015, January, 17, 21:45:00

NORWAY: NO CRISIS

Norway’s oil revenues have been hit hard by a 50% drop in prices over the past six months and oil companies operating in Norway are set to reduce their capital expenditure by 15% on the year in 2015

2015, January, 17, 21:40:00

US FALL DRILLING

The number of rigs drilling for oil in the US dropped sharply this week as plunging crude prices hit development of shale reserves, the most-watched survey of industry activity has shown.

2015, January, 14, 21:30:00

2015: $58/BBL

December was the sixth consecutive month in which monthly average Brent prices decreased, falling $17/barrel (bbl) from November to a monthly average of $62/bbl, the lowest since May 2009. The December price decline reflects continued growth in U.S. tight oil production, strong global supply, and weakening outlooks for the global economy and oil demand growth.

2015, January, 14, 21:25:00

GLOBAL GROWTH CUTS

The World Bank on Tuesday lowered its global growth forecast for 2015 and next year due to disappointing economic prospects in the euro zone, Japan and some major emerging economies that offset the benefit of lower oil prices.

2015, January, 14, 21:20:00

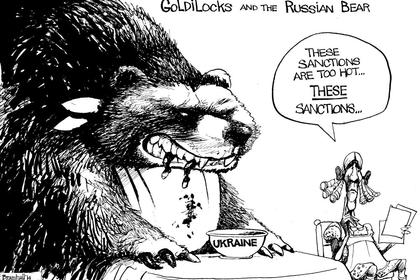

RUSSIA SANCTIONS: WAR PRICE

The European Union could significantly scale back sanctions and resume discussions with Russia on issues ranging from visa-free travel; cooperation with the Moscow-led Eurasian Economic Union; and the crisis in Libya, Syria and Iraq; if Russian President Vladimir Putin moves to end the crisis in eastern Ukraine, according to an EU discussion paper.

2015, January, 14, 21:15:00

2015: GLOBAL OIL SPLITS

Robust recovery in the United States, a moribund euro zone and slowing Chinese growth reflect global splits which plunging oil prices are likely to widen.

2015, January, 14, 21:10:00

CHINA: BIG OIL BUYING

The market consensus is that the China is buying more oil than they need in order to fill strategic reserves.