OPTIMISTIC OIL PRICES

BLOOMBERG - Oil held its gains after an industry report was said to show U.S. gasoline and distillate stockpiles slid as OPEC weighed whether to extend its production caps beyond March.

Futures edged higher from the settlement in after-market trading in New York, prompted by reports that data from the American Petroleum Institute showed a 5.75 million barrel drop in gasoline last week and 4.95 million fewer barrels of distillate. Meanwhile, OPEC, set to meet next month on prolonging the cuts, are said to be planning how to prevent a new price-killing glut once they end.

The market "looks a lot more bullish than it did three or four months ago," said James Williams, president of London, Arkansas-based energy researcher WTRG Economics. The stockpile declines aren't surprising since "refinery utilization is coming down this time of year because it's turnaround season," he said. Nonetheless, he predicted prices will rally again Wednesday if the government confirms the drops.

The Organization of Petroleum Exporting Countries is expected to extend supply cuts beyond their March expiration date, which has supported oil above the key $50-a-barrel psychological threshold. In addition, oil demand is proving more resilient than some expected, Saudi Arabia's Minister of Energy and Industry Khalid Al-Falih said in Riyadh.

OPEC is implying it's "likely to accept the current supply discipline for the rest of 2018, and ultimately the market is looking at that as optimistic," said Bart Melek, head of global commodity strategy at TD Securities in Toronto.

At the same time, one major contributor to weak crude prices -- U.S. shale drillers -- appear to be curtailing some activity. The most recent rig count by Baker Hughes showed the biggest one-week drop in the Permian Basin fleet in 19 months. Schlumberger Ltd. and Baker Hughes, the two largest oilfield-service companies, blamed their own lackluster profit reports on the reluctance of North American explorers to boost spending.

U.S. Inventories

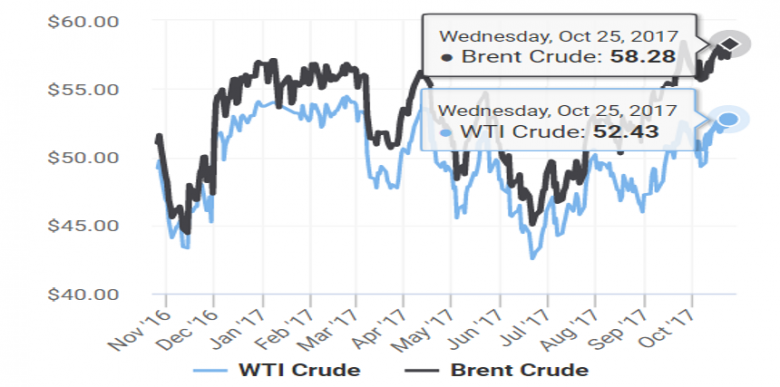

West Texas Intermediate for December delivery traded at $52.54 a barrel at 4:41 p.m. after settling at $52.47 a barrel on the New York Mercantile Exchange. Total volume traded was about 6 percent below the 100-day average.

Brent for December settlement gained 96 cents to end the session at $58.33 on the London-based ICE Futures Europe exchange. The global benchmark traded at a premium of $5.86 to WTI.

Stockpiles at Cushing, Oklahoma, the delivery point for New York-traded futures contracts, probably declined by 500,000 barrels, according to a separate forecast compiled by Bloomberg. A Bloomberg survey estimated that U.S crude stockpiles slid by 3 million barrels last week, while gasoline stockpiles probably rose by 1.7 million barrels.

The API report also showed crude stockpiles rose by 519,000 barrels, while Cushing supplies fell by 55,000 barrels last week. A draw at Cushing would be the first since August if the Energy Information Administration confirms it in its data release on Wednesday.

Oil-market news:

Crude flows from northern Iraq to Turkish port of Ceyhan rose to 300,000 barrels a day, according to a port agent.

The initial public offering of Aramco is on track for next year, the head of the sovereign fund said.

Concho Resources Inc., the $19 billion Texas-based explorer that's been stuck in junk status since its public debut a decade ago, is alone among a group of 240 oil and natural gas companies that Moody's Investors Service said may rise to investment grade by the end of next year.

-----

Earlier:

October, 23, 11:45:00

OIL PRICE: STILL ABOVE $57Brent crude futures were at $57.87 at 0622 GMT, up 12 cents, or 0.21 percent, from their last close. U.S. West Texas Intermediate (WTI) crude was at $52.04 per barrel, up 20 cents, or 0.39 percent. |

October, 16, 12:20:00

WORLD OIL DEMAND UP BY 1.5 MBDWorld oil demand growth in 2017 is now expected to increase by 1.5 mb/d, representing an upward revision of around 30 tb/d from last previous report, mainly reflecting recent data showing an improvement in economic activities. Positive revisions were primarily a result of higher-than-expected oil demand from the OECD region and China. In 2018, world oil demand is anticipated to grow by 1.4 mb/d, following an upward adjustment of 30 tb/d over the previous report, due to the improving economic outlook in the world economy, particularly China and Russia.

|

October, 13, 12:55:00

2018 OIL MARKET FORECASTFalling global crude oil stockpiles in 2017 will help put the market “roughly” into balance in 2018, but an increase in prices could be limited, especially if the Organization of Petroleum Exporting Countries doesn’t stick to its agreement to curb output, the International Energy Agency said.

|

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|

August, 24, 14:20:00

OIL MARKET IS RIGHTAs of July 2017, the OPEC and participating non-OPEC producing countries achieved an impressive conformity level of 94 per cent. This is a demonstration of the commitment of participating producing countries to continue their cooperation towards the rebalancing of the market. The JMMC expressed great satisfaction with the results and steady progress made towards full conformity of the production adjustments, and encouraged all participating countries to achieve full conformity, for the benefit of producers and consumers alike. The JMMC also welcomed the participation of the UAE at the recent JTC meeting, where the UAE reiterated its commitment to adhere to its production adjustments for the remaining period of the Declaration of Cooperation.

|

January, 12, 18:35:00

WBG: 2017 - UNCERTAIN TIMESThe outlook is clouded by uncertainty about policy direction in major economies. A protracted period of uncertainty could prolong the slow growth in investment that is holding back low, middle, and high income countries. |

December, 16, 18:55:00

WORLD ECONOMY OPTIMISMBut for all the talk of trade barriers, oil prices rising on supply cuts, and planned U.S. tax cuts and infrastructure spending, the global inflation outlook hasn't changed much, even if the Fed is sounding more worried about it. |