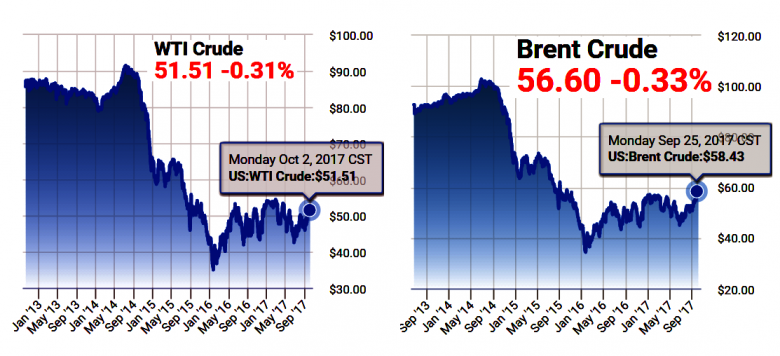

OIL PRICES: $50 - $60 AGAIN

FT - As traders and producers gathered in Singapore this week for Asia's biggest oil event, you might have expected a bit more optimism.

Oil prices reached their highest level in two years on the first day of the event as a succession of traders and analysts told the assembled crowds that global crude demand was soaring, helping to bring to an end the three-year glut that had devastated much of the industry.

But while pessimism no longer abounds, it was difficult to find many who were prepared to bet crude could far surpass today's levels of about $60 a barrel. So bruised were the executives at the event by oil's crash from $100 a barrel that few could bring themselves to predict much brighter days ahead for the industry.

"There's little prospect of significantly higher prices in the short term," said Peg Mackey, a senior oil market analyst at the International Energy Agency.

A snap poll conducted by price reporting agency S&P Global Platts showed that two-thirds of conference attendees thought crude would hold in a narrow range of between $50 and $60 a barrel in the coming year, exactly where it was today.

Concerns about the amount of oil US shale, and other producers, could add to the market with prices back above $50 was the dominant fear.

"I still think there is a little bit of a hill to get over as [fresh] non-Opec supply comes online next year," said David Fyfe, chief economist at commodity trading company Gunvor. "We could have a bearish period in the early part of 2018."

Just how quickly US shale producers could lift production — a question that has plagued the industry — was again debated this week.

"Regardless of your view on the market, you need to test shale. How much can they [US companies] ramp up?" said a senior trading house executive.

US independent shale oil producer WPX Energy said companies were far more cost efficient and productive today than when prices were much higher. WPX was one of many US companies flocking to the event as they sought customers for new supplies in Asia.

"We look much more profitable than we did even in the $100 world," said WPX's chief operating officer, Clay Gaspar.

The comment will not be welcomed by Opec producers and their allies outside of the cartel, such as Russia, which are signed up to a supply agreement to curb 1.8m barrels a day of output. They are widely expected to roll over the deal when it expires in March.

Mike Wittner, analyst at Société Générale, said despite the significant cuts, the best the oil industry could hope for was a balanced market. On prices, he said, "I don't think we go any higher than we are today."

As the tug of war between US producers and Opec plays out, the resolve of these traditional producers would be tested if output cuts and firmer prices only offered an incentive to US shale producers to boost output, said Chris Bake, the head of origination at Vitol, the world's biggest independent oil trader.

"There is finite patience there," said Mr Bake. He said US shale companies should not bank on Opec to prop up prices for the longer term. "Relying on Opec's goodwill is not a God-given right."

The bright spot at this year's conference was global oil consumption, which has far surpassed expectations and is due to cross 100m b/d for the first time next year.

"2017 has been full of surprises," said Janet Kong, who runs BP's powerful trading operations from the Middle East to China. "Demand has been extremely strong and supports our view that the global economy is doing very well."

Ms Kong predicts demand at about 1.8m b/d this year — well above the 10-year average of 1.2m b/d — as diesel and propane drive consumption, particularly in emerging economies China and India.

Even as demand was helping to draw down surplus inventories, there were questions over the sustainability of this Asian demand. Chinese crude purchases have surged as the country fills its strategic petroleum reserve, but concerns have mounted that a government initiative to tackle overcapacity in the refining sector could unleash hundreds of thousands of barrels of crude into the market.

