SAUDI'S BANKS ARE BETTER

FITCH - Liquidity for Saudi Arabian banks has improved significantly since last year but the slowdown in the economy is likely to lead to a rise in non-performing loans (NPLs).

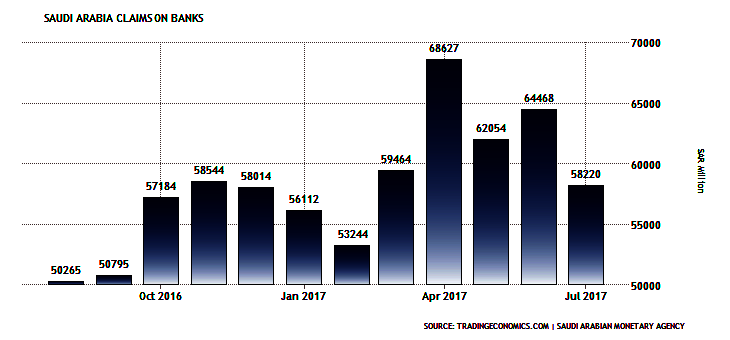

Most of the public-sector deposits that were drained from the banking system in 2016 in response to falling oil prices have since returned and the state has cleared the vast majority of its overdue payments to contractors. Most banks had liquidity coverage ratios above 200% at end-1H17, which we view as strong. Funding costs, which spiked during the 2016 tightening, have fallen back towards the very low levels to which most Saudi banks had become accustomed. Another wave of government deposit withdrawals is less likely now that Saudi Arabia is partly financing its fiscal deficit with international sovereign debt issuance.

But we expect a rise in the sector's NPL ratio and muted credit demand in the second half of 2017 and 2018, reflecting the slowing economy. GDP growth slowed to 1.4% in 2016 from 3.4% in 2015 and we expect it to be below 1% in 2017 and 2018. Most banks' internal rating assessments showed a decline in borrowers' creditworthiness in 2016 and 1H17 and there was a modest rise in the sector's NPL ratio in 1H17 to 1.4% of gross loans. However, this is very low by global standards and loan-loss coverage is strong (end-1H17: 180% across the banks we rate). Even factoring in delinquent loans that are not impaired, watch-listed exposures and restructured loans, we consider the sector's overall asset quality to be strong.

Earnings metrics for Saudi banks are solid by global standards, with a sector return on assets of 1.8% for 2016. However, credit growth has slowed and, as a result, earnings have plateaued for many banks and started to decline in some cases. We do not expect a significant improvement in credit growth for 2017 and there is a risk of a sector-wide earnings decline given the asset-quality pressures.

Saudi banks are among the best capitalised globally, with a sector Fitch Core Capital ratio of 17.2% at end-2016. Although higher impairment charges will affect capital ratios, slow loan growth and still-solid earnings should mean that sector capitalisation will continue to improve, with banks storing excess capital ready to deploy if and when the economy improves in the longer term.

The ratings of most of the 11 Saudi banks we rate are driven by their standalone credit profiles. Al Rajhi Bank, Banque Saudi Fransi, National Commercial Bank, Riyad Bank, SAMBA Financial Group and Saudi British Bank are rated the highest, at 'A-'. The smaller banks, whose ratings are driven by our expectation of a high probability of support from the Saudi authorities if needed, are rated 'BBB+'.

-----

Earlier:

2017, October, 9, 21:45:00

RUSSIA - SAUDIS: VAST OPPORTUNITIESNasser said vast opportunities for collaboration between companies from Saudi Arabia and Russia are created by both the Kingdom’s existing economic pillars and the development and diversification envisaged by Saudi Vision 2030. |

2017, October, 4, 23:55:00

SAUDIS - RUSSIA RELATIONSHIPSSaudi Aramco will participate in the historic Royal Visit to Russia by The Custodian of the Two Holy Mosques King Salman bin Abdulaziz Al-Saud from October 4 to 7, 2017.

|

2017, August, 14, 14:20:00

SAUDI'S DEFICIT DOWNSaudi Arabia's state budget deficit shrank by a fifth from a year earlier in the second quarter of this year as revenues rose moderately and spending fell marginally, finance ministry figures showed on Sunday.

|

2017, July, 12, 14:05:00

SAUDI ARAMCO INVESTMENT: $300 BLN“Saudi Aramco plans to invest more than $300 billion over the coming decade to reinforce our preeminent position in oil, maintain our spare oil production capacity and pursue a large exploration and production program centered on conventional and unconventional gas resources.”

|

2017, May, 26, 14:10:00

NO ONE ENVIES THE SAUDISNo one envies the Saudi Arabians now. Yes, the Brent price has rebounded from its of 2015-16 lows to stabilise over $50. At the Opec meeting in Vienna this week the delegates agreed to extend production curbs for another nine months.

|

2017, April, 19, 17:40:00

SAUDI'S RENEWABLE ENERGYSaudi Arabia aims to produce 10 percent of its power from renewable sources in the next six years as it pushes ahead with a multi-billion-dollar plan to diversify its energy mix and free up more crude oil for export.

|

2017, April, 17, 17:35:00

SAUDI'S INVESTMENT STRATEGY“We are continuing to invest and strengthen our core oil and gas business across the value chain.” |