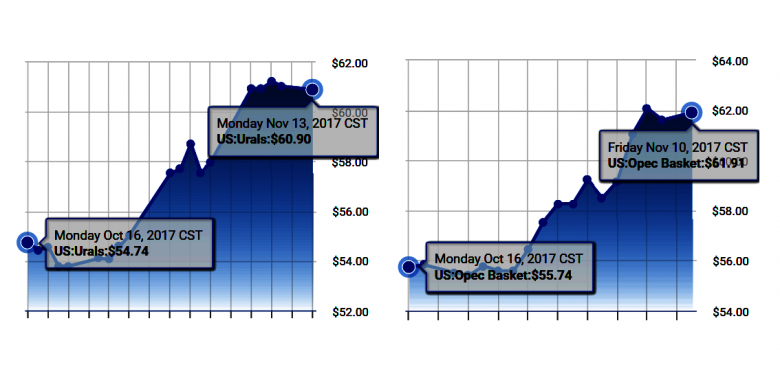

OIL PRICE: ABOVE $62

REUTERS, BLOOMBERG - Oil prices eased for a third day on Tuesday as traders and investors questioned how much the prospect of further rises in U.S. output might overshadow some of the optimism that OPEC-led production cuts would tighten the balance between crude supply and demand.

Brent crude futures LCOc1 were last down 34 cents on the day at $62.82 a barrel at 1212 GMT (7.12 a.m. E.T.), while U.S. West Texas Intermediate (WTI) futures CLc1 fell 27 cents to $56.49.

Both benchmarks early in the previous week hit highs last seen in 2015, but traders said the market had lost some momentum since then.

Traders said they were cautious about betting on further price rises.

"Prices ... are starting to look like a pause or pullback is needed," said Greg McKenna, chief market strategist at futures brokerage AxiTrader.

This sentiment comes in part on the back of rising U.S. oil output C-OUT-T-EIA, which has grown by more than 14 percent since mid-2016 to a record 9.62 million barrels per day (bpd).

The U.S. government said on Monday U.S. shale production in December would rise for a 12th consecutive month, increasing by 80,000 bpd.

"The recent price support, namely the tension in the Middle East has been swept aside as rising rig counts and US shale output (are) in the focus of traders," PVM Oil Associates analyst Tamas Varga said.

Fitch Ratings said in its 2018 oil outlook that it assumed 2018 "average oil prices will be broadly unchanged year-on-year and that the recent price recovery with Brent exceeding $60 per barrel may not be sustained".

So far in 2017, Brent has averaged $54.5 per barrel.

Despite the cautious sentiment, traders said oil prices were unlikely to fall far, largely due to supply restrictions led by the Organization of the Petroleum Exporting Countries and Russia, which have helped reduce excess stockpiles.

The International Energy Agency on Tuesday delivered a more cautious outlook for oil demand.

In a monthly report, the Paris-based agency cut its oil demand forecast by 100,000 bpd for this year and next, to an estimated 1.5 million bpd in 2017 and 1.3 million bpd in 2018.

The IEA said warmer temperatures could cut consumption, while sharply rising production from outside OPEC might mean the global market tilts back into surplus in the first half of 2018.

"You cannot have the same forecast at $60 as you have at $40. You need to address that and the IEA is starting to make that adjustment," Petromatrix strategist Olivier Jakob said.

-----

Earlier:

November, 9, 14:05:00

OIL PRICE: ABOVE $63Benchmark Brent crude oil LCOc1 was unchanged at $63.49 a barrel by 0840 GMT. On Tuesday, Brent reached an intra-day high of $64.65, its highest since June 2015. U.S. light crude CLc1 was steady at $56.81, not too far off this week’s more than two-year high of $57.69 a barrel.

|

November, 9, 13:55:00

EIA: OIL PRICE $53 - $56North Sea Brent crude oil spot prices averaged $58 per barrel (b) in October, an increase of $1/b from the average in September. EIA forecasts Brent spot prices to average $53/b in 2017 and $56/b in 2018.

|

November, 7, 12:35:00

OIL PRICE 2018: $55Barclays raised its Brent oil price forecast, saying Brent will average $60/bbl during the fourth quarter and will average $55/bbl in 2018. The average 2018 forecast was up $3 compared with Barclays earlier forecast. |

November, 3, 12:35:00

OIL PRICE: ABOVE $61 YETBrent futures LCOc1 were at $60.75 per barrel at 0739 GMT, up 13 cents, or 0.2 percent, from their last close. Brent has risen by around 37 percent since its low in 2017 reached last June. U.S. West Texas Intermediate (WTI) crude CLc1 was at $54.70 a barrel, up 16 cents, or 0.3 percent, from the last close. WTI is around 30 percent above its 2017-low in June. |

November, 3, 12:30:00

OPEC OIL PRICE: $58.49OPEC daily basket price stood at $58.49 a barrel Thursday, 2 November 2017

|

November, 3, 12:25:00

ЦЕНА URALS: $51,15Средняя цена нефти марки Urals по итогам января – октября 2017 года составила $ 51,15 за баррель.

|

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|