2015

2015, April, 9, 18:50:00

MEGA-DEAL $70 BLN

Shares in BG Group rose as much as 42 percent in early trade after Royal Dutch Shell agreed to pay that amount (47 billion pounds) for its smaller rival, making it the biggest deal in the sector in more than a decade.

2015, April, 9, 18:45:00

2016: OIL PRICES COULD BE REDUCED

Iran is believed to hold at least 30 million barrels in storage, and EIA believes Iran has the technical capability to ramp up crude oil production by at least 700,000 bbl/day (bbl/d) by the end of 2016. The pace and magnitude at which those volumes would reach the market would depend on the terms of a final agreement.

2015, April, 9, 18:40:00

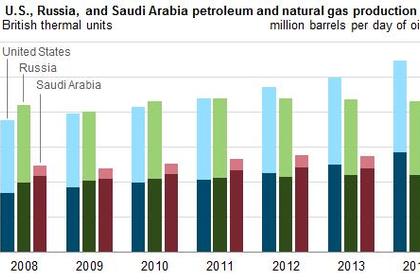

U.S.: THE LARGEST PRODUCER

The United States remained the world's top producer of petroleum and natural gas hydrocarbons in 2014, according to U.S. Energy Information Administration estimates. U.S. hydrocarbon production continues to exceed that of both Russia and Saudi Arabia, the second- and third-largest producers, respectively. For the United States and Russia, total petroleum and natural gas hydrocarbon production, in energy content terms, is almost evenly split between petroleum and natural gas. Saudi Arabia's production, on the other hand, heavily favors petroleum.

2015, April, 9, 18:35:00

U.S.: THE MONEY EXHAUSTED

Ever since the exponential boom of light tight oil (LTO) production flowing from the major shale plays began, American refineries have worked vigorously to process greater LTO volumes. Now a new report has stated that the load is beginning to become a burden, and the cheapest options for refineries to take on the growing amounts of LTO are over.

2015, April, 7, 20:55:00

U.S. SEISMIC SHIFTS

A barrel of crude oil costs under $50, having more than halved in price since June. This means wells are pumping out smaller profits, if not losses. When oil prices plunge and billions of dollars are at stake, oil companies tend to respond quickly to curb production. The number of active rigs has fallen 50 percent since October, according to Baker Hughes, the oilfield services company. This has led to layoffs, tighter budgets and fewer orders for equipment, all which hurt growth.

2015, April, 7, 20:50:00

U.S. CUTTING JOBS

With crude oil prices dropping near $40 a barrel in March, area industry leaders are reacting to the deflated market prices by cutting jobs and ramping down production.

2015, April, 7, 20:45:00

U.S. SHALE REVOLUTION DOWN

OPEC members (predominately Saudi Arabia) have traditionally been the only countries with the ability to ramp-up production through spare oil supply capacity. Nowadays, however, following the shale revolution, the US onshore market is widely being touted as the industry’s new ‘swing’ producer.

2015, April, 7, 20:40:00

U.S.: 100 RIGS WILL FALL

U.S. companies remain nervous about oil prices. Spending has been cut as prices fail to rebound significantly, and further price drops could quickly lead to more shrinkage in the rig count.

2015, April, 7, 20:35:00

THE NEW LONG-TERM GAS CONTRACTS

Will there be a “new deal” between natural gas marketers and producers? That was the question posed to a panel of experts, who grappled with topics such as the future of long-term contracts as well as what the price of gas will be, at the European Gas Conference in Vienna, Austria.

2015, April, 7, 20:30:00

THE NEW GREECE & RUSSIA LINE

Preparing the ground for a much-discussed visit in Moscow (8-9 April), Greek Prime Minister Alexis Tsipras reiterated his opposition to EU sanctions against Moscow, adding that debt-ridden country’s ambition is to upgrade its relations with Russia.