EUROPEAN ECONOMY UP 3.3%

EBRD - The European Bank for Reconstruction and Development (EBRD) has revised up sharply its 2017 economic growth forecasts, with higher export levels, a revival in investment and firmer commodity prices supporting a broad-based upswing.

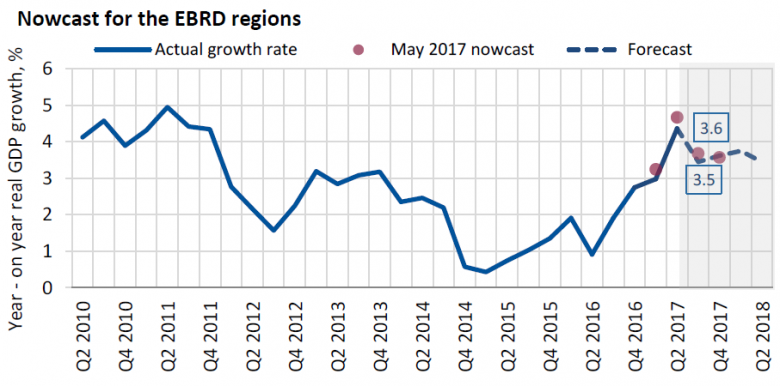

Average growth across the EBRD region is seen at 3.3 per cent this year, a rise of 0.9 percentage points against the previous forecast from May, and compared with growth of just 1.9 per cent in 2016.

The EBRD tracks the economies of 37 emerging countries, where it finances projects and supports reforms that promote sustainable and environmentally-friendly market economies.

The pace of growth has picked up in 27 of the EBRD's economies this year, the first time that such a broad upturn has been seen since 2010. All economies in the region, except Azerbaijan and FYR Macedonia, saw positive growth in the first half of the year.

Several countries, notably Romania and Turkey, are enjoying growth rates comparable to the pre-crisis levels of the mid-2000s.

The EBRD's chief economist Sergei Guriev said: "The broad-based recovery is a very welcome development. It also creates a window of opportunity to carry out reforms that will ensure the sustainability of the stronger growth rates over the longer term."

Growth across the region is expected to continue into 2018, but at a slightly more moderate pace of 3.0 per cent.

Despite the recent acceleration in economic output, the EBRD expects average growth in the region to remain slightly below that of other comparable emerging markets.

It also says the current outlook is subject to numerous risks, including geopolitical tensions, persistent security threats, the growing appeal of populist anti-globalisation policies in advanced economies and a high degree of concentration in the sources of global growth.

The economy in Russia, the largest in the EBRD region and a major influence on output in many other EBRD countries of operations, has now pulled out of recession after a cumulative contraction of 3 per cent over the last two years. Russia is expected to see GDP growth of 1.8 and 1.7 per cent in 2017 and 2018, respectively.

The increase in the oil price – compared with 2016 – has been a positive factor for Russia, and also for other commodity exporters and countries in Central Asia and eastern Europe and the Caucasus that rely on Russia for remittance flows or as a destination for their exports.

The gap in growth rates between the east and west of the EBRD region was now expected to narrow further, it added.

However, the report says that investment activity in Russia is constrained by economic uncertainty, and signs of stress have appeared in the financial sector.

After a slow-down in 2016 linked to lower investment levels, growth in central Europe and the Baltic states is expected to accelerate to close to 4 per cent in 2017, before moderating to around 3.5 per cent in 2018.

In this sub-region, skilled labour shortages may act as a constraint on potential growth in the medium term.

In Poland, where growth is seen rising to 4.1 per cent this year, the pace will slow to 3.4 per cent as the one-off impact of increased social payments fades.

The near-term economic outlook has improved in Hungary on the back of cuts in the rates of corporate income tax and social security contributions as well as increased minimum wages.

In south-eastern Europe, average growth is also expected to accelerate, reaching 3.6 per cent in 2017 before moderating to 3.3 per cent in 2018. The Greek economy has returned to growth in the first half of the year amid progress in reforms and rising confidence.

Growth in eastern Europe and the Caucasus as a whole is expected to pick up from near zero to close to 1.5 per cent in 2017 as headwinds from low commodity prices and the earlier recession in Russia subside, although Azerbaijan's economy is projected to remain in recession. A gradual recovery in the region is set to continue in 2018.

Growth in Turkey is projected to accelerate to 5.1 per cent in 2017 on the back of government stimulus before slowing to 3.5 per cent in 2018 as the fiscal impact wears off.

Economies in the southern and eastern Mediterranean (SEMED) region are expected to show growth of 3.8 per cent in 2017 and 4 per cent in 2018, supported by reform implementation and continued recovery in the tourism sector, and export rebounds in Egypt and Jordan.

Morocco is the only country in the SEMED region that is expected to see a slow-down in growth during 2018, as the base effect from the agricultural rebound in 2017 (after a very poor 2016) is removed.

-----

Earlier:

2017, September, 20, 08:45:00

RENEWABLE'S FUTUREThe falling cost of renewable energy will increasingly allow wind and solar projects to make money without subsidies, say the top executives in Europe’s power industry. |

2017, September, 4, 12:30:00

RUSSIAN GAS FOR EUROPE: UP TO 23%Russian natural gas volumes piped via Ukraine to European consumers are up by 23.4 percent so far this year at 61.9 billion cubic metres (bcm), Ukrainian gas transport monopoly Ukrtransgaz said.

|

2017, August, 31, 12:15:00

U.S. LNG FOR EUROPE - 4Last week, U.S. liquefied natural gas (LNG) made its way to the somewhat unlikely market of Lithuania. The former Soviet republic traditionally bought its gas from Russian state company Gazprom; this was its first shipment from the United States. For President Donald Trump, that must have been a gratifying sign of the success of his administration’s nascent energy diplomacy.

|

2017, August, 28, 19:40:00

HUGE NORWAY'S OIL & GAS“We have been producing oil and gas in Norway for nearly 50 years and we are still not halfway done. Vast volumes of oil and gas have been discovered on the Norwegian shelf that are still waiting to be produced. We want companies with the ability and willingness to utilise new knowledge and advanced technology. This will yield profitable production for many decades in the future,” says Ingrid Sølvberg, Director of development and operations in the Norwegian Petroleum Directorate.

|

2017, July, 28, 09:50:00

GAZPROM'S EXTRA CAPACITYRussia's Gazprom will soon be able to bid for up to 12.8 Bcm/year of extra capacity in Germany's 36.5 Bcm/year Opal natural gas pipeline after an EU court lifted a temporary ban late Friday.

|

2017, July, 26, 14:35:00

IMF WANT EUROPEThe European Union could do more to convince countries to put EU reform recommendations into practice. For example, targeted support from the EU budget could be provided to incentivize reforms. The EU should also continue pushing for greater integration of the energy, transport, and digital markets.

|

2017, May, 6, 17:00:00

RUSSIAN GAS CORRIDOROne of the highest priorities in Russia's gas export and marketing strategy is establishing its own southern corridor for gas exports to Europe, in competition with the EU-backed project. |