SAUDIS & RUSSIA LEADERSHIP

PLATTS - Saudi Arabia reasserted its leadership of the oil market Thursday after brokering its desired extension of output cuts with OPEC and non-OPEC partners through to the end of 2018.

The deal -- agreed after nearly nine hours of negotiations in Vienna -- kept its new ally Russia onside and prevented a sell-off that many analysts had feared.

To help beef up the deal's impact, Nigeria and Libya were issued a combined 2.8 million b/d output cap. Both nations had previously been exempt from the cuts.

With consensus very much in doubt entering OPEC's closely watched meeting, Saudi energy minister Khalid al-Falih emerged from the talks deal in hand, pledging a firm commitment to completing the rebalancing of the market and promising to keep a close eye on his OPEC counterparts, many of whom have been lax in compliance with their quotas.

Saudi Arabia -- the world's largest exporter of crude -- would adjust its production levels to stay ahead of any US shale resurgence, he said.

"We as a grouping will be agile, will be on our toes, and we will react and respond depending on how events go," Falih said in a press briefing after the decision was announced.

The cuts would aim to bring OECD oil inventories down at least 150 million barrels from current levels, he added -- even more ambitious than the OPEC/non-OPEC coalition's stated goal of reducing them to the five-year average.

Commercial OECD oil inventories stood 140 million barrels above that benchmark as of October, OPEC has estimated. An exact target would be developed by midyear, Falih said.

Furthermore, Falih said he would assume the co-chairmanship of the monitoring committee overseeing the deal, alongside Russian counterpart Alexander Novak. That would ensure Falih's stewardship of the extension, even after he hands off the rotating OPEC presidency to UAE energy minister Suhail al-Mazrouei next year.

Falih, who played a key role in negotiating the production cut agreement late last year, said that under his and Novak's leadership, there would be no excuses for deal participants not meeting their quotas.

"I will be breathing down the necks of the other 24 countries" on compliance, he said.

The scale of the agreement left little doubt about Saudi resolve in 2018, said Helima Croft, an analyst with RBC Capital Markets.

"All in all a successful end to Khalid al-Falih's exceedingly activist 2017 OPEC presidency," she said.

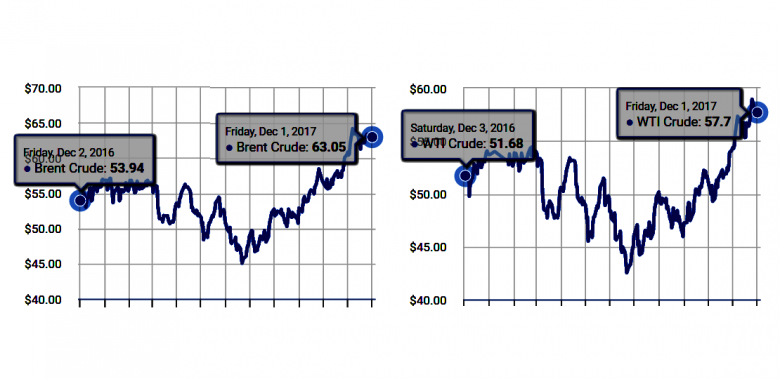

Oil futures were little changed Thursday. ICE January Brent expired 46 cents higher at $63.57/b, while the strip from February to June was lower until just before the close. The February contract settled 10 cents higher at $62.63/b.

Many observers had been wary of a sell-off, given the significant length in the market that appeared to price in the nine-month extension at a minimum.

"In agreeing to extend current production quotas OPEC and non-OPEC nations are managing a fine balance which is likely to maintain prices at current levels in the near term," said Chris Midgley, head of analytics at S&P Global Platts.

SUBJECT TO JUNE REVIEW

Russia's position on the extension had appeared to be a sticking point as the week progressed, with Novak not showing his hand after earlier having suggested that ministers not take any decision on the cuts at this meeting.

Many Russian oil companies had complained that the cuts had hurt their bottom line, while officials had also expressed concern that elevated oil prices could strengthen the ruble and negatively impact the country's export economy.

Saudi Arabia had long signaled its desire for the nine-month extension, seeking a stable market through 2018 as it prepares to embark on significant economic reforms, including the potential public listing of its state-owned oil company Aramco.

That had many commentators proclaiming that Russian President Vladimir Putin -- and by extension Novak -- had effectively wrested control of OPEC from Saudi Arabia, without even being a member of the organization.

Novak, in the press briefing, laughed off those suggestions. Russian oil companies "were on board with this decision," he said, later adding that Russian crude output would remain flat year-on-year in 2018 at about 10.98 million b/d.

"We are of the same view and have a unified position," Novak said.

Crucially, though, the extension includes an early exit option if the market overtightens, with the deal subject to review in June, when the coalition will meet again.

"In view of the uncertainties associated mainly with supply and, to some extent, demand growth, it is intended that in June 2018, the opportunity of further adjustment actions will be considered based on prevailing market conditions and the progress achieved towards rebalancing of the oil market at the time," a communique announcing the decision stated.

Joe McMonigle, an analyst with Hedgeye Capital, said the deal had to be flexible enough to keep Russia in the fold, given its hesitance to lock in a full year of cuts.

"I think it's possible the Russians may not want to continue after June," McMonigle said. "Going into this, they wanted the shortest duration possible and Saudi Arabia wanted the longest duration possible, and this agreement was trying to bridge those gaps."

EXEMPTION DISSENTION

But that concession to Russia -- which does not necessarily amount to any leverage given up by Saudi Arabia since the deal was always going to be reviewed at the June OPEC meeting -- was perhaps more than made up by the output cap on Libya and Nigeria.

Falih said the two militancy-wracked countries had assured the coalition that their production would not likely surpass their peak 2017 levels in 2018.

There would be "no surprises to be expected" from Libya and Nigeria output levels, he said.

But sources said the negotiations were very contentious and caused the talks to drag on for hours past their expected conclusion, with delegates and ministers battling over how the cap would be worded in the communique.

In the end, it was left out of the text of the agreement.

The normally talkative Mustafa Sanalla, the chairman of Libya's state-owned National Oil Corporation, attended the Vienna meeting, but refused to speak with journalists. He has outlined ambitious plans to raise Libyan production from current levels of around 1 million b/d to 1.25 million b/d by the end of 2017.

Nigerian oil minister Emmanuel Kachikwu told reporters before the meeting that his country's current crude oil production was 1.70 million-1.75 million b/d and would not hit 1.8 million b/d until January at the earliest.

Nigeria's 2017 crude production high was 1.85 million b/d, and the country will "try as much as we can to keep our 2017 highest production level," Kachikwu said in a separate press briefing after the meeting.

NO EXIT STRATEGY NEEDED, YET

Much of the speculation and market anxiety surrounding the production cut extension was aimed at how the coalition would exit the deal, with traders wondering whether a price-tanking market share battle would ensue.

Falih, however, dismissed such concerns, even as he acknowledged that ministers had yet to develop any exit strategy.

He said many countries will experience natural declines that likely will allow the OPEC/non-OPEC bloc to exceed its 1.8 million b/d in committed cuts.

But he added that members would not just open the taps and flood the market when the deal ends. The coalition is well aware that low oil prices were "equally damaging to the global economy as unreasonably high prices," he said.

"We just haven't decided how the gradual easing of supply is going to be," he said. "We have to see realistically who has spare capacity. Some of this 1.8 [million b/d in cuts] is going to be involuntary by year end. We have plenty of opportunities to look at this between now and year-end 2018 and come up with a scheme that is good for the market."

-----

Earlier:

November, 29, 10:00:00

OPEC OIL EXPECTATIONSBLOOMBERG - Implied volatility, a gauge of expected price moves, dropped to about 22 percent on Friday for New York-traded crude. That was the lowest level since early March and close to a three-year low. Other gauges of turbulence have also traded at multi-year lows since the start of October, despite the escalating tensions and meetings this week in Vienna, where OPEC and allied oil-producer states will discuss the extension of supply curbs that propped up the market.

|

November, 27, 20:15:00

РОССИЯ ПОДДЕРЖИВАЕТ СОКРАЩЕНИЕМИНЭНЕРГО РОССИИ - «Мы видим, что с рынка ушло примерно 50% излишком запасов нефти, мы видим, что цена сбалансировалась и вышла на достаточно приемлемый уровень в районе 60 и выше долларов за баррель марки Brent, инвестиции начали уже в 17-м году расти, а до этого они 15-16-й год падали. Тем не менее, мы не достигли еще до конца цели по балансировке рынка, и сегодня практически все выступают за то, что необходимо продлить сделку дополнительно для того, чтобы достичь окончательных целей. В принципе, Россия тоже поддерживает такие предложения, рассматриваются разные варианты».

|

November, 24, 09:20:00

OPEC WILL REDUCEREUTERS - The Organization of the Petroleum Exporting Countries, non-member Russia and nine other producers agreed to curb oil output by about 1.8 million barrels per day until March 2018. They are expected to extend the deal at a Nov. 30 meeting in Vienna.

|

November, 17, 19:50:00

RUSSIA'S OIL PAUSEFT - The original deal with Opec’s de facto leader Saudi Arabia, brokered by Mr Novak and Russian president Vladimir Putin, reduced oil production from participating countries by 1.8m barrels a day and helped push the price of benchmark Brent Crude above $60 a barrel this week for the first time in more than two years. |

November, 15, 15:20:00

IEA COOLS THE MARKETBLOOMBERG - Prices dropped during the session as the International Energy Agency said the recent recovery in oil prices, coupled with milder-than-normal winter weather, is slowing demand growth. The worsening outlook for consumption dampened some of the enthusiasm that OPEC and its allies will extend supply curbs.

|

November, 3, 12:20:00

СОТРУДНИЧЕСТВО РОССИИ И САУДОВСКОЙ АРАВИИПо линии энергетики Министр отметил потенциал сотрудничества по вопросам совместной разработки нефтяных и газовых месторождений на территории России и Саудовской Аравии, производства нефтегазового оборудования, разработки и внедрения современных технологий в области нефтегазодобычи, а также подготовки кадров для топливно-энергетического сектора Саудовской Аравии.

|

October, 27, 19:30:00

СПРОС НА НЕФТЬ ВЫРАСТЕТОтвечая на вопрос о прогнозе мирового потребления нефти, Александр Новак отметил, что спрос на нефть будет расти в ближайшие пару десятилетий, но более низкими темпами, чем рост экономики. «Чуть меньше 1% в период ближайших 15-20 лет», - пояснил Министр. |