U.S. OIL EXPORT UP BY 300 TBD

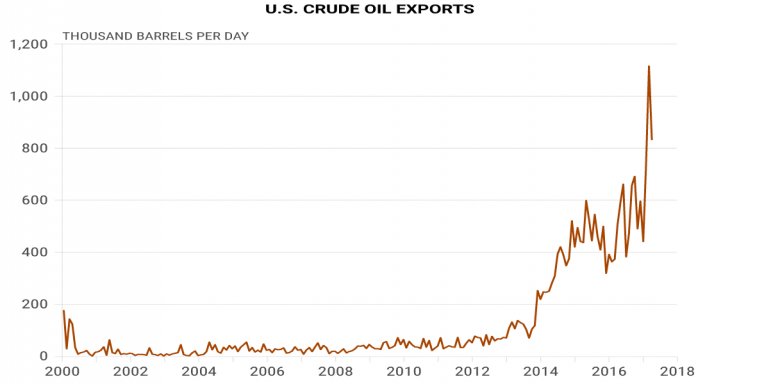

EIA - Crude oil exports in the first half of 2017 increased by more than 300,000 barrels per day (b/d) from the first half of 2016, reaching a record high of 0.9 million b/d. Petroleum product exports also grew over the same period with propane and distillate exports reaching record highs of 0.9 million b/d and 1.3 million b/d, respectively.

Following the removal of restrictions on exporting U.S. crude oil in December 2015, total volumes of crude oil exports and the number of destinations for those exports both increased. The United States exported crude oil to 27 countries in the first half of 2017 compared with 19 countries in the first half of 2016.

Canada remained the largest recipient of U.S. crude oil exports at 307,000 b/d, but imported an average of 63,000 b/d less compared with the first half of 2016. China increased its crude imports from the United States by 178,000 b/d and became the second largest importer of U.S. crude oil, averaging 186,000 b/d in the first half of the year.

Distillate exports in the first half of 2017 were 14% higher than in the first half of 2016, with exports to South and Central America accounting for most of this growth. The share of distillate exports to Central and South America increased slightly to 56%, while the share of distillate exports to Western Europe fell to 19%. Mexico remained the largest single destination for U.S. distillate, averaging 17% of total exports (223,000 b/d), followed by Brazil and the Netherlands.

In the first half of 2017, despite consistently strong domestic demand, U.S. exports of total motor gasoline averaged a record high of 756,000 b/d, a 3% increase from the first half of 2016. High levels of domestic production of gasoline contributed to this record-high export level.

Mexico was the destination of more than half (53%) of total U.S. gasoline exports in the first half of 2017. Recent market reforms in Mexico, which allow entities other than state-owned Pemex to import petroleum products, may have contributed to the recent growth in Mexico's gasoline imports from the United States. Although Mexico produces large amounts of crude oil, Mexico's refinery output of products such as gasoline has been declining since 2015.

In the first half of 2017, Mexico experienced unexpected refinery outages that reduced production of gasoline and distillates even further, and U.S. exports of gasoline to Mexico increased by 27,000 b/d compared with the first half of 2016.

U.S. propane exports reached a record high of 913,000 b/d in the first half of 2017, up from 790,000 b/d in the first half of 2016. Most of this increase is from U.S. exports to Asian markets, which accounted for 74% of the growth since the first half of 2016 and now make up a majority of the destination countries for U.S. propane exports.

-----

Earlier:

2017, October, 18, 18:55:00

U.S. OIL + 81 TBD, GAS + 827 MCFDEIA - Crude oil production from the major US onshore regions is forecast to increase 81,000 b/d month-over-month in November to 6.12 million b/d. |

2017, October, 18, 18:50:00

U.S. OIL PRODUCTION 9.4 MBDEIA forecasts that U.S crude oil production will average 9.4 million barrels per day (b/d) in the second half of 2017, 340,000 b/d more than in the first half of 2017. Production in 2018 is expected to average 9.9 million b/d, surpassing the previous high of 9.6 million b/d set in 1970.

|

2017, October, 18, 18:40:00

U.S. LNG RISKThere are more than a dozen LNG export projects currently being proposed to US regulators, though across the industry almost no final investment decisions have been announced over the last 18 months and some developers have delayed their decisions into 2018 or beyond. Few firm supply purchase agreements have been announced for the projects that have yet to commit to moving forward.

|

2017, October, 16, 12:20:00

WORLD OIL DEMAND UP BY 1.5 MBDWorld oil demand growth in 2017 is now expected to increase by 1.5 mb/d, representing an upward revision of around 30 tb/d from last previous report, mainly reflecting recent data showing an improvement in economic activities. Positive revisions were primarily a result of higher-than-expected oil demand from the OECD region and China. In 2018, world oil demand is anticipated to grow by 1.4 mb/d, following an upward adjustment of 30 tb/d over the previous report, due to the improving economic outlook in the world economy, particularly China and Russia.

|

2017, October, 16, 11:55:00

U.S. ECONOMY UPEconomic activity in the United States has been growing moderately so far this year, and the labor market has continued to strengthen. The terrible hurricanes that hit Texas, Florida, Puerto Rico, and our neighbors in the Caribbean caused tremendous damage and upended many lives, and our hearts go out to those affected. While the effects of the hurricanes on the U.S. economy are quite noticeable in the short term, history suggests that the longer-term effects will be modest and that aggregate economic activity will recover quickly.

|

2017, October, 13, 12:50:00

U.S. OIL FOR ASIAA fresh wave of North American crude cargoes could reach the Far East in the coming months, with an estimated 6 million barrels or more of light sweet US grades loading in November expected to find a home in Asia as regional end-users step up efforts to find cheaper feedstocks amid sustained strength in the Middle Eastern crude complex, Asian trade sources said.

|

2017, October, 11, 12:45:00

U.S. OIL WELLS UP 84%API announced that estimated wells completed in the third quarter of 2017 increased 63 percent compared to the third quarter of 2016. This includes a dramatic 84 percent increase for all oil wells completed from year-ago levels. |