IMF BOUGHT AZERBAIJAN

IMF wrote, on September 9, 2016, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with the Republic of Azerbaijan.

A number of negative shocks have impaired economic performance in Azerbaijan. Lower oil prices, weak regional growth, currency devaluations in its main trading partners, and a contraction in hydrocarbon production rapidly erased the large current account surplus that the country enjoyed during the oil boom years.

Against this backdrop, the authorities have taken a number of actions. With reserves falling and external shocks intensifying, the Central Bank of Azerbaijan (CBA) devalued the manat and shifted to a managed float exchange rate regime. The devaluations helped to improve competitiveness but worsened bank balance sheets and increased dollarization. The authorities have started to close problematic banks, restructure the largest state bank, launched a reform of the financial supervision architecture and added new macro prudential limits on dollar lending. At the same time, a counter-cyclical stimulus tailored to promote growth and protect vulnerable populations is being implemented. Public sector wages, overall pensions, and social protection expenditures have been increased while in train capital expenditure projects will be completed. Fiscal consolidation is set to resume in 2017. To limit inflationary pressures, the CBA has tightened the monetary stance in 2016, raising the refinancing rate by 1,200 basis points to 15.0 percent.

Near-term economic prospects remain weak. Under current policies, growth is expected to contract this year and remain sluggish in the next few years, while inflation is expected to gradually decrease. Large fiscal surpluses during the oil boom years are projected to turn into deficits in the next three years. The current account balance should improve as the devaluations work to limit imports and support non-traditional exports. The authorities plan to utilize a small amount of assets from the Oil Fund to help finance balance of payments gaps. To ensure sustainable growth, the authorities are developing a strategy to rapidly diversify the economy by creating a more business friendly environment and pursuing structural reforms. Risks to the outlook are tilted to the downside as economic growth is still highly linked to oil shocks and government spending. The ongoing restructuring of the financial sector is a major risk to growth."

Executive Board Assessment

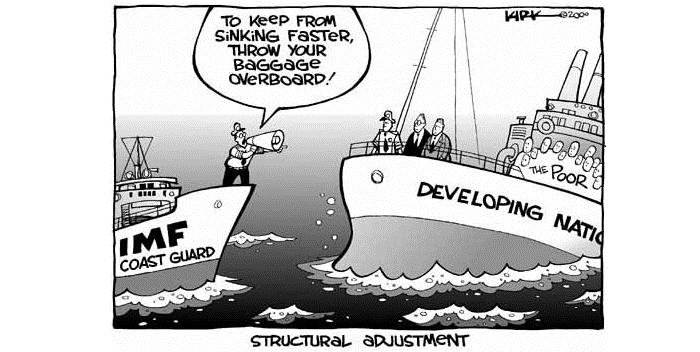

Executive Directors welcomed the steps the authorities have taken to adjust to the decline in oil prices and weaker growth in trading partners. However, they noted that the difficult external environment could hamper macroeconomic outcomes in the near term. While Azerbaijan's policy buffers remain substantial, the balance of payments, fiscal position, and banking system would likely remain under pressure as the economy continues to adjust. Accordingly, Directors stressed the need to press ahead with reforms to secure macroeconomic and financial stability and promote a diversified and private sector-led economy.

Directors supported the authorities' adjustment efforts. While welcoming the implementation of a small counter-cyclical fiscal stimulus in 2016 to shore up economic activity and protect vulnerable segments of the population, they underscored the need to return to a consolidation path. They recommended placing the weight of the adjustment on spending cuts, while protecting priority social spending and enhancing the efficiency of capital expenditure. They took note of the new tax policy aimed at fostering non-oil activity and revenue, but stressed the need to reduce tax exemptions and strengthen tax administration. Directors considered that a rule-based fiscal framework supported by institutional arrangements and careful debt management would help preserve fiscal sustainability. They also encouraged the authorities to implement their pension reform plans.

Directors welcomed the authorities' move to a managed float exchange rate regime and recent interest rate increases aimed at containing inflation. They noted the importance of improving policy communication to help anchor expectations and reduce uncertainty. They urged the central bank to stand ready to adjust monetary conditions to reflect changes in the fiscal impulse and the bank restructuring process. Directors also noted that greater exchange rate flexibility would help preserve international reserve buffers, pave the way for modernizing the monetary and exchange rate frameworks, and allow adoption of the policy rate as a nominal anchor. Improving monetary transmission and the functioning of the foreign exchange market will also be crucial.

Directors highlighted the need to closely monitor the banking system. They were encouraged by ongoing efforts to close non-viable banks, and recommended further prompt actions to bolster financial sector resilience. They urged the authorities to move ahead with the restructuring of the largest state bank with a view to its privatization, and address the problems in the rest of the banking system. They emphasized the importance of completing the implementation of the FSAP recommendations including strengthening banking supervision and the macro-prudential framework.

Directors welcomed the authorities' efforts to diversify the economy away from oil toward non‑traditional sectors. They emphasized that creating a private sector-led, non-oil economy requires reforms to reduce the costs of doing business and remove barriers to competition. They also highlighted the need to improve governance.

-----

Earlier:

IMF:

AZERBAIJAN:

AZERBAIJAN & CHINA OPPORTUNITIES