OPEC: 2040 GLOBAL ENERGY CHANGES

OPEC - WORLD OIL OUTLOOK 2040

The global economic picture will change in the long-term

The size of the global economy in 2040 is estimated to be 226% that of 2016. Developing countries are estimated to account for three-quarters of the global GDP growth over the forecast period. Furthermore, one of every two additional $ (2011 purchasing power parity (PPP)) of GDP is expected to come from China and India.

In 2016, OECD America accounted for 20% of global GDP, OECD Europe and China were both at 18%, and India was at 7%. By 2040 the share of OECD America is anticipated to drop to 16% and that of OECD Europe to 12%. On the other hand, China's contribution to the global economy is forecast to increase to 23%. Even more remarkable is the case of India. Its weight in terms of global GDP is expected to increase to 16%.

Driven by expansion in Developing countries, global energy demand is set to increase by 35% over the period 2015–2040

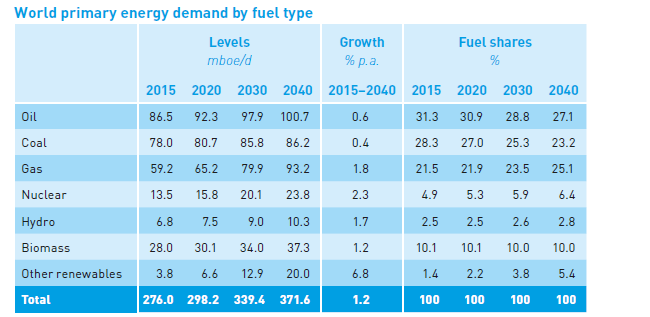

Reflecting the underlying assumed developments of the key drivers, total primary energy demand is forecast to increase by 96 mboe/d between 2015 and 2040, rising from 276 mboe/d to 372 mboe/d. In relative terms, this represents a 35% increase compared to the base year of 2015, with an average annual growth rate of 1.2 % during the forecast period.

India and China are the two largest contributors to future energy demand

Within the grouping of Developing countries, India and China are the two nations with the largest additional energy demand over the forecast period, both in the range of 22–23 mboe/d. It should be noted, however, that for the first time recent projections see India as the single largest contributor to future energy demand, followed by China and other countries. However, this change in the leading position is primarily the result of the downward revisions made for China, compared to the Reference Case, rather than a more positive outlook for India.

Gas contributes most to future energy demand growth

At the global level, the largest contribution to future energy demand is projected to come from natural gas. In absolute terms, demand for gas will increase by almost 34 mboe/d, reaching a level of 93 mboe/d by 2040. Its share in the global energy mix will increase by a significant 3.6 percentage points.

Renewables are projected to record the fastest growth rate, but oil and gas are still expected to supply more than half of global energy needs by 2040

Other renewables – consisting mainly of wind, photovoltaic, solar and geothermal energy – is projected to be by far the fastest growing energy type. It is estimated to have an average annual growth rate of 6.8% over the forecast period. Its share is expected to increase by 4 percentage points by 2040. However, given that its current base in the global energy demand mix is rather low, at about 1.4%, the share of other renewables is still anticipated to be below 5.5% by 2040, despite its impressive growth.

Oil and coal are projected to grow at much lower rates of 0.6% and 0.4% p.a., respectively. Despite these relatively low rates, fossil fuels will retain a dominant role in the global energy mix, although with a declining overall share. Indeed, the share of fossil fuels in the global energy mix stood at 81% in 2015. This is set to decline to below 80% by 2020 and then drop further to under 78% by 2030. It is estimated to reach 74% by 2040. It should be noted, however, that oil and gas together are still expected to provide more than half of the world's energy needs over the forecast period, with their combined share relatively stable between 52–53%.

Medium-term oil demand growth remains healthy

The medium-term oil demand outlook for the period 2016–2022 shows an increase of 6.9 mb/d, rising from 95.4 mb/d to 102.3 mb/d. This corresponds to a healthy average annual increase of almost 1.2 mb/d. Demand in Developing countries is expected to be strong, increasing from 43.2 mb/d in 2016 to 49.6 mb/d in 2022.

