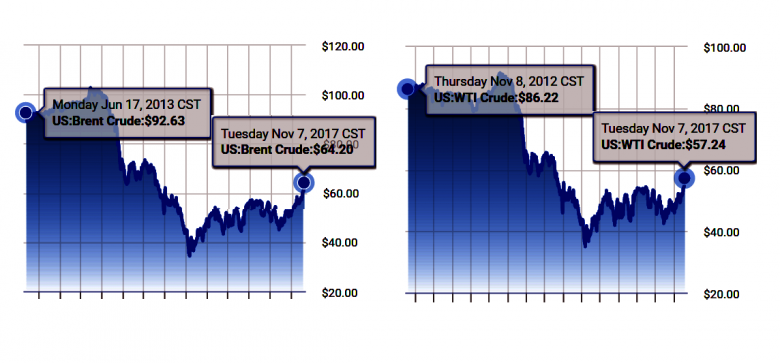

OIL PRICE 2018: $55

OGJ - Light, sweet crude oil prices gained more than $1 to close above $55/bbl on the New York market Nov. 3—the second consecutive day the US benchmark reached a settlement high since July 2015.

Barclays analysts credited recent oil-price support to reports of global economic growth and new supply disruptions. Overall, ample world oil supplies are falling.

"Owing to the improvement in the inventory situation, which has accelerated due to unforeseen disruptions, prices have broken above resistance levels established earlier this year," Barclays said. "Brent appears to be consolidating around $60/bbl and could make another move higher, targeting $70/bbl."

But Barclays analysts said $70/bbl "would be unsustainable both fundamentally and from a positioning perspective and would thus be short lived."

Barclays raised its Brent oil price forecast, saying Brent will average $60/bbl during the fourth quarter and will average $55/bbl in 2018. The average 2018 forecast was up $3 compared with Barclays earlier forecast.

"We have long forecasted a tightening fundamental backdrop in the second half of this year," Barclays analysts said. "We think this strength will be sustained through first quarter next year."

They cited tightening world oil supplies stemming from a variety of reasons, including a 300,000 b/d drop in northern Iraq crude exports and production during October due to unrest and technical issues.

"Hurricane-related production shut ins in the Gulf of Mexico reduced US and Mexican supply by more than 500,000 b/d in September," Barclays said. "Finally, a synchronized and robust global economic recovery has emerged."

In addition, Chinese oil demand growth is expected "to remain robust in 2018," Barclays said.

Energy prices

The December light, sweet crude contract on the New York Mercantile Exchange increased $1.10 to $55.64/bbl on Nov. 3. The January 2018 contract rose $1.09 to $55.86/bbl.

The NYMEX natural gas price for December climbed nearly 5¢ to $2.98/MMbtu. The Henry Hub cash gas price for Nov. 3 was $2.74/MMbtu, up 5¢.

Heating oil for December rose 3¢ to $1.88/gal. The NYMEX reformulated gasoline blendstock for December climbed 2¢ to a rounded $1.79/gal.

The Brent crude contract for January 2018 on London's ICE gained $1.45 to $62.07/bbl. The February 2018 contract increased $1.43 to $61.80/bbl. The gas oil contract for November was up $5.75 to $560.25/tonne.

The Organization of Petroleum Exporting Countries' basket of crudes price was up 66¢ Nov. 3 to $59.15/bbl.

-----

Earlier:

November, 3, 12:35:00

OIL PRICE: ABOVE $61 YETBrent futures LCOc1 were at $60.75 per barrel at 0739 GMT, up 13 cents, or 0.2 percent, from their last close. Brent has risen by around 37 percent since its low in 2017 reached last June. U.S. West Texas Intermediate (WTI) crude CLc1 was at $54.70 a barrel, up 16 cents, or 0.3 percent, from the last close. WTI is around 30 percent above its 2017-low in June. |

November, 3, 12:30:00

OPEC OIL PRICE: $58.49OPEC daily basket price stood at $58.49 a barrel Thursday, 2 November 2017

|

November, 3, 12:25:00

ЦЕНА URALS: $51,15Средняя цена нефти марки Urals по итогам января – октября 2017 года составила $ 51,15 за баррель.

|

October, 25, 12:30:00

OIL PRICES NO OPPORTUNITIES"They [big OPEC and Middle Eastern producers] cannot be too ambitious [on their oil price targets]...there's not much [upside] room for them to hope for," Sadamori said. "Once the oil price goes to certain levels, this will stimulate new drilling and investments in North America," he added.

|

October, 16, 12:20:00

WORLD OIL DEMAND UP BY 1.5 MBDWorld oil demand growth in 2017 is now expected to increase by 1.5 mb/d, representing an upward revision of around 30 tb/d from last previous report, mainly reflecting recent data showing an improvement in economic activities. Positive revisions were primarily a result of higher-than-expected oil demand from the OECD region and China. In 2018, world oil demand is anticipated to grow by 1.4 mb/d, following an upward adjustment of 30 tb/d over the previous report, due to the improving economic outlook in the world economy, particularly China and Russia.

|

October, 13, 12:55:00

2018 OIL MARKET FORECASTFalling global crude oil stockpiles in 2017 will help put the market “roughly” into balance in 2018, but an increase in prices could be limited, especially if the Organization of Petroleum Exporting Countries doesn’t stick to its agreement to curb output, the International Energy Agency said.

|

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI). |