EU ENERGY MARKET

Before Donald Tusk became president of the European Council, the former Polish prime minister had already begun campaigning for a European energy union.

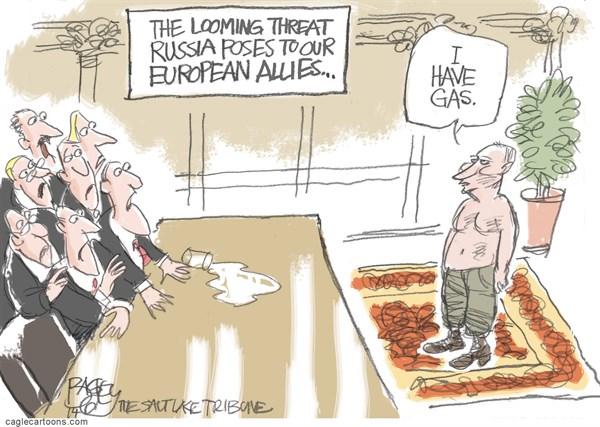

The idea was that the European Union would establish a single market for electricity and gas and would build interconnectors to enable energy to flow between networks. Above all, Tusk wanted transparency over gas supply contracts so that Gazprom, Russia's giant state-owned gas company, could not arbitrarily set prices for its European customers and thus wield political power over them.

On March 19, after a summit of EU leaders, Tusk won a small victory. "All leaders agreed to reinforce transparency in the gas market so suppliers cannot abuse their position to break EU law and reduce our energy security," Tusk said.

But the biggest prize—the disclosure of contracts—was omitted from the leaders' final text. Instead, the summit conclusions stated: "As regards commercial gas supply contracts, the confidentiality of commercially sensitive information needs to be guaranteed."

That must have pleased, among others, Viktor Orbán, Hungary's prime minister. In January, he signed a contract with Vladimir Putin, the Russian president, to finance and build a second nuclear power plant at the Hungarian town of Paks. The Hungarian parliament later voted to ban for thirty years the release of any details of the deal. It was precisely that secrecy that Tusk wanted to end.

Yet even if EU leaders ducked the sensitive issue of confidentiality, Tusk and leaders from the Baltic states, Poland, and other countries that are seeking more transparency and security in Europe's energy sector have a powerful ally: the European Commission's Directorate General for Competition.

This is the body, not the commission's energy department or EU leaders, that is proving a highly effective force in reining in Gazprom's hold on Europe's energy sector. The commission is doing this by taking the EU's Third Energy Package literally.

Passed in 2011, the package is aimed at creating a liberalized gas market in the EU. Once fully implemented, it will unbundle or break up vertically integrated gas companies that until recently could enjoy near monopolies over the production, purchase, and distribution of gas. Furthermore, the package included third-party access to pipelines and the publicity of tariffs to create competition (and lower prices) in the sector.

The EU's antitrust authorities didn't waste much time in testing compliance with the Third Energy Package, even if some EU member states had dragged their feet in pushing it through. In 2012, the commission opened an investigation into Gazprom's pricing practices in several Eastern and Central European member states.

One of the countries, Lithuania, had complained to the commission that Gazprom was blocking competition by virtue of its monopoly. As a result, Gazprom could charge very high prices for its gas exports to these countries. In doing so, Russia could use its state-owned energy company as a political instrument.

Margrethe Vestager, the European competition commissioner, told the Wall Street Journal on February 18 that the results of the antimonopoly investigation could be presented in a matter of weeks. She added that it was "very important for me to make sure that any company in the European market is being faced with the same set of rules and the same effort of enforcement."

And that's not all. The EU's competition authorities put a stop to Gazprom's plans to build the South Stream pipeline, which would have run from Russia under the Black Sea to Bulgaria and on to Central Europe. Besides weakening Moscow's dependence on Ukraine as the major transit country for Russian gas to Europe, South Stream would have given Russia direct access and a grip over the energy markets in Southeastern Europe.

Gazprom abandoned the project after the European Commission insisted on third-party access and warned Bulgaria, one of Gazprom's partners in South Stream, that it would face heavy penalties if it did not abide by the Third Energy Package legislation.

The competition authorities also stepped in over OPAL. This is the onshore pipeline in Germany that transmits gas inland from Nord Stream, the Gazprom pipeline that runs from Northwest Russia to Germany via the Baltic Sea. The commission opposes Gazprom monopolizing OPAL and has argued it should limit its usage of the pipeline to 50 percent. The upshot is that Gazprom has postponed the building of another Nord Stream spur.

And in another blow to Gazprom, BASF, the German chemicals group, pulled out of a deal with the Russian energy giant. Wingas, BASF's gas marketing company, had signed a deal that would have increased Gazprom's stake in Wingas from 50 to 100 percent. In return, Wintershall, BASF's oil and gas unit, would have gained more access to Siberian gas fields. More importantly, the deal would have given Gazprom substantial access to gas trading and storage in Germany.

Announcing the cancellation of the asset swap, BASF blamed the political tensions between the EU and Russia over Russia's annexation of Crimea and its invasion of eastern Ukraine. "Due to the currently difficult political environment, BASF and Gazprom have decided not to complete the asset swap," the German company said.

The EU sanctions against Russia also contributed to BASF's decision. But there is little doubt that the commission's competition arm was looking at the case.

The European Commission's work doesn't come easy, especially since some EU countries still stick to Gazprom rather than diversify their suppliers. But the commission's zeal in pursuing antitrust cases proves how Gazprom's once omnipotent grip over Europe's gas sector is being loosened.

naturalgaseurope.com