BP INVESTS TO SOLAR

BP - Lightsource and BP today announced that they have agreed to form a strategic partnership, bringing Lightsource's solar development and management expertise together with BP's global scale, relationships and trading capabilities to drive further growth across the world.

BP will acquire on completion a 43% equity share in Lightsource for a total consideration of $200 million, paid over three years. The great majority of this investment will fund Lightsource's worldwide growth pipeline. The company will be renamed Lightsource BP and BP will have two seats on the board of directors.

Nick Boyle, Group CEO and founder of Lightsource, said: "We founded Lightsource to lead the solar revolution and chose to partner with BP because, like us, their ambition is to build and grow this company for the long-term. Not only does this partnership make strategic sense, but our combined forces will be part of accelerating the low-carbon transition. Solar power is the fastest growing source of new energy and we are excited to be at the forefront of this development."

Bob Dudley, BP group chief executive added: "BP has been committed to advancing lower-carbon energy for over 20 years and we're excited to be coming back to solar, but in a new and very different way. While our history in the solar industry was centred on manufacturing panels, Lightsource BP will instead grow value through developing and managing major solar projects around the world. I am confident that the combination of Lightsource's expertise and experience with BP's relationships and resources will propel this innovative business to even more rapid growth."

Global installed solar generating capacity more than tripled in the past four years and grew by over 30% in 2016 alone, according to BP's Statistical Review of World Energy. BP's Energy Outlook analysis sees solar as likely to generate around a third of the world's total renewable power and up to 10% of total global power by 2035.

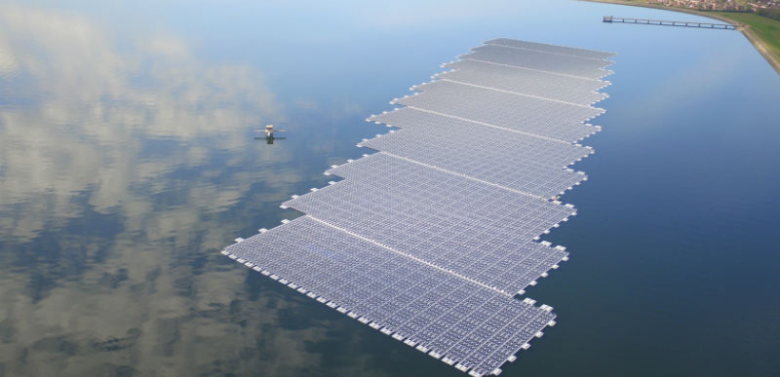

Lightsource is a global leader in the development, acquisition and long-term management of large-scale solar projects and smart energy solutions worldwide. It has grown in just seven years to become Europe's largest developer and operator of utility-scale solar projects. The company has commissioned 1.3 GW of solar capacity to date and manages approximately 2GW of capacity under long-term operations and maintenance contracts - the equivalent of powering over half a million homes through clean energy.

BP's interest in Lightsource BP will complement its existing Alternative Energy business, which includes wind energy, biofuels and biopower. BP Wind Energy has interests in onshore wind energy across the US with total gross generating capacity of 2.3GW. BP Biofuels has world scale plants in Brazil, which produce around 800 million litres of ethanol equivalent per year as well as generating low-carbon power for Brazil's national grid.

Lightsource BP will target the growing demand for large-scale solar projects worldwide with a focus on grid-connected plants and corporate power purchase agreements (PPAs) signed with private companies. The company will continue to develop and deliver Lightsource's 6GW growth pipeline, which is largely focused in the US, India, Europe and the Middle East.

The company sees opportunities to create additional value through integrating solar with BP's other businesses and trading capabilities as well as through BP's international scale and relationships.

Dev Sanyal, BP's chief executive for Alternative Energy, added: "We see significant opportunity to offer affordable, reliable, low-carbon power solutions by integrating solar alongside our existing Alternative Energy and gas business. We see Lightsource as a strategic partner with a similar vision and, with the benefits of BP's global scale and relationships, we together plan to build the global market leader for solar."

Under the terms of the agreement, BP will pay Lightsource $50million on completion of the agreement, with the balance paid in instalments over three years. Completion is anticipated in early 2018.

Lightsource were advised by Rothschild, White and Case, Deloitte and Baker & McKenzie.

-----

Earlier:

2017, November, 7, 12:10:00

BP, SHELL, STATOIL COOPERATIONEnergy majors BP, Shell and Statoil are to co-develop a blockchain-based digital platform for energy trading.

|

2017, November, 1, 13:15:00

BP PROFIT $4 BLNBob Dudley – Group chief executive: “We are steadily building a track record of delivering on our plans and growing across our businesses. This quarter, three new Upstream projects and the highest Downstream earnings in five years, underpinned by reliable operations and disciplined spending, have generated healthy earnings and cash flow. There is still room for further improvement and we will keep striving to increase sustainable free cash flow* and distributions to shareholders.”

|

2017, September, 20, 08:35:00

BP - AZERBAIJAN OIL DEALBP and its partners in Azerbaijan's giant ACG oil production complex agreed Thursday to extend the production sharing contract by 25 years to 2049 and to increase the stake of state-owned SOCAR, reducing the size of their own shares.

|

2017, September, 18, 12:15:00

BP ARGENTINIAN TANGOBP has agreed with Bridas Corporation to form a new integrated energy company by combining their interests in the oil and gas producer Pan American Energy and the refiner and marketer Axion Energy in a cash-free transaction. The new company, Pan American Energy Group, will be the largest privately-owned integrated energy company operating in Argentina.

|

2017, July, 14, 09:40:00

BP: EXCELLENCE, SUSTAINABILITY, COLLABORATIONI think there are three areas where we should focus our efforts. The first is excellence in our operations, or as this session’s title puts it, leadership in responsible operations. The second, is sustainability in our products - fully realising the benefits of both natural gas and renewables as well as our Downstream product range. And the third is collaboration, or simply working together, in our partnerships - the kind of working together that makes new things happen and drives real change.

|

2017, June, 21, 11:25:00

BP ENERGY REVIEWBob Dudley, BP group chief executive, said: “Global energy markets are in transition. The longer-term trends we can see in this data are changing the patterns of demand and the mix of supply as the world works to meet the challenge of supplying the energy it needs while also reducing carbon emissions. At the same time markets are responding to shorter-run run factors, most notably the oversupply that has weighed on oil prices for the past three years."

|

2017, March, 29, 18:30:00

BP SELL REFINERIESRefining of crude oil into fuels such as gasoline, diesel and jet fuel has for years been the industry's problem child, having to grapple with weak and volatile profit margins as well as competition from modern refineries built in China, India and the Middle East. |