Globally, oil demand has been revised upwards by 2.24 mb/d in 2022 compared to the WOO 2016. This revision includes the upward shift to the baseline (+1.2 mb/d) in 2016. In addition, in this year's WOO, OECD regional oil demand is expected to grow until 2019, before the trend reverses. In last year's publication, OECD demand grew only until 2017.

Oil demand increases by 15.8 mb/d to reach 111.1 mb/d by 2040, but demand growth decelerates

Long-term oil demand is expected to increase by 15.8 mb/d, rising from 95.4 mb/d in 2016 to 111.1 mb/d in 2040. Demand in the OECD region is anticipated to show a significant decline of 8.9 mb/d over the forecast period. Driven by an expanding middle class, high population growth rates and stronger economic growth potential, Developing countries' oil demand is expected to increase by almost 24 mb/d. China is anticipated to continue to be the largest oil consumer over the forecast period, adding 6 mb/d to reach 17.8 mb/d by 2040. India will be the region with the second largest overall demand growth, adding 5.9 mb/d between 2016 and 2040. Indian demand growth is also set to witness the fastest average growth of 3.6% p.a.

Long term global oil demand growth is forecast to decelerate steadily, falling from an annual average of around 1.3 mb/d during the period 2016–2020 to only 0.3 mb/d every year between 2035 and 2040. This deceleration is a result of slowing GDP growth, assumed oil price increases, a structural shift of economies towards a more service-oriented structure, efficiency improvements as a result of tightening energy efficiency policies and/or technological improvements, and oil facing strong competition from other energy sources.

Non-OPEC supply shows strong growth in the medium-term, slowing thereafter

Non-OPEC supply in the Reference Case is forecast to grow from 57 mb/d in 2016 to 62 mb/d in 2022. Of this, 3.8 mb/d, or 75%, stems from US oil production alone, with the tight oil sector expected to continue its recovery after its dramatic 2016 slump. Brazil and Canada are the other significant contributors to supply growth, meaning incremental non-OPEC production is heavily focused on the Americas. While this WOO's medium-term outlook is more optimistic than last year's projected growth, the long-term forecast is largely unchanged. Total non-OPEC supply is projected to decline by 0.3 mb/d in the 2020–2040 period, with US tight oil production estimated to peak in the latter half of the 2020s.

US tight oil is by far the most important contributor to non-OPEC supply, but peaks after 2025

Non-OPEC supply growth is overwhelmingly driven by higher tight oil production, predominantly in the US and to a lesser extent elsewhere. This growth is heavily front-loaded, as drillers seek out and aggressively produce barrels from sweet spots in the Permian and other basins. As such, global tight oil grows 4.8 mb/d in the 2016–2022 period, mostly in the US, but the WOO also assumes some growth in Canada, Argentina and Russia – before peaking after 2025 and then declining modestly from around 2030. As in previous reports, no tight oil volumes are expected from other countries outside of these four.

Demand for OPEC crude is quite flat until 2025 and then rises sharply

In the Reference Case, demand for OPEC crude stays relatively flat at just over 33 mb/d until 2025, after which US tight oil is projected to peak, and with it overall non-OPEC supply. Thereafter, the call on OPEC crude production rises steadily, reaching 41.4 mb/d in 2040, or up 8.8 mb/d from 2016. This would imply OPEC's share of global oil production (including not only crude, but also all other liquids), would rise from 40% in 2016 to 46% in 2040.

Long term global oil trade is set to increase gradually with the Middle East playing a significant and expanded role in crude and products

The anticipated rather sharp changes in crude trade between 2016 and 2020 stem mainly from developments in the US & Canada region. As oil production in the US & Canada increases, it is expected that crude exports rise significantly to world markets. Although a net-importing region, the US & Canada is estimated to export an appreciable share of its production, as a large portion of the crude produced is light-sweet (notably tight oil) and sold at a premium to high-sulphur and heavier grades, while US refineries process mainly medium and heavy grades. At the same time, imports to the US & Canada are also expected to increase in the period to 2020 as most refineries in the US are complex and capable of converting low-quality and highly-discounted crude into high-value products such as diesel and gasoline.

