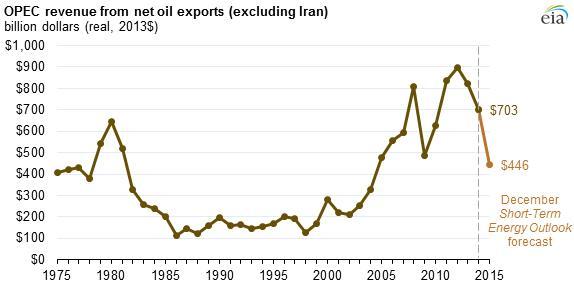

OPEC EARNING: $446 BLN

Based on crude oil market assessments in the Short-Term Energy Outlook, EIA estimates that members of the Organization of the Petroleum Exporting Countries (OPEC), excluding Iran, will earn about $700 billion in revenue from net oil exports in 2014, a 14% decrease from 2013 earnings and the lowest earnings for the group since 2010. OPEC earnings declined in 2014 largely for two reasons: decreases in the amount of OPEC oil exports and lower oil prices, with the 2014 average for Brent crude oil projected to be 8% below the average 2013 price.

For similar reasons, revenues for OPEC (excluding Iran) in 2015 are expected to fall further, to $446 billion, 46% below the 2013 level. Brent crude oil is projected to average $68 per barrel in 2015, down from $100 per barrel in 2014 and $109 per barrel in 2013.

Iran is excluded in this calculation because current sanctions make it difficult to estimate their crude oil export revenues. Iran may be taking discounts on the crude oil it exports and may not be receiving all the revenue from those sales because of restrictions on accessing international payment systems.

Prolonged periods of lower oil prices have the largest effect on OPEC countries that are more sensitive to losses in revenue, most notably Venezuela, Iraq, and Ecuador. Governments in these countries were already running fiscal deficits in 2013, and their sovereign wealth funds are smaller compared to other OPEC members. This implies that these countries may not be able to fill budget gaps for as long as other OPEC members.

Further revisions to future budget plans may be required in many OPEC member countries, particularly the countries cited above, because of lower oil prices and large uncertainty over future global economic growth and crude oil production levels. Geopolitical risk may also be elevated because of lower government spending.

eia.gov