U.S. DEFICIT $100.6 BLN

BEA - The U.S. current-account deficit decreased to $100.6 billion (preliminary) in the third quarter of 2017 from $124.4 billion (revised) in the second quarter of 2017, according to statistics released by the Bureau of Economic Analysis (BEA). The deficit decreased to 2.1 percent of current-dollar gross domestic product (GDP) from 2.6 percent in the second quarter.

The $23.8 billion decrease in the current-account deficit reflected decreases in the deficits on secondary income and goods and increases in the surpluses on primary income and services.

Exports of goods and services and income receipts

Exports of goods and services and income receipts increased $23.4 billion in the third quarter to $858.7 billion.

* Primary income receipts increased $9.4 billion to $234.5 billion, mostly reflecting increases in portfolio investment income and in direct investment income.

* Secondary income receipts increased $6.9 billion to $41.1 billion, mostly reflecting an increase in U.S. government transfers, primarily fines and penalties.

* Goods exports increased $5.2 billion to $388.1 billion, mostly reflecting an increase in capital goods except automotive, primarily civilian aircraft, engines, and parts and telecommunications equipment.

Imports of goods and services and income payments

Imports of goods and services and income payments decreased $0.4 billion to $959.2 billion.

* Secondary income payments decreased $3.0 billion to $64.3 billion, mostly reflecting a decrease in private transfers, primarily fines and penalties.

* Primary income payments increased $2.8 billion to $177.5 billion, reflecting increases in portfolio investment income and in other investment income.

Capital transfer receipts were $24.9 billion in the third quarter. The transactions reflected receipts from foreign insurance companies for losses resulting from hurricanes Harvey, Irma, and Maria.

Net U.S. borrowing measured by financial-account transactions was $105.6 billion in the third quarter of 2017, a decrease from net borrowing of $114.4 billion in the second quarter.

Financial assets

Net U.S. acquisition of financial assets excluding financial derivatives decreased $7.0 billion in the third quarter to $337.9 billion.

* Net U.S. acquisition of direct investment assets decreased $13.9 billion to $76.7 billion, reflecting a decrease in net acquisition of equity assets.

* Net U.S. acquisition of portfolio investment assets decreased $10.9 billion to $175.6 billion, reflecting a decrease in net U.S. purchases of equity and investment fund shares.

* Net U.S. acquisition of other investment assets increased $18.0 billion to $85.6 billion, partly offsetting the decreases in net acquisition of direct investment assets and in net acquisition of portfolio investment assets. The increase in net acquisition of other investment assets reflected an increase in net acquisition of currency and deposits.

Liabilities

Net U.S. incurrence of liabilities excluding financial derivatives decreased $6.5 billion to $462.1 billion.

* Net U.S. incurrence of portfolio investment liabilities decreased $7.2 billion to $284.0 billion, reflecting a decrease in net foreign purchases of U.S. debt securities.

* Net U.S. incurrence of other investment liabilities decreased $4.0 billion to $82.3 billion, reflecting largely offsetting changes in transactions in deposit and loan liabilities. In deposits, transactions shifted to net foreign withdrawal of deposits in the United States in the third quarter from net foreign placement in the second quarter. In loans, transactions shifted to net U.S. incurrence from net U.S. repayment.

* Net U.S. incurrence of direct investment liabilities increased $4.7 billion to $95.8 billion, partly offsetting the decreases in net incurrence of portfolio investment liabilities and in net incurrence of other investment liabilities. The increase in net incurrence of direct investment liabilities reflected an increase in net incurrence of equity liabilities.

Financial derivatives

Transactions in financial derivatives other than reserves reflected third-quarter net lending of $18.6 billion, an increase of $9.3 billion from the second quarter.

-----

Earlier:

2017, December, 18, 12:25:00

U.S. INDUSTRIAL PRODUCTION UP 0.2%FRB - Industrial production moved up 0.2 percent in November after posting an upwardly revised increase of 1.2 percent in October. |

2017, December, 11, 09:50:00

U.S. EMPLOYMENT UP BY 228,000U.S. BLS - Total nonfarm payroll employment increased by 228,000 in November, and the unemployment rate was unchanged at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in professional and business services, manufacturing, and health care.

|

2017, December, 6, 12:10:00

U.S. DEFICIT UP TO $48.7 BLNBEA - The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $48.7 billion in October, up $3.8 billion from $44.9 billion in September, revised. October exports were $195.9 billion, down less than $0.1 billion from September exports. October imports were $244.6 billion, $3.8 billion more than September imports.

|

2017, December, 1, 12:30:00

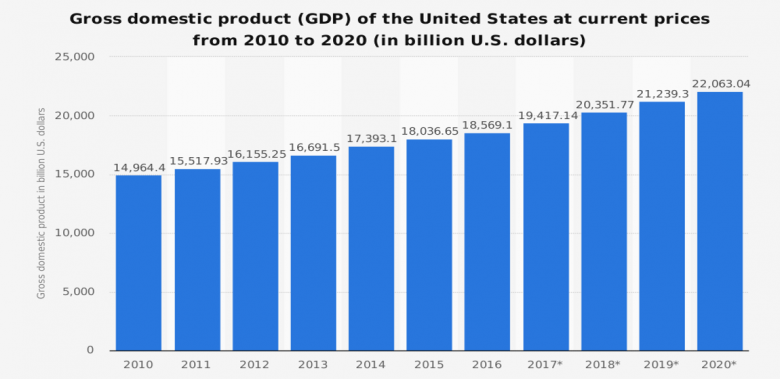

U.S. GDP UP 3.3%BEA - Real gross domestic product (GDP) increased at an annual rate of 3.3 percent in the third quarter of 2017, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 3.1 percent.

|

2017, November, 20, 09:10:00

U.S. PETROLEUM DEMAND UP TO 19.9 MBDAPI - Total petroleum deliveries in October moved up by 1.1 percent from October 2016 to average 19.9 million barrels per day. These were the highest October deliveries in 10 years, since 2007. Compared with September, total domestic petroleum deliveries, a measure of U.S. petroleum demand, decreased 1.8 percent. For year-to-date, total domestic petroleum deliveries moved up 1.2 percent compared to the same period last year.

|

2017, November, 17, 19:30:00

U.S. INDUSTRIAL PRODUCTION UP 0.9%FRB - Industrial production rose 0.9 percent in October, and manufacturing increased 1.3 percent. The index for utilities rose 2.0 percent, but mining output fell 1.3 percent, as Hurricane Nate caused a sharp but short-lived decline in oil and gas drilling and extraction. Even so, industrial activity was boosted in October by a return to normal operations after Hurricanes Harvey and Irma suppressed production in August and September. Excluding the effects of the hurricanes, the index for total output advanced about 0.3 percent in October, and the index for manufacturing advanced about 0.2 percent.

|

2017, November, 14, 17:30:00

U.S. OIL + 80 TBD, GAS + 779 MCFDEIA - Crude oil production from the major US onshore regions is forecast to increase 80,000 b/d month-over-month in December to 6.174 million b/d, gas production to increase 779 million cubic feet/day. |