In the period post-2020, the international crude trade is estimated to drop slightly by 2025, as more regions are expected to use more crude locally in newly installed refining units, for example, in Latin America and Africa, as well as the Middle East. Thereafter, global trade increases gradually, in line with growing liquids demand, resulting predominantly in increasing exports from the Middle East and imports to the Asia-Pacific. The overall crude and condensate trade in 2040 is estimated to be just below 44 mb/d. On the product side, the trade volumes drop significantly between 2020 and 2025 as the refining system in product-importing regions expands, which reduces somewhat the need for refined product imports.

-----

Earlier:

November, 1, 13:30:00

SOUTHEAST ASIA NEED ENERGYAccess to modern energy is incomplete. With a total population of nearly 640 million, an estimated 65 million people remain without electricity and 250 million are reliant on solid biomass as a cooking fuel. Investment in upstream oil and gas has been hit by lower prices since 2014 and the region faces a dwindling position as a gas exporter, and a rising dependency on imported oil. |

October, 16, 12:20:00

WORLD OIL DEMAND UP BY 1.5 MBDWorld oil demand growth in 2017 is now expected to increase by 1.5 mb/d, representing an upward revision of around 30 tb/d from last previous report, mainly reflecting recent data showing an improvement in economic activities. Positive revisions were primarily a result of higher-than-expected oil demand from the OECD region and China. In 2018, world oil demand is anticipated to grow by 1.4 mb/d, following an upward adjustment of 30 tb/d over the previous report, due to the improving economic outlook in the world economy, particularly China and Russia.

|

October, 13, 12:55:00

2018 OIL MARKET FORECASTFalling global crude oil stockpiles in 2017 will help put the market “roughly” into balance in 2018, but an increase in prices could be limited, especially if the Organization of Petroleum Exporting Countries doesn’t stick to its agreement to curb output, the International Energy Agency said.

|

October, 4, 23:45:00

GAS IS ESSENTIALAPI - “The increased use of natural gas in electric power generation has not only enhanced the reliability of the overall system, but it has also provided significant environmental and consumer benefits. The abundance, affordability, low-emissions profile and flexibility of natural gas and natural gas-fired generating units make natural gas a fuel of choice. There is no question, however, that the bulk power system will continue to rely on multiple fuels, including natural gas, nuclear, coal, hydro, wind and solar, as projected by the Energy Information Administration.

|

September, 25, 13:10:00

RENEWABLE ENERGY UPChina accounts for the lion’s share of the upsurge. But Middle East and north African countries are scheduled to have installed 14GW in solar plants by the end of 2018 — a seven-fold increase from 2015. Central and South America are also expected to reach 14GW, nearly five times more than in 2015, while India is set to hit 28GW, a jump of nearly six times.

|

September, 15, 08:55:00

WORLD ENERGY CONSUMPTION UP TO 28%The U.S. Energy Information Administration projects that world energy consumption will grow by 28% between 2015 and 2040. Most of this growth is expected to come from countries that are not in the Organization for Economic Cooperation and Development (OECD), and especially in countries where demand is driven by strong economic growth, particularly in Asia. Non-OECD Asia (which includes China and India) accounts for more than 60% of the world's total increase in energy consumption from 2015 through 2040.

|

September, 13, 15:10:00

IMF: SOUTHEAST ASIA'S TRANSFORMATIONIMF - When we think about Asia’s economic future, we know that this future is being built on strong foundations—on the richness and diversity of its cultures, on the incredible energy and ingenuity of the people who have changed the world by transforming their own economies. China and India have been driving the greatest poverty reduction in human history by creating the world’s largest middle classes. In a single generation, Vietnam has moved from being one of the world’s poorest nations to being a middle-income country. |