OIL PRICE: STILL ABOVE $57

REUTERS, BLOOMBERG - Oil prices rose on Monday over supply concerns in the Middle East and as the U.S. market showed further signs of tightening while demand in Asia keeps rising.

Brent crude futures were at $57.87 at 0622 GMT, up 12 cents, or 0.21 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude was at $52.04 per barrel, up 20 cents, or 0.39 percent.

"Oil prices are holding comfortably above $50 as possible supply disruptions in the Kurdish region of Iraq support prices," said William O'Loughlin, analyst at Rivkin Securities.

"U.S. production was also recently impacted by a hurricane for the second time in as many months and the number of U.S. drilling rigs declined for the third week in a row," O'Loughlin said.

The amount of U.S. oil rigs drilling for new production fell by seven to 736 in the week to Oct. 20, the lowest level since June, energy services firm Baker Hughes said on Friday.

With the U.S. tightening, flows from Iraq reduced due to fighting between government forces and Kurdish groups, and production still being withheld as part of a pact between the Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC producers to tighten the market, much will depend on demand going forward.

In Asia, growth remains strong especially in China and India, the world's number one and three importers.

China's oil demand remains voracious, hitting a January to September average of 8.5 million barrels per day (bpd).

"Three main factors are driving China's insatiable appetite for crude: declining domestic production, increased access to imports and exports for independent refiners, and building up the strategic petroleum reserve," Britain's Barclays bank said.

India's fuel thirst is also increasing. India imported a record 4.83 million barrels per day (bpd) of oil in September as several refiners resumed operations after extensive maintenance to meet rising local fuel demand.

The country's September imports stood 4.2 percent above this time last year and about 19 percent more than in August, ship-tracking data from industry sources and Thomson Reuters Analytics showed.

Given the tightening oil market conditions, many analysts expect prices to rise further.

"We will see oil prices higher by 10 percent by the end of the year. We have started to accumulate strong positions within the oil sector," said Shane Chanel, equities and derivatives adviser at ASR Wealth Advisers.

Despite the tightening market and recent price rises, market volatility has been low.

The crude oil volatility index, which measures market expectations for 30-day price volatility, fell to levels similar of 2014 last Friday.

-----

Earlier:

October, 20, 12:40:00

OIL PRICE: ABOVE $56 AGAINBrent crude futures LCOc1, the international benchmark for oil prices, were at $57.45 at 0639 GMT, up 22 cents, or 0.4 percent from their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $51.54 per barrel, up 25 cents, or 0.5 percent. |

October, 20, 12:05:00

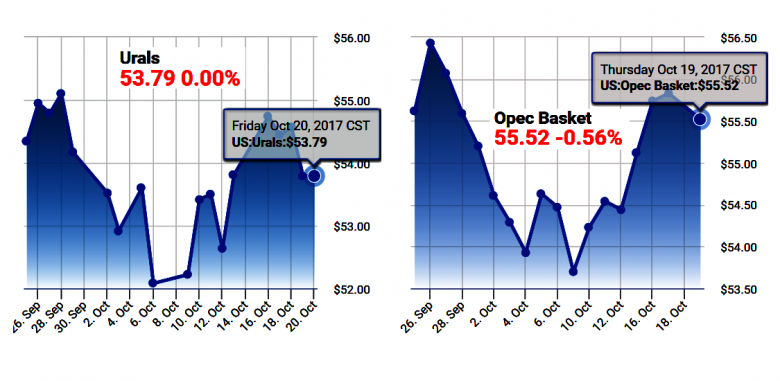

ЦЕНА URALS: $ $55,55881Средняя цена на нефть Urals за период мониторинга с 15 сентября по 14 октября 2017 года составила $55,55881 за баррель, или $405,6 за тонну.

|

October, 18, 19:10:00

OIL PRICE: ABOVE $58Brent crude futures, the international benchmark for oil prices, were at $58.16 at 0643 GMT, up 28 cents, or 0.5 percent from their last close - and almost a third above mid-year levels. U.S. West Texas Intermediate (WTI) crude futures were at $52.03 per barrel, up 15 cents, or 0.3 percent, and almost a quarter above mid-June levels. |

October, 16, 12:20:00

WORLD OIL DEMAND UP BY 1.5 MBDWorld oil demand growth in 2017 is now expected to increase by 1.5 mb/d, representing an upward revision of around 30 tb/d from last previous report, mainly reflecting recent data showing an improvement in economic activities. Positive revisions were primarily a result of higher-than-expected oil demand from the OECD region and China. In 2018, world oil demand is anticipated to grow by 1.4 mb/d, following an upward adjustment of 30 tb/d over the previous report, due to the improving economic outlook in the world economy, particularly China and Russia.

|

October, 13, 13:00:00

PRICES: OIL $52-54; GAS $3.03-3.19EIA forecasts Brent spot prices to average $52/b in 2017 and $54/b in 2018, which is $1/b higher in 2017 and $2/b higher in 2018 compared with last month's forecast. West Texas Intermediate (WTI) average crude oil prices are forecast to be $3.50/b lower than Brent prices in 2018.

|

October, 13, 12:55:00

2018 OIL MARKET FORECASTFalling global crude oil stockpiles in 2017 will help put the market “roughly” into balance in 2018, but an increase in prices could be limited, especially if the Organization of Petroleum Exporting Countries doesn’t stick to its agreement to curb output, the International Energy Agency said.

|

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|