OIL PRICES MAXIMUM ANEW

BLOOMBERG - Oil reached levels last seen more than two years ago as Saudi Arabian King Salman's anti-corruption drive shook the world's biggest crude exporter just weeks before major producers gather to discuss prolonging historic production caps.

Futures advanced as much as 1.2 percent in New York. The purge eliminated potential rivals to Crown Prince Mohammed bin Salman and included a member of the royal council overseeing state oil producer Saudi Aramco and one of its directors. The arrests of princes, government ministers and billionaires may cast a shadow over the Nov. 30 OPEC meeting.

"The geopolitical supply risk premium is starting to bear its head in the market right now because OPEC supply cuts have made it relevant," Michael Loewen, a commodities strategist at Scotiabank in Toronto, said by telephone. Now that OPEC "has capped supply and demand has continued to grow higher over time, we are near balanced and that means supply risk is more important."

Oil has advanced for four straight weeks in New York on signs that a global glut is shrinking in response to output caps implemented by the Organization of Petroleum Exporting Countries and allied producers including Russia. At the Nov. 30 gathering, Saudi Arabia, Iraq and other major suppliers are expected to make the case for extending the limits beyond their March expiration.

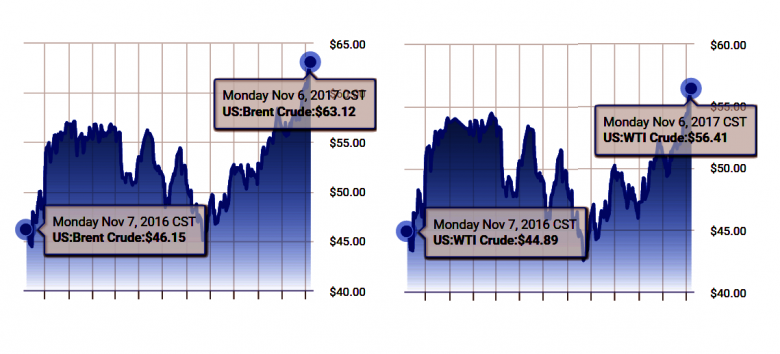

West Texas Intermediate for December delivery rose 23 cents to $55.87 a barrel at 10:04 a.m. on the New York Mercantile Exchange after earlier rising to $56.28, the highest intraday price since July 2015.

Brent for January settlement climbed 46 cents to $62.53 on the London-based ICE Futures Europe exchange, and traded at a $6.41 premium to WTI for the same month.

Security forces arrested 11 princes, four ministers and dozens of former ministers and prominent businessmen, according to Saudi media and a senior official who spoke on condition of anonymity.

"I wouldn't expect a change of strategy for Saudi Arabia" in terms of production and OPEC policy, Rupert Harrison, chief macro strategist at BlackRock International Ltd., said in a Bloomberg television interview. "But clearly the risk is always from disruption, and that's the uncertainty that hangs over this and is always very hard to call."

-----

Earlier:

|

|

|

|

|

|

|