U.S. LNG UP

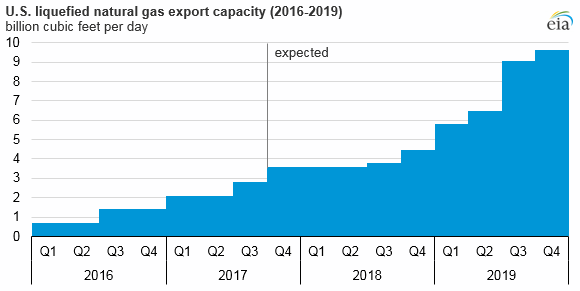

EIA - In August 2017, total U.S. natural gas liquefaction capacity in the Lower 48 states increased to 2.8 billion cubic feet per day (Bcf/d) following the completion of the fourth liquefaction unit at the Sabine Pass liquefied natural gas (LNG) terminal in Louisiana. With increasing liquefaction capacity and utilization, U.S. LNG exports averaged 1.9 Bcf/d, and capacity utilization averaged 80% this year, based on data through November.

Sabine Pass, located on the U.S. Gulf Coast near the Louisiana-Texas border, consists of four existing natural gas liquefaction units, or trains, with a fifth train currently under construction. When complete, Sabine Pass will have a total liquefaction capacity of 3.5 Bcf/d. Five additional LNG projects are currently under construction in the United States, and they are expected to increase total U.S. liquefaction capacity to 9.6 Bcf/d by the end of 2019:

Cove Point liquefaction terminal (one train, 0.75 Bcf/d capacity) in Maryland is 97% complete, and Dominion Energy expects to place it in service before the end of 2017.

Elba Island LNG (10 modular liquefaction trains, 0.03 Bcf/d capacity each) in Georgia is owned by Kinder Morgan. Six trains are scheduled to come online in the summer of 2018, and four trains are scheduled to come online by May 2019.

Freeport LNG (three trains, 0.7 Bcf/d capacity each) in Texas is being developed by Freeport LNG Development, L.P. The first train is expected to come online in November 2018, with the remaining two trains following in six-month intervals.

Corpus Christi (two trains, 0.6 Bcf/d capacity each) in Texas is being developed by Cheniere and is expected to come online in 2019.

Cameron LNG (three trains, 0.6 Bcf/d capacity each) in Louisiana is being developed by Sempra LNG and is expected to come online in 2019.

Overall utilization of existing LNG liquefaction facilities is expected to average 80% in 2017 and 79% in 2018, based on LNG export projections in EIA's latest Short-Term Energy Outlook. Several factors can affect utilization rates, including weather-related disruptions, demand fluctuations, seasonality in import markets, production schedules for new LNG facilities, and maintenance on existing facilities.

At Sabine Pass, the ramp-up process, combined with maintenance on Train 1, resulted in capacity utilization for Trains 1 and 2 averaging 51% in 2016. Capacity increased in 2017 with the addition of Trains 3 and 4, but the ramp-up periods for those trains, as well as lower spring demand in markets in Asia and Europe and disruptions caused by Hurricane Harvey in August, limited total utilization.

Exports from Sabine Pass began to increase in September 2017 as Train 4 ramped up to full production—reaching 2.7 Bcf/d in November—with an overall capacity utilization rate of 96% across four trains. Utilization at Sabine Pass is projected to remain well above 90% in winter 2017–2018 as a result of expected strong natural gas winter demand and high spot LNG prices in Asia and Europe.

-----

Earlier:

2017, December, 1, 12:35:00

CHINA'S LNG GROWTHPLATTS - Average domestic trucked LNG prices in China jumped more than 47% since November 14, according to Shanghai Petroleum and Natural Gas Exchange which monitors trucked LNG transactions from 50 LNG terminals and factories.

|

2017, November, 29, 09:55:00

CHINA'S LNG UPPLATTS - Asia LNG spot prices surged to a near three-year high Monday as surging Chinese demand and robust oil prices coincided with persistent supply anxieties.

|

2017, November, 9, 13:35:00

U.S. - CHINA LNGChina’s top state oil major Sinopec, one of the country’s top banks and its sovereign wealth fund have agreed to help develop Alaska’s liquefied natural gas sector as part of U.S. President Donald Trump’s visit, the U.S. government said on Thursday. The agreement will involve investment of up to $43 billion, create up to 12,000 U.S. jobs during construction, reduce the trade deficit between the United States and Asia by $10 billion a year, and give China clean energy.

|

2017, November, 3, 12:15:00

SOUTH CHINA SEA LNGThe South China Sea is a major route for liquefied natural gas (LNG) trade, and in 2016, almost 40% of global LNG trade, or about 4.7 trillion cubic feet (Tcf), passed through the South China Sea.

|

2017, October, 18, 18:40:00

U.S. LNG RISKThere are more than a dozen LNG export projects currently being proposed to US regulators, though across the industry almost no final investment decisions have been announced over the last 18 months and some developers have delayed their decisions into 2018 or beyond. Few firm supply purchase agreements have been announced for the projects that have yet to commit to moving forward.

|

2017, October, 13, 12:45:00

JAPAN - INDIAN LNGIndia will work with Japan to make long-term liquefied natural gas (LNG) import deals more affordable for its price-sensitive consumers, it said on Wednesday, as these two big importers try to secure better prices and concessions from suppliers.

|

2017, August, 31, 12:15:00

U.S. LNG FOR EUROPE - 4Last week, U.S. liquefied natural gas (LNG) made its way to the somewhat unlikely market of Lithuania. The former Soviet republic traditionally bought its gas from Russian state company Gazprom; this was its first shipment from the United States. For President Donald Trump, that must have been a gratifying sign of the success of his administration’s nascent energy diplomacy. |