OPEC'S TRIUMPH

PLATTS - With a renewed output cut agreement in place through the end of 2018 that brings Libya and Nigeria into the fold, OPEC enters the new year brimming with confidence that its market rebalancing efforts will remain on track.

Natural field declines in several countries -- notably crisis-ridden Venezuela -- and continued strong production discipline could likely be enough to keep the bloc's output within the bounds of its ceiling under the deal.

The issuance of a combined 2.8 million b/d cap on formerly exempt members Libya and Nigeria at the organization's November 30 meeting means that OPEC as a whole now has a notional collective ceiling of 32.74 million b/d, when all the members' quotas are added up.

It has surpassed that level just once in all of 2017, according to S&P Global Platts estimates in July, when output averaged 32.82 million b/d in the month.

OPEC's November output was 32.35 million b/d, comfortably under the ceiling, the latest survey found.

For sure, OPEC has defied critics by maintaining extremely robust conformity with its quotas to date.

From January-November, compliance was 108% according to S&P Global Platts, one of the six secondary sources used by the organization to monitor output.

But with oil prices now 40% above mid-2017 levels, several analysts believe compliance could slip if some OPEC members are tempted to overproduce to capture more revenue.

"Compliance has been pretty good, but that's when prices were lower," Hedgeye analyst Joe McMonigle said. "Now, prices are higher -- so I definitely see some compliance challenges ahead."

At any rate, production restraint from OPEC, along with the 10 non-OPEC producers led by Russia that agreed to join the curbs, is but one part of the market balancing equation.

Factors outside the bloc's control will likely determine the success of its efforts to rebalance the oil market.

In particular, will US shale production, buoyed by rising oil prices in recent months, surge and undo the OPEC/non-OPEC cuts? And will global oil demand grow in 2018 as forecast, helping soak up any additional supplies that come onto the market?

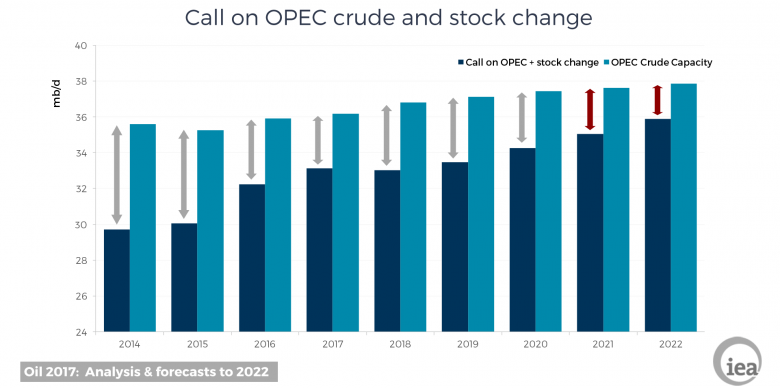

On both counts, OPEC itself remains bullish. Its December oil market report forecast a major tightening of the market in 2018, with the so-called 'call on OPEC crude,' to average 33.15 million b/d for the year, far in excess of its current production.

The International Energy Agency, which represents major oil-consuming nations in the Organization for Economic Cooperation and Development, however, is far less optimistic.

It estimates that the world will need 32.5 million b/d of OPEC crude, some 650,000 b/d less than OPEC forecasts, to meet global demand.

US SHALE CONCERNS

Of course, by OPEC ministers' own reckoning when the production cuts were first implemented at the start of 2017, the market's stock overhang was to have disappeared months ago and the deal long unwound by now.

But the OPEC-led coalition's target of returning OECD commercial oil stocks to the five-year average has been held up.

OPEC estimates OECD stocks are still about 140 million barrels above the target level as of November.

Much of the delay is the result of US shale drillers, which have responded to the clear price signals from OPEC's resolve.

US production could hit a new all-time record of almost 10 million b/d in December, according to consultancy Rystad Energy.

By the time of next OPEC meeting in June 2018, the US could very well be producing more than Saudi Arabia, consultancy Petromatrix has noted.

Even more of a concern for OPEC is that US oil exports are also climbing fast.

US data shows the country exported 1.73 million b/d of crude in October, more than triple year-ago levels and stealing OPEC market share in key markets in Asia, notably China.

EXIT STRATEGY TO COME?

OPEC also still has to contend with market hand-wringing over its perceived lack of an exit strategy from the production cut agreement.

The deal is due to be reviewed at OPEC's next meeting, and any signs of an overtightening market could lead to sell-off fears, with traders suspecting that member countries could return to the bruising market share battle that preceded the implementation of the deal.

Though ministers have repeatedly tried to assure the market that this will not happen under their watch, their inability or unwillingness to articulate a clear exit strategy has led to much speculation over how the coalition might unwind the cuts.

Saudi energy minister Khalid al-Falih has largely brushed off the concerns, noting that producers will have "plenty of opportunities" in 2018 to plot a new course.

Analysts, however, have noted that OPEC has never declared any kind of exit strategy from previous production cut agreements, or indeed any hard expiration date.

Rather, quotas have simply been allowed to lapse without much fanfare or outrage. Under this scenario, OPEC would simply stop referring to any caps, ceilings or other semantics for production restraints.

This time may prove different, however, if OPEC sticks to its target of returning OECD oil stocks to the five year average.

With Falih, OPEC's de facto leader, now co-chairing the deal's six-country monitoring committee along with Russian energy minister Alexander Novak, their comments as that stocks target nears will come under closer and closer scrutiny.

That likely suits Saudi Arabia just fine, as it increasingly speaks of OPEC as more like a central bank than a price-setting cartel.

-----

Earlier:

2017, December, 25, 20:45:00

OIL PRICES - 2018: VOLATILEThe price of oil in 2018 will be volatile with commodity market traders selling on signals of OPEC-Russia “cheating” or members producing more oil than the extended Algiers Agreement output quotas.

|

2017, December, 11, 09:40:00

OPEC WILL BACK BY 2040“Tight oil supplies are the wild card. They have reshaped the global outlook in recent years,” observed Ayed S. Al-Qahtani, who directs the research division at the OPEC Secretariat in Vienna. “US tight oil supplies will be the most important contributor but are expected to reach their peak around 2025.”

|

2017, December, 4, 23:10:00

SAUDI ARABIA - RUSSIA COMPROMISEREUTERS - The outcome represents a successful compromise between de facto OPEC leader Saudi Arabia (which wanted to announce an extension throughout 2018) and non-OPEC heavyweight Russia (which wanted to avoid giving such a long commitment).

|

2017, November, 29, 10:00:00

OPEC OIL EXPECTATIONSBLOOMBERG - Implied volatility, a gauge of expected price moves, dropped to about 22 percent on Friday for New York-traded crude. That was the lowest level since early March and close to a three-year low. Other gauges of turbulence have also traded at multi-year lows since the start of October, despite the escalating tensions and meetings this week in Vienna, where OPEC and allied oil-producer states will discuss the extension of supply curbs that propped up the market.

|

2017, November, 9, 14:00:00

OPEC: 2040 GLOBAL ENERGY CHANGESWithin the grouping of Developing countries, India and China are the two nations with the largest additional energy demand over the forecast period, both in the range of 22–23 mboe/d.

|

2017, August, 16, 09:30:00

OPEC: GLOBAL OIL DEMAND WILL UP TO 97.8 MBDOPEC said world oil demand in 2018 will grow 1.28 million b/d from 2017 levels, meaning that total oil consumption is expected to hit a new record high of 97.8 million b/d in 2018.

|

2017, July, 7, 08:10:00

MARKET WILL BE BETTERNovak said prices had room to rise from current levels and said inventories in industrialized nations were expected to ease back to the five-year average thanks to the decision by OPEC and its allies to extend supply curbs from the first half of 2017 to the first quarter of 2018. |