OIL PRICE: ABOVE $56 YET

REUTERS, BLOOMBERG, OILPRICE - Oil traded largely unchanged on Friday after a week of profit-taking and the return of oversupply concerns led the market lower, snapping a multi-week bull run that was Brent's longest in 16 months.

Investors were wary of tropical storm Nate shutting down some oil production in the Gulf of Mexico ahead of its expected arrival in the area as a hurricane on Sunday.

"The biggest impact (from Nate) could be on gasoline prices, depending on how many refineries are forced to shut down. But I don't think we will see another bull run," said Frank Schallenberger, head of commodity research at LBBW in Stuttgart.

Global benchmark Brent crude futures were up 7 cents at $57.07 a barrel at 0848 GMT. Week on week, the contract was set for a near 1 percent loss, snapping a five-week winning streak that was the longest since June 2016.

U.S. West Texas Intermediate (WTI) crude was at $50.59, down 20 cents. It was set to close the week down more than 2 percent, the biggest weekly loss in three months.

In the Gulf of Mexico, BP and Chevron were shutting production at all platforms, while Royal Dutch Shell and Anadarko Petroleum suspended some activity. Exxon Mobil, Statoil and other producers have withdrawn personnel.

The prospect of extended oil production cuts by the Organization of the Petroleum Exporting Countries and other producers led by Russia had supported prices in recent sessions.

Saudi Arabia's energy minister said on Thursday he was "flexible" regarding Moscow's suggestion a day earlier to prolong the production-curbing pact until the end of 2018.

However, concerns linger about growing U.S. crude exports, incentivised by a hefty WTI discount to Brent prices.

"We have a couple of bearish factors like a new record for U.S. crude exports, the reopening of Libya's biggest oilfield, a new year high in U.S. crude production and the recent strength of the U.S. dollar," Schallenberger said.

"I expect Brent to drop below $55 a barrel and WTI below $50 in the next couple of days."

U.S. government data showed this week that crude exports had risen to a record of nearly 2 million barrels per day.

-----

Earlier:

October, 4, 23:59:00

OIL PRICE: ABOVE $55U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $50.16 per barrel at 0648 GMT, down 26 cents, or 0.5 percent, from their last close. They fell below $50 per barrel earlier in the session. Brent crude futures LCOc1 were down 22 cents, or 0.4 percent, at $55.78 a barrel.

|

October, 4, 23:30:00

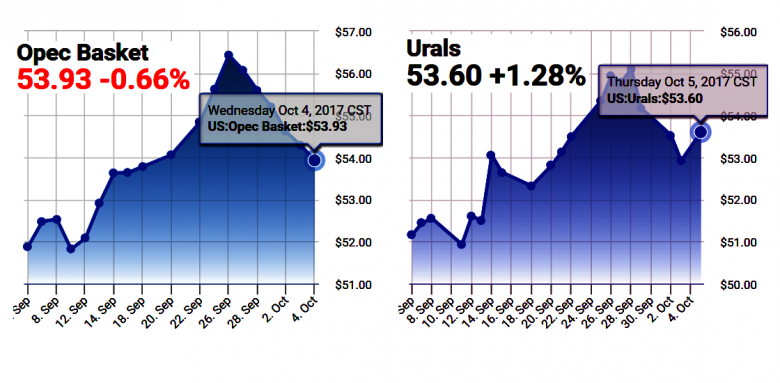

ЦЕНА URALS: $ 50,55Средняя цена нефти марки Urals по итогам января - сентября 2017 года составила $ 50,55 за баррель.

|

October, 2, 15:00:00

OIL PRICE: ABOVE $56Brent crude, the global benchmark, was down 12 cents at $56.67 a barrel at 0846 GMT. It notched up a third-quarter gain of around 20 percent, the biggest third-quarter increase since 2004 and traded as high as $59.49 last week. U.S. crude was down 17 cents at $51.50. The U.S. benchmark posted its strongest quarterly gain since the second quarter of 2016.

|

October, 2, 14:45:00

OIL PRICES: $50 - $60 AGAINA snap poll conducted by price reporting agency S&P Global Platts showed that two-thirds of conference attendees thought crude would hold in a narrow range of between $50 and $60 a barrel in the coming year, exactly where it was today.

|

September, 29, 12:35:00

OIL PRICE: ABOVE $57U.S. crude CLc1 was down 8 cents at $51.48 a barrel at 0641 GMT, after earlier rising slightly. Still, the contract is heading for a fourth consecutively weekly gain and is on track for a 9 percent advance this month. Brent LCOc1 rose 1 cent to $57.42 a barrel, heading for a fifth weekly climb and a nearly 10 percent gain for September.

|

September, 29, 12:10:00

CANADA NEED $60“Fifty-dollar WTI is not high enough to support a material uptick in oilsands investments,” said Randy Ollenberger, managing director of oil and gas equity research for BMO Capital Markets. “Sustained US$60-plus oil prices are required to support most projects.”

|

September, 27, 13:55:00

OIL PRICE: NOT ABOVE $58Brent November crude futures were down 14 cents at $58.30 a barrel at 0832 GMT, while U.S. crude for November delivery edged up 11 cents to $51.99. |