OIL PRICE: ABOVE $61 YET

REUTERS, BLOOMBERG - Oil markets were firm on Friday, supported by OPEC-led supply cuts which are tightening the market as well as by strong demand, but analysts cautioned that the cuts would need to be extended to counter rising U.S. output.

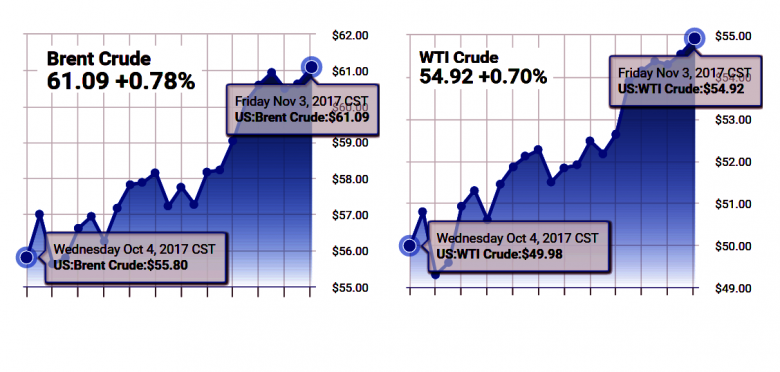

Brent futures LCOc1 were at $60.75 per barrel at 0739 GMT, up 13 cents, or 0.2 percent, from their last close. Brent has risen by around 37 percent since its low in 2017 reached last June.

U.S. West Texas Intermediate (WTI) crude CLc1 was at $54.70 a barrel, up 16 cents, or 0.3 percent, from the last close. WTI is around 30 percent above its 2017-low in June.

Physical oil prices are also rising. Saudi Aramco has raised the December official selling price (OSP) for its Arab Light grade for Asian customers by 65 cents a barrel from November to a premium of $1.25 a barrel to the average of the Oman and Dubai benchmarks. That is the highest since September 2014.

Futures prices are rising in part because of the decision by the Organization of the Petroleum Exporting Countries (OPEC) and other producers, including Russia, to hold back 1.8 million barrels per day (bpd) in production to tighten markets.

While supplies are being withheld, demand is rising, especially in China, whose roughly 9 million bpd of imports have surpassed the United States as the world's biggest crude importer.

"China's oil demand growth appears to be accelerating," investment bank Jefferies said.

Furthermore, crude inventories have dropped as markets have been slightly undersupplied during the past quarters.

However, the outlook for next year is uncertain.

"We are bearish on Brent in the near term given bullish speculative positioning moving ahead of expected weaker fundamentals in late 2017 and Q118," BMI Research said.

The pact to cut supply runs to March 2018. While there is growing consensus to extend the deal to cover all of 2018, an agreement has yet to be made.

Analysts say that without an extension of the cuts, a supply glut could re-emerge.

"Our oil balance numbers imply a modest global drawdown of inventories in 2017, not nearly enough to reverse the large builds seen from 2014 to 2016. What's more, our balance points to the resumption of global stock builds in 2018," said Harry Tchilinguirian of BNP Paribas.

Tchilinguirian said rising U.S. output, which is up more than 13 percent since the middle of 2016 to 9.6 million bpd C-OUT-T-EIA, was resulting in increased exports.

The Energy Information Administration said this week that the latest U.S. crude export figure rose to a record 2.1 million bpd.

"With the U.S. oil surplus increasingly exported... it may be difficult for Brent to hold on to $60 per barrel in 2018," Tchilinguirian said, adding that he expected WTI and Brent to average $50 per barrel and $55 per barrel, respectively, in 2018.

-----

Earlier:

November, 1, 13:40:00

OIL PRICE: ABOVE $61Brent crude futures LCOc1 were up 59 cents at $61.53 per barrel at 0905 GMT, having hit a session peak of $61.70 earlier, the highest since July 2015. U.S. West Texas Intermediate (WTI) crude CLc1 was at $55.12 a barrel, up 74 cents. |

November, 1, 13:35:00

OIL PRICES MAXIMUMICE Brent crude futures remained at 27-month highs in mid-morning trade in Asia Monday, following the gains last week on the expectation that planned supply cuts will be extended to the end of 2018.

|

October, 30, 11:50:00

OIL PRICE: ABOVE $60 YETBrent crude futures, the international benchmark for oil prices, were at $60.55 per barrel at 0655 GMT, 10 cents or 0.15 percent above their last settlement and near their highest level since July 2015. They have risen more than 36 percent since from 2017-lows marked in June. U.S. West Texas Intermediate (WTI) crude futures were up 11 cents, or 0.2 percent, at $54.01 a barrel. |

October, 30, 11:45:00

OIL PRICES WILL UP TO $56WBG - Oil prices are forecast to rise to $56 a barrel in 2018 from $53 this year as a result of steadily growing demand, agreed production cuts among oil exporters and stabilizing U.S. shale oil production, while the surge in metals prices is expected to level off next year, the World Bank said.

|

October, 27, 19:40:00

OIL PRICE: ABOVE $60Brent LCOc1 rose 59 cents to $58.89 a barrel by 10:51 a.m. ET, after rising to a session high of $60.08, the highest since July 2015 and more than 35 percent above its 2017 lows touched in June. U.S. light crude oil CLc1 was up 78 cents, or 1.48 percent at $53.42 after rising to a session high of $53.52 a barrel. U.S. crude prices have been capped by rising U.S. production. |

October, 25, 12:30:00

OIL PRICES NO OPPORTUNITIES"They [big OPEC and Middle Eastern producers] cannot be too ambitious [on their oil price targets]...there's not much [upside] room for them to hope for," Sadamori said. "Once the oil price goes to certain levels, this will stimulate new drilling and investments in North America," he added.

|

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|