OIL PRICE: ABOVE $55

REUTERS, BLOOMBERG, OILPRICE - Oil prices eased on Wednesday, pulled down by caution that a rally that lasted for most of the third quarter would not extend through the last three months of the year.

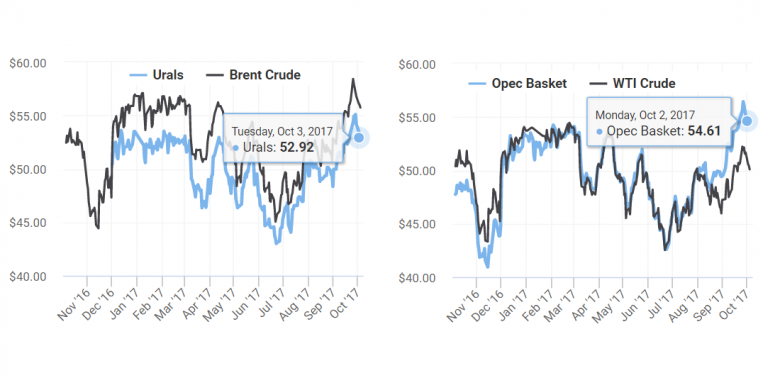

U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $50.16 per barrel at 0648 GMT, down 26 cents, or 0.5 percent, from their last close. They fell below $50 per barrel earlier in the session.

Brent crude futures LCOc1 were down 22 cents, or 0.4 percent, at $55.78 a barrel.

The drops came over concerns that a third-quarter market rally that had lifted Brent to mid-2015 highs by late September had been overdone.

"Fundamentals may not yet be strong enough to support a continued rally, especially in growth-dependent commodities such as oil," said Ole Hansen, head of commodity strategy at Denmark's Saxo Bank in a quarterly outlook to investors.

Traders said that a so-called market rebalancing is now well underway, meaning that demand is no longer undershooting available supply.

The re-balancing is a result of strong consumption and also due to efforts led by the Organization of the Petroleum Exporting Countries (OPEC) to cut output by around 1.8 million barrels per day (bpd) in 2017 and the first quarter of next year.

"Compliance with the OPEC production cuts was over 100 percent in August (meaning members produced less than their quotas, on average) and U.S. oil inventories have been declining for several months now," said William O'Loughlin, investment analyst at Australia's Rivkin Securities.

But rising production in the United States, which is not participating in the deal to cut output, has prevented prices from climbing further.

U.S. production hit 9.55 million bpd in late September, its highest level since July 2017 and not far off its 9.61 million bpd record from June 2015.

"The number of active drilling rigs in the U.S. increased last week, highlighting the fact that higher oil prices will inevitably lead to more production from U.S. shale. These factors have kept WTI oil in a relatively tight trading-range for several months now," O'Loughlin wrote in a note to clients.

Drillers added six oil rigs looking for new production in the week to Sept. 29, bringing the total count up to 750, according to energy services firm Baker Hughes.

Due largely to rising U.S. output, Saxo Bank's Hansen said that "an extension of output curbs beyond March (2018) will be needed to ensure continued support for the oil market".

Traders said they would be watching for fuel inventory data from the U.S. Energy Information Administration (EIA), due to be published later on Wednesday, for further market guidance.

-----

Earlier:

September, 29, 12:35:00

OIL PRICE: ABOVE $57U.S. crude CLc1 was down 8 cents at $51.48 a barrel at 0641 GMT, after earlier rising slightly. Still, the contract is heading for a fourth consecutively weekly gain and is on track for a 9 percent advance this month. Brent LCOc1 rose 1 cent to $57.42 a barrel, heading for a fifth weekly climb and a nearly 10 percent gain for September. |

September, 29, 12:30:00

СПРОС ПРЕВЫШАЕТ ПРЕДЛОЖЕНИЕСегодня спрос превышает предложение уже на миллион баррелей в день. При этом уровень запасов нефти в хранилищах превышает средний пятилетний показатель всего на 170 миллионов баррелей – это вдвое меньше, чем было ранее. |

September, 29, 12:10:00

CANADA NEED $60“Fifty-dollar WTI is not high enough to support a material uptick in oilsands investments,” said Randy Ollenberger, managing director of oil and gas equity research for BMO Capital Markets. “Sustained US$60-plus oil prices are required to support most projects.” |

September, 27, 13:55:00

OIL PRICE: NOT ABOVE $58Brent November crude futures were down 14 cents at $58.30 a barrel at 0832 GMT, while U.S. crude for November delivery edged up 11 cents to $51.99. |

September, 25, 13:25:00

OIL PRICE: ABOVE $56The Organization of the Petroleum Exporting Countries, Russia and several other producers have cut production by about 1.8 million barrels per day (bpd) since the start of 2017, helping lift oil prices by about 15 percent in the past three months. |

September, 25, 13:20:00

СОКРАЩЕНИЕ ОБЪЕМОВ ДОБЫЧИ: 116%В заявлении Министерского мониторингового комитета (ММК) стран ОПЕК и не входящих в ОПЕК государств говорится, что, согласно отчету Совместного технического комитета (СТК) стран ОПЕК и не входящих в организацию нефтедобывающих стран за август 2017 года, уровень выполнения странами ОПЕК и участвующими государствами не-ОПЕК своих добровольной корректировки объемов добычи нефти достиг исторического максимума, составив 116%.

|

September, 22, 09:20:00

OIL PRICE: NOT ABOVE $57International benchmark Brent crude futures were at $56.51 a barrel at 0644 GMT, up 8 cents, or 0.14 percent, from their last close. U.S. West Texas Intermediate (WTI) crude futures were up 12 cents, or 0.24 percent, at $50.67 per barrel. |