OIL PRICE: NOT ABOVE $64

BLOOMBERG - Oil extended gains after a third monthly advance as OPEC agreed to prolong production cuts through to the end of 2018 in an effort to drain a global glut.

Futures added 0.6 percent in New York after rising 0.2 percent Thursday. The nine-month extension was beefed up through the inclusion of Nigeria and Libya, two OPEC members originally exempted from the curbs. By keeping the 1.8 million barrels a day of cuts in place, the group aims to return stockpiles to their five-year average without overheating the market.

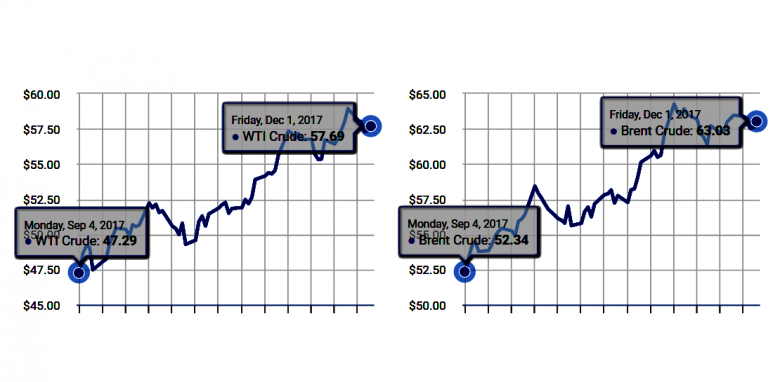

Oil has climbed about 22 percent since the start of September on tightening supplies and expectations the Organization of Petroleum Exporting Countries and its allies would prolong cuts past the end of March. U.S. output expanded to another record last week, highlighting the challenge ahead for OPEC and Russia as shale producers ramp up production amid rising prices.

"It's good to have Nigeria and Libya in the fold, but the market reaction has been fairly muted given the outcome was largely expected," said David Lennox, a commodity analyst at Fat Prophets in Sydney. "The focus now is on U.S. output. We're not going to see the oil price rally too much further because when it rises, we see much more activity from the U.S. producers."

West Texas Intermediate for January delivery was at $57.72 a barrel on the New York Mercantile Exchange, up 32 cents, at 7:50 a.m. in London. Total volume traded was about 16 percent below the 100-day average. Prices rose 10 cents to $57.40 on Thursday, capping a 5.6 percent gain for November.

Brent for February settlement climbed 43 cents to $63.06 a barrel on the London-based ICE Futures Europe exchange. The January contract expired Thursday after adding 46 cents, or 0.7 percent, to $63.57. The global benchmark crude was at a premium of $5.32 to February WTI.

U.S. oil production may climb by another 1 million barrels a day before the end of 2018 after the extension of the OPEC-led cuts, according to Barclays Plc. There is a "clear upside risk" to further output gains if current prices persist, the bank said. The nation pumped 9.68 million barrels a day last week, the highest level in more than three decades, according to government data.

-----

Earlier:

November, 29, 10:05:00

OIL PRICE: ABOVE $63 STILLREUTERS - U.S. West Texas Intermediate (WTI) crude futures were at $57.67 a barrel at 0427 GMT, down 32 cents, or 0.6 percent below their last settlement. Brent crude futures, the international benchmark for oil prices, were at $63.14 a barrel, down 47 cents, or 0.7 percent. |

November, 27, 20:20:00

OIL PRICE: ABOVE $63 ANEWBLOOMBERG - West Texas Intermediate for January delivery was at $58.51 a barrel on the New York Mercantile Exchange, down 44 cents, at 10:22 a.m. London time. Total volume traded was about 24 percent above the 100-day average. Prices gained 93 cents to $58.95 on Friday, capping a 4.2 percent weekly advance. Brent for January settlement fell 21 cents to $63.65 a barrel on the London-based ICE Futures Europe exchange, after rising 1.8 percent last week. The global benchmark crude traded at a premium of $5.11 to WTI.

|

November, 24, 09:45:00

OIL PRICE: ABOVE $63 TOOBLOOMBERG - WTI for January delivery was at $58.43 a barrel on the New York Mercantile Exchange at 1:25 p.m. in Singapore, up 41 cents. The contract added $1.19 to $58.02 on Wednesday. There was no settlement Thursday because of the Thanksgiving holiday in the U.S. and all transactions will be booked Friday. Brent for January settlement lost 14 cents, or 0.2 percent, to $63.41 a barrel on the London-based ICE Futures Europe exchange. Prices rose 23 cents to $63.55 on Thursday. The global benchmark crude traded at a premium of $4.98 to WTI. |

November, 9, 14:05:00

OIL PRICE: ABOVE $63Benchmark Brent crude oil LCOc1 was unchanged at $63.49 a barrel by 0840 GMT. On Tuesday, Brent reached an intra-day high of $64.65, its highest since June 2015. U.S. light crude CLc1 was steady at $56.81, not too far off this week’s more than two-year high of $57.69 a barrel.

|

November, 9, 13:55:00

EIA: OIL PRICE $53 - $56North Sea Brent crude oil spot prices averaged $58 per barrel (b) in October, an increase of $1/b from the average in September. EIA forecasts Brent spot prices to average $53/b in 2017 and $56/b in 2018.

|

November, 7, 12:35:00

OIL PRICE 2018: $55Barclays raised its Brent oil price forecast, saying Brent will average $60/bbl during the fourth quarter and will average $55/bbl in 2018. The average 2018 forecast was up $3 compared with Barclays earlier forecast. |

October, 11, 12:50:00

OIL PRICES 2020: $50 - $60Based on a “lower-for-longer” base-case scenario, global oil prices will remain in the $50-60/bbl range until late 2020, due to increasing supply that breaks even at $50/bbl, according to to the most recent global oil supply and demand outlook from McKinsey Energy Insights (MEI).

|