But not everyone was cautious about oil prices. An outlier was Trafigura, one of the world's biggest commodity traders, which was at the centre of the week's most bullish call on the market.

Ben Luckock, co-head of group market risk at Trafigura, warned the era of persistently low prices was nearing its end as a "sizeable shortfall" in supply made itself apparent in the next couple of years.

He projects demand will exceed supply by 2m-4m barrels a day by the end of 2019 as $1tn of spending cuts since oil plunged finally hits future production. US shale, he said, would not be able to fill the gap no matter how quickly output increased.

"When we count up the barrels across the next couple of years, we are coming up short," he said. "We are nearing the end of 'lower for longer' oil."

-----

Earlier:

September, 29, 12:35:00

OIL PRICE: ABOVE $57U.S. crude CLc1 was down 8 cents at $51.48 a barrel at 0641 GMT, after earlier rising slightly. Still, the contract is heading for a fourth consecutively weekly gain and is on track for a 9 percent advance this month. Brent LCOc1 rose 1 cent to $57.42 a barrel, heading for a fifth weekly climb and a nearly 10 percent gain for September. |

September, 29, 12:30:00

СПРОС ПРЕВЫШАЕТ ПРЕДЛОЖЕНИЕСегодня спрос превышает предложение уже на миллион баррелей в день. При этом уровень запасов нефти в хранилищах превышает средний пятилетний показатель всего на 170 миллионов баррелей – это вдвое меньше, чем было ранее.

|

September, 25, 13:20:00

СОКРАЩЕНИЕ ОБЪЕМОВ ДОБЫЧИ: 116%В заявлении Министерского мониторингового комитета (ММК) стран ОПЕК и не входящих в ОПЕК государств говорится, что, согласно отчету Совместного технического комитета (СТК) стран ОПЕК и не входящих в организацию нефтедобывающих стран за август 2017 года, уровень выполнения странами ОПЕК и участвующими государствами не-ОПЕК своих добровольной корректировки объемов добычи нефти достиг исторического максимума, составив 116%.

|

September, 20, 09:05:00

OIL PRICE: ABOVE $55 YETThe October light, sweet crude contract on the New York Mercantile Exchange gained 2¢ to settle at $49.91/bbl on Sept. 18. The November contract dropped 9¢ to settle at $50.35/bbl. The NYMEX natural gas price for October rose 12¢ to $3.14/MMbtu. The Henry Hub cash gas price climbed by 11¢ to $3.10/MMbtu. Heating oil for October fell nearly 2¢ to a rounded $1.78/gal. The NYMEX reformulated gasoline blendstock for October was up less than 1¢ to $1.67/gal on Sept. 18. The Brent crude contract for November on London’s ICE fell 14¢ to $55.48/bbl. The December contract declined 17¢ to $55.25/bbl. The gas oil contract for October was $525/tonne, down $9.75. OPEC’s basket of crudes for Sept. 18 was $53.78/bbl, up 14¢.

|

September, 20, 08:55:00

ЦЕНА URALS: $51,81591Средняя цена на нефть Urals за период мониторинга с 15 августа по 14 сентября 2017 года составила $51,81591 за баррель, или $378,3 за тонну. Согласно расчетам Минфина России экспортная пошлина на нефть в РФ с 1 октября 2017 года повысится на $3,8 и составит $87,9 за тонну.

|

September, 15, 09:00:00

OIL PRICES: $50 - $60Oil prices are expected to hold between $50 and $60 a barrel as bloated global stocks fall after a deal between OPEC and other producers to trim output, BP Chief Executive Bob Dudley said on Thursday.

|

September, 13, 15:20:00

OIL PRICES: $51 - $52, GAS PRICES: $3.05 - $3.29EIA forecasts Brent spot prices to average $51/b in 2017 and $52/b in 2018. Expected growth in natural gas exports and domestic natural gas consumption in 2018 contribute to the forecast Henry Hub natural gas spot price rising from an annual average of $3.05/MMBtu in 2017 to $3.29/MMBtu in 2018.

|