CHINA & PHILIPPINES TALKS

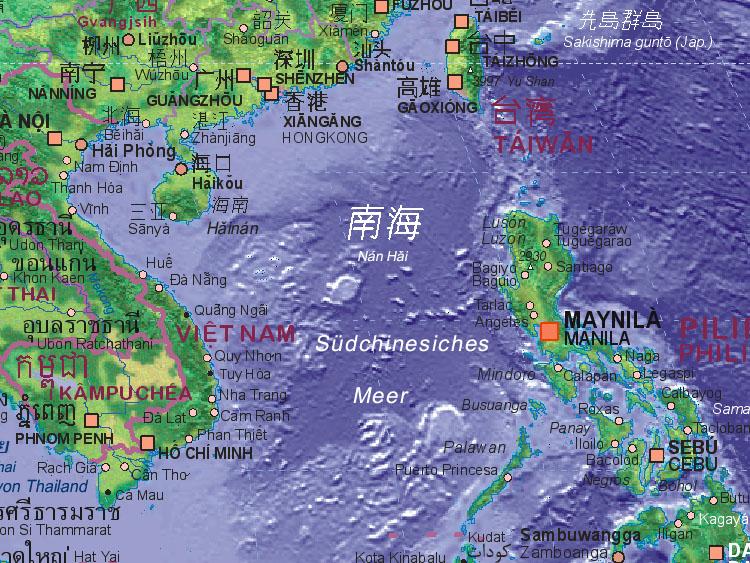

China's ambassador to the Philippines has suggested that the two countries sit down for talks on the most squeamish territorial dispute in Asia. The question of who controls the fishery-rich, 3.5 million-square-kilometer South China Sea, also full of oil and natural gas as well as major world shipping lanes, could proceed from military preparations to a calm negotiating room. The two governments – both unusually aggressive in asserting rival claims to the sea — might be able to work something out. The Philippines is talking now to Taiwan to agree on law enforcement in their own overlapping waters.

Philippine leaders have not answered Chinese Ambassador Zhao Jinhua's proposal this month and may never give an outright yes. There's no need. China is coming around like a dog with its tail between its legs as international opinion mounts against it. Much of Southeast Asia and its allies as far away as Washington tacitly back the Philippines as they oppose Beijing's landfilling of hundreds of hectares of ocean to expand its national territory despite competing claims.

"I suspect China is making this overture now because the regional response to China's artificial island-building campaign is heating up and the U.S., Australia, Japan and India are making noises that they will support front-line Southeast Asian states that refuse to cave to Chinese pressure," says Scott Harold, the Center for Asia-Pacific Policy deputy director with The RAND Corp. think tank in the United States. The Philippines is one such state.

China's ambassador called twice this month to date for a resumption of dialogue aimed at a peaceful solution, according to Philippine media reports. Previous talks went on hold in 2012 when China occupied waters near Scarborough Shoal west of Luzon, leading to a tense standoff that blocked Philippine fishing boats. Since then Philippine authorities have nabbed Chinese poachers at sea and anti-China sentiment has risen sharply among common Filipinos.

The Philippines prefers multi-country dialogue with other maritime claimants. Those include Brunei, Malaysia and Vietnam. The Philippines also has the United States and Japan on its side, having received military aid from both since 2014 in case China grows too aggressive. To bolster support from abroad, Manila is asking the United Nations Permanent Court of Arbitration to rule on Beijing's legal basis for using an 11-dash line to claim nearly the entire sea from Taiwan to Singapore. China believes historical documents validate its maritime claims and calls the Philippines, among others, the troublemakers. It has refused to work with the U.N. legal process.

Against the bite of international opinion, China would find it hard to win in any multilateral talks. China prefers one-on-one dialogue with other sea claimants so it can use its massive economy and military might as bargaining power. That's another reason the Philippines would say no thanks.

"The Philippines has consistently refused to have one-on-one talks with China on the South China Sea claims and proposes instead a meeting of all claimants," notes Ramon Casiple, Manila-based political commentator and executive director of the Philippine advocacy group Institute for Political and Electoral Reform.

A meeting of all claimants would further isolate China as it bares its teeth against a possible pro-Philippine ruling by the U.N. court, followed by more hostile international opinion against the Communist leadership. "Beijing would like to avoid the international opprobrium that would inevitably follow if the (U.N.) court rules that China's dashed-line claim is illegal and China refuses to abide by it," says Bonnie Glaser, senior adviser for Asia at the Center for Strategic and International Studies in Washington.

forbes.com