U.S. OIL LOSERS

FT - ExxonMobil and Chevron, the two largest US oil and gas groups, are continuing to lose money on oil and gas production in their home country, in spite of the rise in commodity prices since last year.

The losses raise a question over the companies' forecasts of strong growth in US production, particularly in the Permian basin of Texas and New Mexico.

Reporting earnings for the third quarter, Exxon said it lost $238m on oil and gas production in the US, while Chevron lost $26m. The losses were reduced from the equivalent period of 2016, but came as both companies made healthy profits on their international operations.

In presentations for analysts on Friday, both companies set out projections showing strong growth in production from US shale resources. Exxon forecast average annual growth of 20 per cent in its shale oil and gas production, with 45 per cent growth in the Permian region.

It has been building up its position in the region in recent years, and in September did another deal to acquire more drilling rights, increasing its 6bn barrels of oil equivalent resource base by a further 400m boe.

Chevron similarly projected strong growth in production in the Permian Basin, where it has retained a large legacy position built up over decades.

John Watson, Chevron's chief executive who is stepping down at the end of January, said the company was "exceeding expectations" in the Permian. However, unlike "conventional" oil developments, where an initial capital cost to drill wells and install facilities is followed by a long period of production that declines only slowly, shale resources require continual drilling to maintain output.

Raising profitability while increasing production in shale will require Exxon and Chevron to cut costs by drilling those multiple wells more efficiently and maximising their productivity, analysts say.

On a call with analysts, Exxon said it was aiming to have "industry leading development costs", helped by drilling longer horizontal wells than have been standard in shale. It plans soon to start drilling its first three-mile horizontal well in the Permian basin.

The two companies discussed their similar plans for the US as they reported differing sets of earnings. Exxon beat analysts' expectations with earnings per share up 48 per cent at 93 cents for the quarter.

The results would have been even better but for the disruption to Exxon's refineries and other operations caused by hurricane Harvey, which cut an estimated 4 cents from earnings per share.

Darren Woods, the new chief executive who took over from Rex Tillerson at the start of the year, described the earnings as a "solid performance" and "a step forward in our plan to grow profitability".

Strong results from oil and gas production elsewhere in the world offset the losses in the US, and overall upstream earnings more than doubled to $1.57bn from $620m in the third quarter of last year.

Chevron, meanwhile reported a 51 per cent rise in earnings per share to $1.03 for the third quarter, helped by the strength of its downstream refining and marketing operations and a one-off gain of $675m. Excluding that gain and other one-off items, earnings per share were 85 cents below analysts' average forecast of 99 cents.

They were the first set of results to be published since Chevron confirmed last month that Michael Wirth, executive vice-president for midstream and development at the group, would be taking over from Mr Watson as chief executive.

In a statement, Mr Watson said the company's cash flow was "at a positive inflection point, with oil and gas production increasing and capital spending falling".

He said projects such as the huge Australian liquefied natural gas plants Gorgon and Wheatstone had been completing construction, coming on line and starting to ramp up production, boosting cash flows.

Production volumes show the benefits of Chevron's heavy capital investment in recent years starting to kick in, with output up 8 per cent compared to the equivalent period of 2016 at 2.72m barrels of oil equivalent per day, but that is not showing up very strongly in profits yet.

In spite of the rise in oil and gas prices over the past year, Chevron's production operations reported earnings up just 8 per cent at $489m.

Downstream earnings from refining, marketing and chemicals were up 70 per cent at $1.81bn.

-----

Earlier:

2017, October, 25, 12:30:00

OIL PRICES NO OPPORTUNITIES"They [big OPEC and Middle Eastern producers] cannot be too ambitious [on their oil price targets]...there's not much [upside] room for them to hope for," Sadamori said. "Once the oil price goes to certain levels, this will stimulate new drilling and investments in North America," he added. |

2017, October, 23, 11:00:00

U.S. RIGS DOWN 15 TO 913U.S. Rig Count is up 360 rigs from last year's count of 553, with oil rigs up 293, gas rigs up 69, and miscellaneous rigs down 2 to 2. Canada Rig Count is up 59 rigs from last year's count of 143, with oil rigs up 38 and gas rigs up 21.

|

2017, October, 20, 12:30:00

OIL & GAS WILL CRUTIALOGJ - Oil and gas will remain crucial energy components as their share of the total global mix falls from 53% now to 43% in 2050, Torstad said during a presentation at the National Press Club sponsored by the US Energy Association. “We’ve assumed a generally steady change toward 2050, with less crude oil production but more natural gas and electricity, where solar and wind power will grow because of cost reductions,” she said.

|

2017, October, 18, 18:55:00

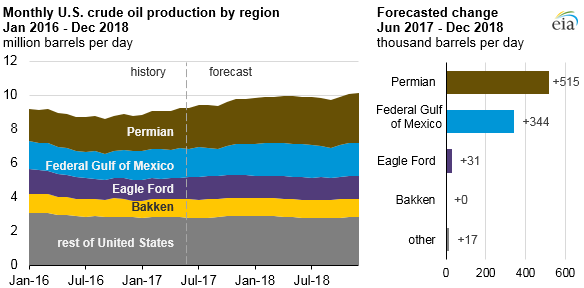

U.S. OIL + 81 TBD, GAS + 827 MCFDEIA - Crude oil production from the major US onshore regions is forecast to increase 81,000 b/d month-over-month in November to 6.12 million b/d.

|

2017, October, 18, 18:50:00

U.S. OIL PRODUCTION 9.4 MBDEIA forecasts that U.S crude oil production will average 9.4 million barrels per day (b/d) in the second half of 2017, 340,000 b/d more than in the first half of 2017. Production in 2018 is expected to average 9.9 million b/d, surpassing the previous high of 9.6 million b/d set in 1970.

|

2017, October, 18, 18:40:00

U.S. LNG RISKThere are more than a dozen LNG export projects currently being proposed to US regulators, though across the industry almost no final investment decisions have been announced over the last 18 months and some developers have delayed their decisions into 2018 or beyond. Few firm supply purchase agreements have been announced for the projects that have yet to commit to moving forward.

|

2017, October, 13, 12:50:00

U.S. OIL FOR ASIAA fresh wave of North American crude cargoes could reach the Far East in the coming months, with an estimated 6 million barrels or more of light sweet US grades loading in November expected to find a home in Asia as regional end-users step up efforts to find cheaper feedstocks amid sustained strength in the Middle Eastern crude complex, Asian trade sources said.

|