MODEST OIL GAS PRICES

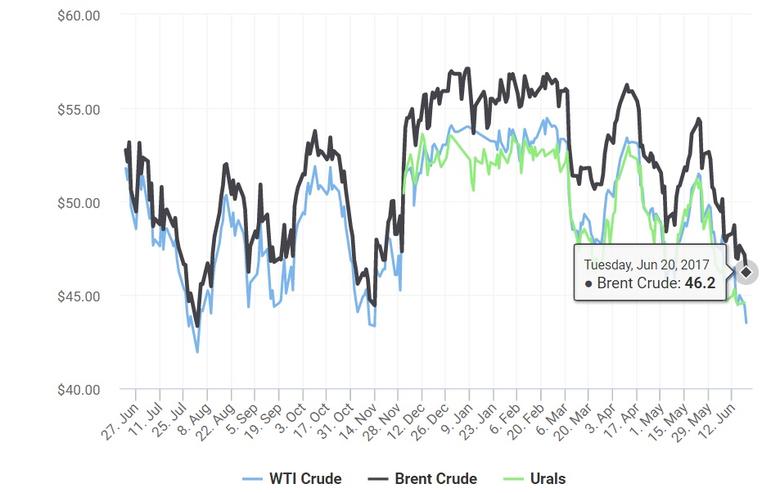

OGJ, BLOOMBERG, OILPRICE - US and Brent crude oil benchmarks both gained moderately on June 26 but analysts say crude oil remains in a bear market territory given ample world oil supplies and increasing production from US, Libya, and Nigeria.

Light, sweet crude oil settled at nearly $43.40/bbl on the New York market June 26, up about 40¢. Brent settled on the London market above $45.80/bbl, up nearly 30¢.

The American Petroleum Institute was scheduled to release its weekly US oil supply estimate on June 27. The US Energy Information Administration was scheduled to release its weekly oil and product inventory on June 28.

Some analysts expect both US oil inventory and production will decline following last week's Tropical System Cindy, which forced about 17% of oil production in the Gulf of Mexico and less than 1% of natural gas production to be shut in temporarily.

On world oil markets, the Organization of Petroleum Exporting Countries along with some non-OPEC producers in May extended production-cut targets of 1.8 million barrels p/d through Mar. 31, 2018.

Market observers note the production-cut targets have yet to reduce global oil oversupply levels. Libya and Nigeria were exempted from OPEC's production-cut targets.

"It's a bit of fatigue," for oil prices, said Miswin Mahesh, Energy Aspects oil market analyst. "But for sentiment to reverse, there needs to be more constructive fundamental data."

The Wall Street Journal reported light, sweet crude prices dropped more than 20% by June 21 compared with Feb. 23, marking the first bear market since August 2016. Economists generally define a bear market as a decline of 20% or more from a recent peak.

Energy prices

The August light, sweet crude contract on NYMEX gained 37¢ on June 26 to settle at $43.38/bbl. The September contract was up 34¢ to close at $43.61/bbl.

The NYMEX natural gas price for July gained nearly 10¢ to a rounded $3.03/MMbtu. The Henry Hub cash gas price was $2.98/MMbtu, up 12¢.

Heating oil futures for July also edged up less than 1¢ to a rounded $1.38/gal. Reformulated gasoline stock for oxygenate blending for July dropped a fraction of a penny to remain at $1.43/gal.

The Brent crude contract for August on London's ICE increased 29¢ to $45.83/bbl while the September contract was up 29¢ to $46.04/bbl. The July gas oil contract dropped $1.75 to $409.50/tonne.

OPEC's basket of crudes on June 26 was $43.14/bbl, down 12¢.

-----

Earlier: