NORWAY'S PRODUCTION UP TO 1.9 MBD

NPD - Preliminary production figures for October 2017 show an average daily production of 1 901 000 barrels of oil, NGL and condensate, which is an increase of 141 000 barrels per day compared to September.

Total gas sales were 10.9 billion Sm3 (GSm3), which is an increase of 1.5 GSM3 from the previous month.

Average daily liquids production in October was: 1 540 000 barrels of oil, 330 000 barrels of NGL and 31 000 barrels of condensate.

Oil production is approx. 4.5 percent lower than the NPD's forecast, and about 0.9 percent below the forecast so far this year.

The main reasons that production in October was below forecast is that Goliat was closed down most of the month and production from Gina Krog was less than expected, one of the reasons being loading problems due to bad weather.

The increase in oil production since September is a result of increased production on several fields, with Snorre and Ivar Aasen having the largest increases.

The total petroleum production for the first ten months in 2017 is about 197.9 million Sm3 oil equivalents (MSm3 o.e.), broken down as follows: about 77.6 MSm3 o.e. of oil, about 18.2 MSm3 o.e. of NGL and condensate and about 102.1 MSm3 o.e. of gas for sale. The total volume is 7.1 MSm3 o.e. higher than in 2016.

Final production figures from September 2017 show an average daily production of about 1.445 million barrels of oil, 0.316 million barrels of NGL and condensate and a total of 9.4 billion Sm3 saleable gas production.

-----

Earlier:

2017, November, 20, 09:00:00

NORWAY SELLS OIL & GASNorway, which relies on oil and gas for about a fifth of economic output, would be less vulnerable to declining crude prices without its fund investing in the industry, the central bank said Thursday. The divestment would mark the second major step in scrubbing the world’s biggest wealth fund of climate risk, after it sold most of its coal stocks.

|

2017, October, 20, 12:10:00

NORWAY'S PRODUCTION DOWN 171 TBDNPD - Preliminary production figures for September 2017 show an average daily production of 1 772 000 barrels of oil, NGL and condensate, which is a decrease of 171 000 barrels per day compared to August.

|

2017, August, 31, 12:10:00

U.S. WANT NORWAYNorway’s $970-billion sovereign wealth fund, the world’s largest, should allocate a bigger share of its investments to renewable energy to boost returns, a U.S. energy policy think-tank said

|

2016, November, 21, 18:45:00

NORWAY'S OIL PRODUCTION UP TO 30%Preliminary production figures for October 2016 show an average daily production of 2 099 000 barrels of oil, NGL and condensate, which is an increase of 486 000 barrels per day (approx. 30 percent) compared to September.

|

2016, November, 11, 18:30:00

NORWAY'S INVESTMENT DOWN 21%Total investment in oil and natural gas extraction in Norway was 21% lower in the first half of 2016 compared with the first half of 2015, a decline of about 20.9 billion Norwegian kroner (US $3.5 billion). However, investment cuts have affected some segments of the industry more than others.

|

2016, July, 6, 18:15:00

IMF WANT NORWAYDirectors emphasized the need for continuing structural reforms to support a successful transition and improve the efficiency of the economy. They saw merit in continued restraint in wage settlements and further reforms to reinvigorate productivity growth. Aligning public sector pensions with recent private sector reforms and reforms to sickness and disability pensions could increase labor force participation. Directors also saw scope for efficiency gains from reducing tax preferences for owner-occupied housing and relaxing supply restrictions in the housing market.

|

2016, May, 9, 19:20:00

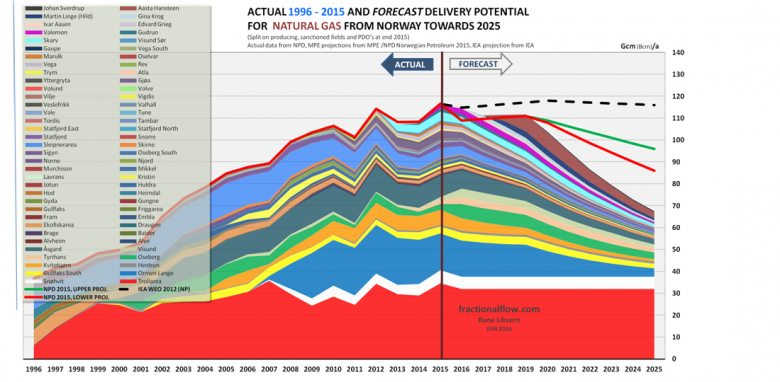

THE NEXT ENERGY WARIf this price drop does happen, then Norway will be caught in the crossfire, as its production is more expensive than Gazprom's. Further, Gazprom has already developed the giant Bovanenkovo field in the Yamal Peninsula, where output has been curtailed as export markets and Gazprom's own domestic demand have have not required the additional gas. This means it is in a position to bring more cheap gas to market at little additional cost beyond transport. For Norway, however, adding more production capacity entails more capital expenditure. |