OIL & GAS WILL CRUTIAL

OGJ - Electricity will gain ground globally on oil and natural gas by 2050 as its use in vehicles continues to rise and power distribution systems are built in developing countries, an inaugural forecast by DNV GL AS, Oslo, said. But natural gas will be the single biggest energy source by mid-century, despite its supplies peaking in 2035 after surpassing crude oil a year earlier, where supplies will fall in 2028, it added.

"Energy demand is flattening. We're using more electricity, and its generation is more efficient than other forms of energy. Investors are increasingly optimistic that wind and solar power cost reductions can continue to be achieved," said Elisabeth Torstad, chief executive of the independent risk management and quality assurance advisory firm's oil and gas division.

Oil and gas will remain crucial energy components as their share of the total global mix falls from 53% now to 43% in 2050, Torstad said during a presentation at the National Press Club sponsored by the US Energy Association. "We've assumed a generally steady change toward 2050, with less crude oil production but more natural gas and electricity, where solar and wind power will grow because of cost reductions," she said.

Investments will be needed to add production capacity and to operate existing assets safely and sustainably, DNV said in a separate forecast. "The stage is set for gas to become the world's primary energy source toward 2050, and the last of the fossil fuels to experience peak demand, which will occur in 2035 according to our model," it said. "Gas can play a central role in supporting energy security alongside variable renewables during the transition."

Torstad noted that more than a year ago, DNV decided to develop the forecast because every other oil and gas outlook seemed to reach at least one conclusion which did not reflect what the firm was seeing now.

"We see a world where demand will be more scarce than supplies, largely because of increase efficiency," Torstad said. "In transportation, the biggest change is the uptick in electrical vehicles. China and India recently announced more aggressive steps. Railroads also could use electricity more. The vehicles themselves also could provide storage, which we believe is a very compelling story. Natural gas pipelines also could provide efficient storage."

DNV's oil and gas forecast showed conventional oil production continuing to play an import role. Onshore conventional production was expected to decline an average 1.4%/year through 2050, but still account for more than half of total global oil production by mid-century.

Unconventional onshore oil production will roughly double to around 22 million b/d by 2035, when it will have nearly a 30% share of all global crude production, the forecast said. "We expect unconventional oil and gas to represent a growing part of total North and Latin American production," Torstad said.

-----

Earlier:

October, 16, 12:20:00

WORLD OIL DEMAND UP BY 1.5 MBDWorld oil demand growth in 2017 is now expected to increase by 1.5 mb/d, representing an upward revision of around 30 tb/d from last previous report, mainly reflecting recent data showing an improvement in economic activities. Positive revisions were primarily a result of higher-than-expected oil demand from the OECD region and China. In 2018, world oil demand is anticipated to grow by 1.4 mb/d, following an upward adjustment of 30 tb/d over the previous report, due to the improving economic outlook in the world economy, particularly China and Russia. |

September, 15, 08:55:00

WORLD ENERGY CONSUMPTION UP TO 28%The U.S. Energy Information Administration projects that world energy consumption will grow by 28% between 2015 and 2040. Most of this growth is expected to come from countries that are not in the Organization for Economic Cooperation and Development (OECD), and especially in countries where demand is driven by strong economic growth, particularly in Asia. Non-OECD Asia (which includes China and India) accounts for more than 60% of the world's total increase in energy consumption from 2015 through 2040. |

September, 13, 15:10:00

IMF: SOUTHEAST ASIA'S TRANSFORMATIONIMF - When we think about Asia’s economic future, we know that this future is being built on strong foundations—on the richness and diversity of its cultures, on the incredible energy and ingenuity of the people who have changed the world by transforming their own economies. China and India have been driving the greatest poverty reduction in human history by creating the world’s largest middle classes. In a single generation, Vietnam has moved from being one of the world’s poorest nations to being a middle-income country. |

July, 26, 14:40:00

WORLD OIL CHOKEPOINTSEIA - World chokepoints for maritime transit of oil are a critical part of global energy security. About 61% of the world's petroleum and other liquids production moved on maritime routes in 2015. The Strait of Hormuz and the Strait of Malacca are the world's most important strategic chokepoints by volume of oil transit.

|

July, 14, 09:40:00

BP: EXCELLENCE, SUSTAINABILITY, COLLABORATIONI think there are three areas where we should focus our efforts. The first is excellence in our operations, or as this session’s title puts it, leadership in responsible operations. The second, is sustainability in our products - fully realising the benefits of both natural gas and renewables as well as our Downstream product range. And the third is collaboration, or simply working together, in our partnerships - the kind of working together that makes new things happen and drives real change.

|

May, 29, 13:35:00

HARD OIL DEMANDWhile most big oil companies foresee a day when the world will need less crude, timing when that peak in oil demand will materialize is one of the hottest flashpoints for controversy within the industry. It’s tough to predict because changes to oil demand will hinge on future disruptive technologies, such as batteries in electric cars that will allow drivers to travel for hundreds of miles on a single charge.

|

February, 28, 18:50:00

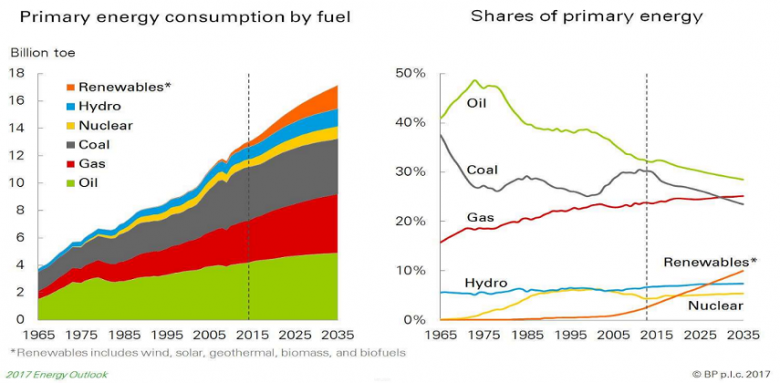

BP ENERGY OUTLOOK 2035The growing world economy will require more energy, but consumption is expected to grow less quickly than in the past - at 1.3% per year over the Outlook period (2015-2035) compared with 2.2% per year in 1995-2015. |