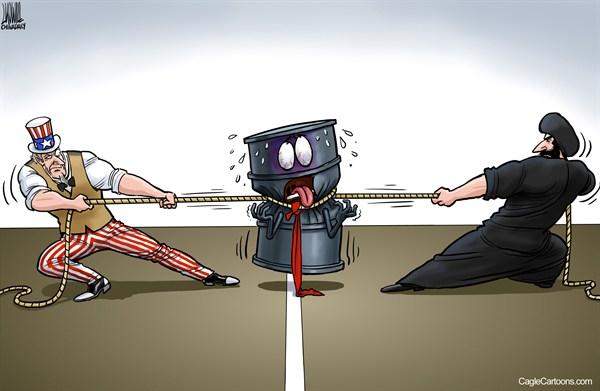

OIL PRICE WAR

REUTERS - A recovery in U.S. oil output may deter OPEC and non-OPEC producers from extending production cuts beyond June and might lead to a new price war, Russia's top oil major said on Monday.

U.S. shale oil production had been in retreat as oil prices tumbled from above $100 a barrel in 2014 to below $30 in 2015, making costly fracking processes less profitable.

A deal by the Organization of the Petroleum Exporting Countries with Russia and other producers to rein in output by 1.8 million barrels per day (bpd) for six months from Jan. 1 lifted prices but also encouraged U.S. firms to boost supplies.

"It became evident that U.S. shale oil output has become and will remain a new global oil price regulator for the foreseeable future," Rosneft said in a written response to Reuters.

"There are significant risks the (OPEC-led) deal won't be extended partially because of the main participants, but also because of the output dynamics in the United States, which will not want to join any deals in the foreseeable future."

Russia agreed to join OPEC supply curbs late last year despite initial opposition from Rosneft's boss Igor Sechin, one of President Vladimir Putin's closest allies.

"We think that in the long-term global oil demand dynamics and reduced investment during the period of ultra low prices will balance the market, but that the risk of a price war resuming remains," Rosneft wrote.

Russia has yet to deliver on the pledged cuts, while Saudi Arabia has cut its production far below the levels it had pledged, compensating for waker compliance by other OPEC states.

Rosneft said it came as a surprise to many observers that OPEC's compliance with cuts was more than 90 percent, and said the success was because the Saudi position on reducing production had "changed a great deal" from the past.

The kingdom, the world's biggest oil exporter, had long refused to cut output under veteran oil minister Ali al-Naimi. He was replaced last year by Khalid al-Falih.

"It was Saudi Arabia which initiated the pricing war in the first place with the aim of radically increasing its market share by squeezing out producers of 'costly' oil," Rosneft said, in a reference to shale producers.

"This goal became impossible to reach because of the efficiency and viability of the Russian oil industry," it added.

Naimi had forecast a collapse in output from Russia's mature fields. Instead, production has risen in the past two years to an all-time high of 11.2 million bpd, partly because a devaluation in the rouble reduced production costs.

Rosneft said the only guaranteed route to balance the market was for all producers to limit supplies, but acknowledged this would not happen because U.S. shale producers would not join any such pact. U.S. law bars them from such action.

-----

Earlier: