UNCERTAIN OIL PRICES

EIA - The U.S. Energy Information Administration expects global liquid fuels demand to increase in 2018, but not keep pace with supply growth, resulting in global liquids inventories increasing modestly in 2018. STEO forecasts increasing global liquid fuels inventories by an average of 50,000 barrels per day (b/d) in 2018, a downward revision from a 290,000 b/d inventory increase forecast in the November STEO (Figure 1). The change in STEO is driven by upward historical revisions to Chinese consumption and downward revisions to forecast production from countries within the Organization of the Petroleum Exporting Countries (OPEC).

On November 30, 2017, OPEC announced an extension of its agreement to reduce crude oil production through the end of 2018, which was broadly in line with both EIA's November STEO and market expectations in the days leading up to the meeting. The non-OPEC countries that agreed to crude oil production cuts in 2017 also agreed to continue limiting output through the end of 2018. Saudi Arabia and Russia will co-chair a monitoring committee designed to assess the group's adherence to the production targets. The group plans to reassess target production levels at their June 2018 meeting in the context of market conditions at that time. EIA estimates OPEC crude oil production averaged 32.5 million b/d in 2017, a 0.2 million b/d decrease from 2016 levels, and forecasts OPEC crude oil production to average 32.7 million b/d in 2018.

Although OPEC is expected to restrain production growth, EIA forecasts that higher output from non-OPEC countries will contribute to overall growth in world liquid fuels production in 2018. The non-OPEC outlook for liquid fuels production is 0.1 million b/d higher than EIA's November STEO, averaging 60.3 million b/d in 2018, 1.7 million b/d higher than the 2017 level. This growth, together with the forecast 0.3 million b/d growth in OPEC crude oil production and another 0.1 million b/d increase in OPEC non-crude liquids production, results in forecast total global liquids production growth of 2.0 million b/d in 2018 (Figure 2). EIA expects that crude oil price increases in late 2017 will support growth in U.S. crude oil production to more than 10.0 million b/d by mid-2018. Overall U.S. crude oil production is forecast to increase by an average of 0.8 million b/d in 2018. Canada, Brazil, Norway, the United Kingdom, and Kazakhstan are also forecast to add a combined 0.7 million b/d of growth in liquids production in 2018.

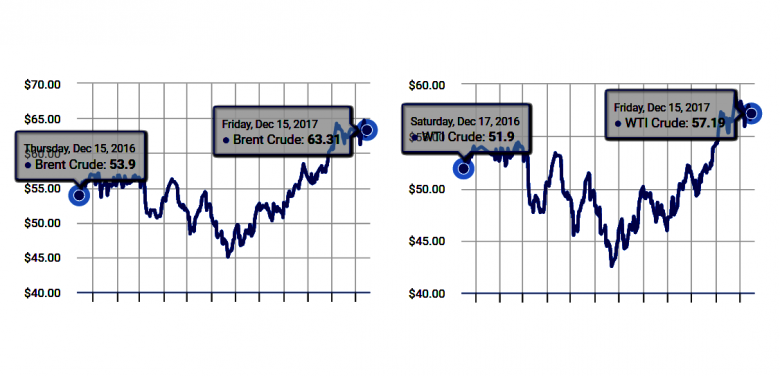

Despite higher oil prices, EIA expects global liquid fuels demand to increase by more than 1.6 million b/d in 2018, up from growth of almost 1.4 million b/d in 2017. Demand growth is not forecast to keep pace with supply growth, however, resulting in global liquids inventories increasing modestly in 2018. With global inventories expected to increase in 2018, EIA forecasts Brent crude oil prices will decline from current levels of more than $60 per barrel (b) to an average of $57/b in 2018, nearly $2/b higher than previously forecast in the November STEO. EIA forecasts West Texas Intermediate (WTI) crude oil prices to average $53/b in 2018, which is also nearly $2/b higher than forecast in the November STEO.

The forecast for oil prices remains highly uncertain. WTI futures contracts for March 2018 delivery, traded during the five-day period ending December 7, 2017, averaged $57/b. The value of options contracts currently establishes the lower and upper limits of the 95% confidence interval for the market's expectations of monthly average WTI prices for March at $48/b and $68/b, respectively (Figure 3). The 95% confidence interval for market expectations widens considerably over time, with lower and upper limits of $36/b and $84/b, respectively, for prices in December 2018.

-----

Earlier:

2017, December, 13, 12:40:00

OIL PRICE: ABOVE $64 YETREUTERS - Brent crude was up 69 cents, or 1.1 percent, at $64.03 a barrel by 0743 GMT. It had settled down $1.35, or 2.1 percent, on Tuesday on a wave of profit-taking after news of a key North Sea pipeline shutdown helped send the global benchmark above $65 for the first time since mid-2015. U.S. West Texas Intermediate crude was up 45 cents, or 0.8 percent, at $57.59 a barrel. |

2017, December, 13, 12:30:00

OIL PRICE - 2018: $57EIA - North Sea Brent crude oil spot prices averaged $63 per barrel (b) in November, an increase of $5/b from the average in October. EIA forecasts Brent spot prices to average $57/b in 2018, up from an average of $54/b in 2017.

|

2017, December, 4, 23:15:00

СОТРУДНИЧЕСТВО С ОПЕКМИНЭНЕРГО РОССИИ - ОПЕК оставляет в силе решения, принятые 30 ноября 2017 года; в «Декларацию о сотрудничестве» вносится поправка, согласно которой ее срок действия охватывает весь 2018 год с января по декабрь 2018 года, при этом входящие и участвующие в кооперации не входящие в ОПЕК страны обязуются обеспечить полное и своевременное исполнение условий «Декларации о сотрудничестве» и скорректировать объемы добычи в соответствии с достигнутыми на добровольной основе договоренностями.

|

2017, November, 27, 20:05:00

OIL SUPPLY & DEMANDBLOOMBERG - Global crude inventories are declining and supply and demand are in balance, according to the head of Saudi Aramco, while the United Arab Emirates energy minister said U.S. shale oil doesn’t threaten OPEC’s efforts to support the market.

|

2017, November, 15, 15:20:00

IEA COOLS THE MARKETBLOOMBERG - Prices dropped during the session as the International Energy Agency said the recent recovery in oil prices, coupled with milder-than-normal winter weather, is slowing demand growth. The worsening outlook for consumption dampened some of the enthusiasm that OPEC and its allies will extend supply curbs.

|

2017, November, 9, 13:55:00

EIA: OIL PRICE $53 - $56North Sea Brent crude oil spot prices averaged $58 per barrel (b) in October, an increase of $1/b from the average in September. EIA forecasts Brent spot prices to average $53/b in 2017 and $56/b in 2018.

|

2017, November, 1, 13:30:00

SOUTHEAST ASIA NEED ENERGYAccess to modern energy is incomplete. With a total population of nearly 640 million, an estimated 65 million people remain without electricity and 250 million are reliant on solid biomass as a cooking fuel. Investment in upstream oil and gas has been hit by lower prices since 2014 and the region faces a dwindling position as a gas exporter, and a rising dependency on imported oil. |