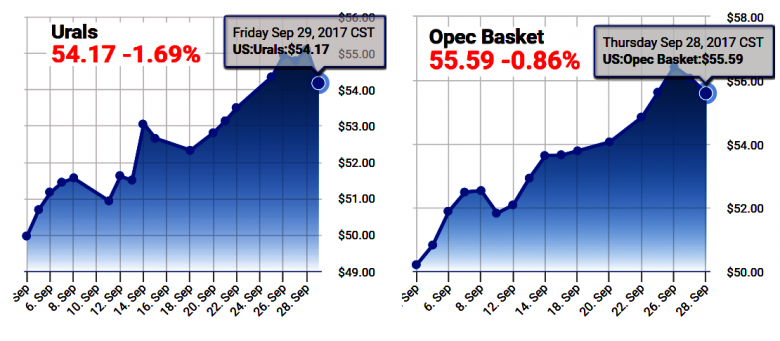

OIL PRICE: ABOVE $56

REUTERS, BLOOMBERG, OILPRICE - Oil dipped further below $57 a barrel on Monday as an increase in U.S. drilling and higher OPEC output put the brakes on a rally in which the market scored its biggest third-quarter gain in 13 years.

U.S. energy companies added oil rigs for the first week in seven and Iraq announced its exports increased slightly in September when OPEC overall boosted output according to a Reuters survey.

Brent crude, the global benchmark, was down 12 cents at $56.67 a barrel at 0846 GMT. It notched up a third-quarter gain of around 20 percent, the biggest third-quarter increase since 2004 and traded as high as $59.49 last week.

"I think it's going to be a struggle to move above $60 Brent," said Olivier Jakob, oil analyst at Petromatrix.

U.S. crude was down 17 cents at $51.50. The U.S. benchmark posted its strongest quarterly gain since the second quarter of 2016.

Oil's rally has been driven by mounting signs that a three-year supply glut is easing, helped by a production cut deal by global producers led by the Organization of the Petroleum Exporting Countries.

"Brent crude oil prices have gone from strength to strength as surplus oil stocks are being depleted," Bank of America Merrill Lynch said in a report. "Importantly, this rally is supported by a tighter physical market, providing a fundamental backbone that was not present before."

But a Reuters survey on Friday found OPEC oil output rose last month, gaining mostly because of higher supplies from Iraq and also from Libya, an OPEC member exempt from cutting output.

The Libyan gain appears short-lived, though. The country's largest oilfield, Sharara, has been closed since Sunday, an engineer at the field and a Libyan oil source said.

And in a sign U.S. oil output could rebound, energy services firm Baker Hughes said on Friday energy companies added oil rigs for the first week in seven after a 14-month drilling recovery stalled in August.

Middle Eastern oil producers are concerned the price rise will only stir U.S. shale producers into more drilling and push prices lower again.

-----

Earlier:

September, 29, 12:35:00

OIL PRICE: ABOVE $57U.S. crude CLc1 was down 8 cents at $51.48 a barrel at 0641 GMT, after earlier rising slightly. Still, the contract is heading for a fourth consecutively weekly gain and is on track for a 9 percent advance this month. Brent LCOc1 rose 1 cent to $57.42 a barrel, heading for a fifth weekly climb and a nearly 10 percent gain for September. |

September, 29, 12:30:00

СПРОС ПРЕВЫШАЕТ ПРЕДЛОЖЕНИЕСегодня спрос превышает предложение уже на миллион баррелей в день. При этом уровень запасов нефти в хранилищах превышает средний пятилетний показатель всего на 170 миллионов баррелей – это вдвое меньше, чем было ранее. |

September, 29, 12:10:00

CANADA NEED $60“Fifty-dollar WTI is not high enough to support a material uptick in oilsands investments,” said Randy Ollenberger, managing director of oil and gas equity research for BMO Capital Markets. “Sustained US$60-plus oil prices are required to support most projects.” |

September, 27, 13:55:00

OIL PRICE: NOT ABOVE $58Brent November crude futures were down 14 cents at $58.30 a barrel at 0832 GMT, while U.S. crude for November delivery edged up 11 cents to $51.99. |

September, 25, 13:25:00

OIL PRICE: ABOVE $56The Organization of the Petroleum Exporting Countries, Russia and several other producers have cut production by about 1.8 million barrels per day (bpd) since the start of 2017, helping lift oil prices by about 15 percent in the past three months. |

September, 25, 13:20:00

СОКРАЩЕНИЕ ОБЪЕМОВ ДОБЫЧИ: 116%В заявлении Министерского мониторингового комитета (ММК) стран ОПЕК и не входящих в ОПЕК государств говорится, что, согласно отчету Совместного технического комитета (СТК) стран ОПЕК и не входящих в организацию нефтедобывающих стран за август 2017 года, уровень выполнения странами ОПЕК и участвующими государствами не-ОПЕК своих добровольной корректировки объемов добычи нефти достиг исторического максимума, составив 116%.

|

September, 22, 09:20:00

OIL PRICE: NOT ABOVE $57International benchmark Brent crude futures were at $56.51 a barrel at 0644 GMT, up 8 cents, or 0.14 percent, from their last close. U.S. West Texas Intermediate (WTI) crude futures were up 12 cents, or 0.24 percent, at $50.67 per barrel. |