U.S.: THE LARGEST PRODUCER

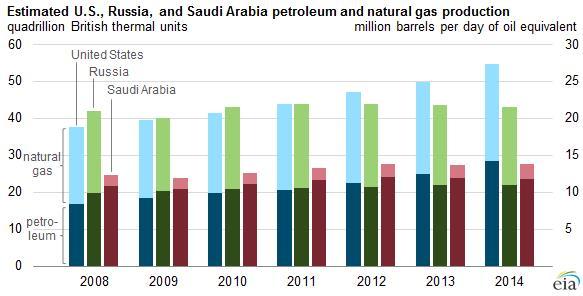

The United States remained the world's top producer of petroleum and natural gas hydrocarbons in 2014, according to U.S. Energy Information Administration estimates. U.S. hydrocarbon production continues to exceed that of both Russia and Saudi Arabia, the second- and third-largest producers, respectively. For the United States and Russia, total petroleum and natural gas hydrocarbon production, in energy content terms, is almost evenly split between petroleum and natural gas. Saudi Arabia's production, on the other hand, heavily favors petroleum.

Since 2008, U.S. petroleum production has increased by more than 11 quadrillion British thermal units (Btu), with dramatic growth in Texas and North Dakota. Despite the 50% decline in crude oil prices that occurred in the second half of last year, U.S. petroleum production still increased by 3 quadrillion Btu (1.6 million barrels per day) in 2014. Natural gas production—largely from the eastern United States—increased by 5 quadrillion Btu (13.9 billion cubic feet per day) over the past five years. Combined hydrocarbon output in Russia increased by 3 quadrillion Btu and in Saudi Arabia by 4 quadrillion Btu over the past five years.

While U.S. hydrocarbon production over the past several years is directly attributed to its success at exploiting tight oil formations and shale gas, other key factors also acted to keep hydrocarbon production from increasing in Russia and Saudi Arabia in 2014. Although Russian petroleum production continued to increase, natural gas production declined because weak European economic growth and a warm 2013-14 winter reduced demand in Russia's primary market for gas exports. While total petroleum and natural gas hydrocarbon production estimates for the United States and Russia in 2011 were roughly equivalent, by 2014 U.S. production exceeded Russian production by almost 12 quadrillion Btu.

In contrast to its past actions to raise or lower oil production levels to balance global oil markets, Saudi Arabia did not cut its production in the fall of 2014 despite falling oil prices and growing global inventories of oil as supply exceeded demand. As a result, Saudi Arabia's total petroleum and natural gas hydrocarbon production was nearly unchanged from 2013. With the increase in U.S. production, the United States produced nearly twice the petroleum and natural gas hydrocarbons as produced by Saudi Arabia in 2014.

eia.gov