OIL PRICE: BELOW $64 YET

REUTERS, BLOOMBERG - Oil prices rose on Monday amid an ongoing North Sea pipeline outage and because a strike by Nigerian oil workers threatened its crude exports.

Signs that booming U.S. crude output growth may be slowing also supported crude prices, although the 2018 outlook still points to ample supply despite production cuts led by OPEC.

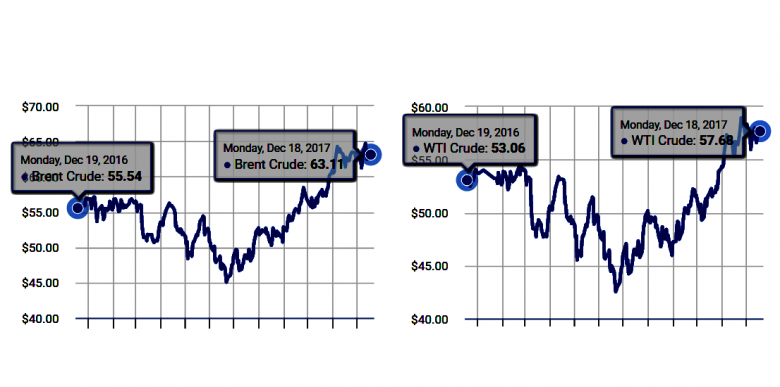

Brent crude futures LCOc1, the international benchmark for oil prices, were at $63.72 a barrel at 0821 GMT, up 49 cents, or 0.8 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $57.70 a barrel, up 40 cents, or 0.7 percent.

The higher prices came on the back of a strike by Nigerian oil workers and the ongoing North Sea Forties pipeline system outage, which provides crude that underpins the Brent benchmark.

North Sea operator Ineos declared force majeure on all oil and gas shipments through its Forties pipeline system last week after cracks were found.

"The force majeure ... is acting as a major prop for crude," said Sukrit Vijayakar, director of energy consultancy Trifecta.

In Nigeria, the Petroleum and Natural Gas Senior Staff Association of Nigeria, whose members mainly work in the upstream oil industry, started industrial action on Monday after talks with government agencies ended in deadlock, potentially hitting the country's production and exports.

"Oil prices are getting a bounce... as the Nigerian oil union talks have hit an impasse and will begin strike action," said Stephen Innes, head of trading for Asia/Pacific at futures brokerage OANDA.

In the United States, energy companies cut rigs drilling for new production for the first time in six weeks, to 747, in the week ended Dec. 15, energy services firm Baker Hughes said on Friday.

Despite the dip in drilling, activity is still well above this time last year, when the rig count was below 500, and actual U.S. production has soared by 16 percent since mid-2016 to 9.8 million barrels per day (bpd).

This means U.S. output is fast approaching that of top producers Saudi Arabia and Russia, which are pumping 10 million bpd and 11 million bpd respectively.

The rising U.S. output also undermines efforts by the Organization of the Petroleum Exporting Countries (OPEC), which is de facto led by Saudi Arabia, and a group of non-OPEC producers including Russia to withhold production to tighten the market and prop up prices.

Largely because of rising shale output from the United States, the International Energy Agency said global oil markets would show a slight supply surplus of around 200,000 bpd during the first half of 2018.

Data from the U.S. Energy Information Administration showed a similar surplus for that period and still indicates a supply overhang of 167,000 bpd for all of 2018.

-----

Earlier:

2017, December, 15, 13:20:00

OIL PRICE: BELOW $64REUTERS - U.S. West Texas Intermediate (WTI) crude futures were at $57.28 a barrel at 0757 GMT, up 26 cents, or 0.5 percent, from their last settlement. Brent crude futures, the international benchmark for oil prices, were at $63.47 a barrel, up 16 cents, or 0.25 percent, from their previous close. |

2017, December, 15, 13:15:00

AFRICA NEEDS GOOD PRICEBLOOMBERG - The region’s median government debt level will probably exceed 50 percent of gross domestic product this year from 34 percent in 2013, while the cost of servicing the liabilities will average almost 10 percent compared with half that four years ago, the International Monetary Fund said.

|

2017, December, 13, 12:40:00

OIL PRICE: ABOVE $64 YETREUTERS - Brent crude was up 69 cents, or 1.1 percent, at $64.03 a barrel by 0743 GMT. It had settled down $1.35, or 2.1 percent, on Tuesday on a wave of profit-taking after news of a key North Sea pipeline shutdown helped send the global benchmark above $65 for the first time since mid-2015. U.S. West Texas Intermediate crude was up 45 cents, or 0.8 percent, at $57.59 a barrel. |

2017, December, 13, 12:30:00

OIL PRICE - 2018: $57EIA - North Sea Brent crude oil spot prices averaged $63 per barrel (b) in November, an increase of $5/b from the average in October. EIA forecasts Brent spot prices to average $57/b in 2018, up from an average of $54/b in 2017.

|

2017, December, 8, 17:50:00

OIL PRICE: NOT ABOVE $63 AGAINREUTERS - U.S. West Texas Intermediate (WTI) crude futures were at $56.58 a barrel at 0714 GMT, down 11 cents, or 0.2 percent from their last settlement. Brent crude futures, the international benchmark for oil prices, were down 8 cents, or 0.1 percent, at $62.12 a barrel. |

December, 2, 18:54:00

OPEC CONFIRMEDOPEC - In agreeing to this decision, Member Countries confirmed their continued focus on a stable and balanced oil market, in the interests of both producers and consumers. Member Countries remain committed to being dependable and reliable suppliers of crude and products to global markets.

|

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|